Posts Tagged ‘taxes’

7 Tips to Cut Your 2019 Taxes by Thousands

We are in the final days of 2019. And for those of you who are last minute, this is the last chance to save $$$ on your 2019 taxes. We have posted about changes in the tax code through the Tax Cuts and Jobs Act, but it is a good idea to go over your…

Read MoreDeadline for Distributions

Reminder: Retirees born prior to July 1, 1949 must take your retirement plan required minimum distributions (RMD) by December 31, 2019. The RMD rules apply to: Retirees with traditional IRAs Retirees with traditional (Simplified Employee Pension) or SEP IRAs Retirees with Savings Incentive Match Plans for Employees (SIMPLE) IRAs Participants in workplace retirement plans such…

Read MoreProtect Yourself and Your Business from Identity Theft

Best Defense against IRS taxpayer Identity theft is a strong password. Just before the season on electronic filing and returns, the IRS reminds you to protect yourself. Taxpayer identity theft has grown exponentially in the last few years, but with Stronger passwords, you can guard identity for yourself and your business. Use word phrases that…

Read MoreHow to Avoid 2019 Tax Surprises.

Amidst all the holiday parties and get-togethers, take a few minutes to save yourself hassle in 2020. Think you know you’re getting a tax refund when you file? Things that happen now might change what you think you will get. You could even owe the government more money! Know what you owe. Certain financial transactions…

Read MoreCheck Your Withholding Before it’s Too Late!

We are in the final stretch of 2019 and now is a good time to check your withholding estimator. Grab your paystubs and other income documents from all income sources. Grab your most recent documents on pensions, annuities, Social Security benefits and self-employment income, as well as 2018 tax return. Go to irs.gov and check…

Read MoreTax Tip Tuesday

December 2019 TAX TIP: It’s international Giving Tuesday! If it matters to you, today is a great day to make your charitable donations to the causes you support. You can save on your taxes and maximize your donation if you find a donation match. Giving Tuesday is the day the people flex their generosity muscles,…

Read MoreGift and Estate Exclusion Amounts

If you have been concerned about what happens to your tax benefits of the increased gift and estate tax exclusion amounts after the effective period of 2018 to 2015 lapses, relax…a little. On the twenty second of November 2019, the treasury department and the internal revenue service issued a news release confirming that …”individuals who…

Read MoreIRS Travel Guidance

The IRS just released guidance on the new business travel per diems that went into effect in October. The guidance is issued to help clarify the definition of incidental expenses as: fees and tips given to porters, baggage carriers, hotel staff and staff on ships. NOT included are Transportation between places of lodging, business and…

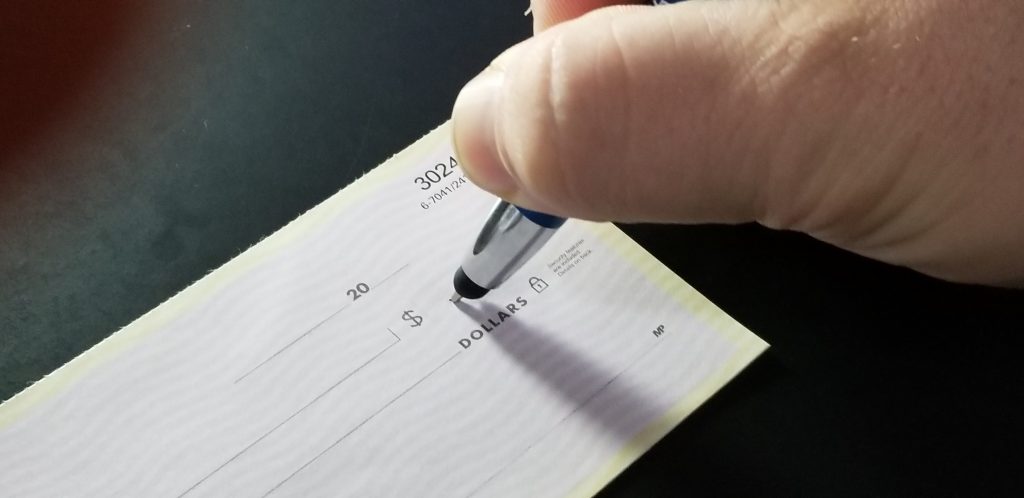

Read MoreCheck Before Cheque

This time of the year is big for charitable contributions. PersonalTaxPrep.com just wants to remind you check before cheque. Before you contribute to that charity hoping for charitable contribution by the end of 2019, check the IRS’ list of tax exempt organizations. IF you just want to give, fine, but if you were hoping for…

Read More