Posts Tagged ‘tax rules’

Tax season guide to small business expense deductions

BUSINESSADVERTISER DISCLOSURE From the kind of expenses you can – and can’t – deduct to the right rewards card to use to pay for deductible expenses, here’s everything you should know. by Rebecca Lake March 9, 2020 see original article at Creditcards.com Summary Claiming deductions can save your business money on your tax return, but you…

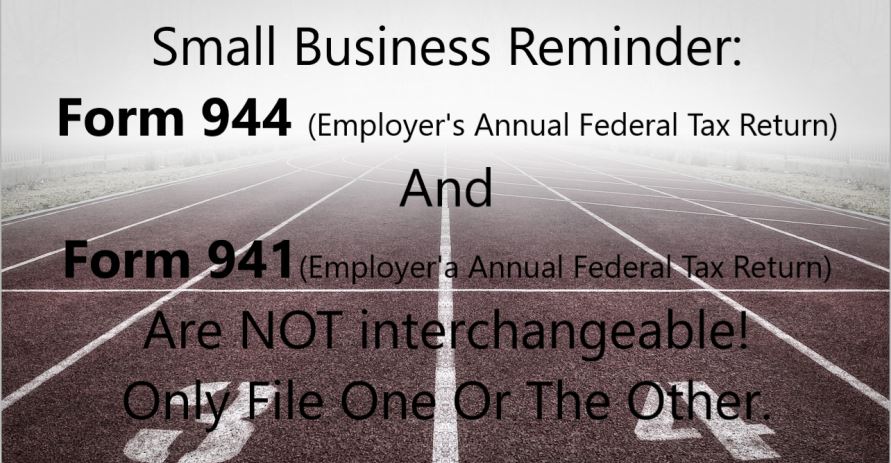

Read MoreBusiness Tax Tip Tuesday

Apparently, the IRS is seeing a problem with small business owner form filing. It has issued a reminder that we are passing along today. A small business files either Form 944, annual tax return OR Form 941, quarterly tax return but NOT both. Want more information? Visit www.businesstaxprep.org to be connected to a tax professional…

Read MoreDeadline for Distributions

Reminder: Retirees born prior to July 1, 1949 must take your retirement plan required minimum distributions (RMD) by December 31, 2019. The RMD rules apply to: Retirees with traditional IRAs Retirees with traditional (Simplified Employee Pension) or SEP IRAs Retirees with Savings Incentive Match Plans for Employees (SIMPLE) IRAs Participants in workplace retirement plans such…

Read MoreHow to Avoid 2019 Tax Surprises.

Amidst all the holiday parties and get-togethers, take a few minutes to save yourself hassle in 2020. Think you know you’re getting a tax refund when you file? Things that happen now might change what you think you will get. You could even owe the government more money! Know what you owe. Certain financial transactions…

Read MoreCheck Your Withholding Before it’s Too Late!

We are in the final stretch of 2019 and now is a good time to check your withholding estimator. Grab your paystubs and other income documents from all income sources. Grab your most recent documents on pensions, annuities, Social Security benefits and self-employment income, as well as 2018 tax return. Go to irs.gov and check…

Read MoreGift and Estate Exclusion Amounts

If you have been concerned about what happens to your tax benefits of the increased gift and estate tax exclusion amounts after the effective period of 2018 to 2015 lapses, relax…a little. On the twenty second of November 2019, the treasury department and the internal revenue service issued a news release confirming that …”individuals who…

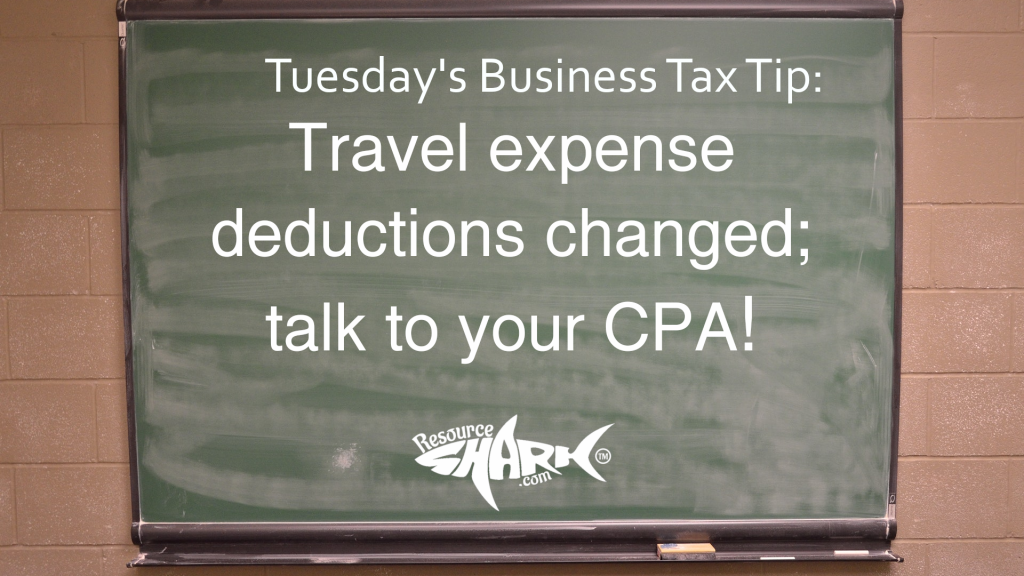

Read MoreIRS Travel Guidance

The IRS just released guidance on the new business travel per diems that went into effect in October. The guidance is issued to help clarify the definition of incidental expenses as: fees and tips given to porters, baggage carriers, hotel staff and staff on ships. NOT included are Transportation between places of lodging, business and…

Read More5 Top ExPat Tax Tips

File on time, every time. This is actually a good tax tip for every US Taxpayer: File your tax return by April 15. If you don’t owe US taxes on your foreign income, the IRS extends that deadline by two months, June 15. You may apply for additional extensions through October 15, but you may…

Read MoreGILTI Implemented

Expatriate taxpayers may need to be aware of tax consequences in multiple nations. When the rules in those nations change, following them becomes more complicated. Recently the United States’ Internal Revenue Service came out with guidance forms and instructions for provisions of the Tax Cuts and Jobs Act under the name Global Intangible Low-Taxed Income,…

Read More