Posts Tagged ‘tax’

Tax season guide to small business expense deductions

BUSINESSADVERTISER DISCLOSURE From the kind of expenses you can – and can’t – deduct to the right rewards card to use to pay for deductible expenses, here’s everything you should know. by Rebecca Lake March 9, 2020 see original article at Creditcards.com Summary Claiming deductions can save your business money on your tax return, but you…

Read MoreBusiness Deduction or Entertainment?

Does the Tax Cuts and Jobs Act (TCJA) help you save money on your business deductions? Many businesses were frustrated by changes in allowed dining and entertainment deductions. Did you know there are proposed regulations addressing that elimination of deductions for entertainment, amusement or recreation activities related expenditures? New guidance will be offered to determine whether…

Read MoreHow Do You Find a Great, Affordable Tax Preparer?

Are you looking for a good tax preparer or do you want to prepare your own tax return? Maybe you have concerns about your income or your expenses. A professional tax preparer can help answer your questions and file on your behalf but how do you find a good preparer? The IRS offers guidance on…

Read MoreDo You Know the Difference Between an Itemized Deduction and a Standard Deduction?

Do you know the difference between an itemized deduction and a standard deduction? Deductions reduce the amount of taxes you owe when filing a federal tax return. That said, there are two types of deductions: The standard deduction, based on an IRS schedule, or the itemized deduction. Knowing which type of deduction is best for…

Read MoreKnow Your Taxpayer Rights

Best PersonalTaxPrep.com tax tip this year: Know your rights. Fifteen years ago, the IRS has created the Taxpayer Bill of Rights (TBOR). Since then, congress codified it as part of the tax code. That means the Taxpayer Bill of Rights is law and it applies to all U.S. taxpayers anytime they must deal with the…

Read MoreTuesday Tax Tip

Tax Tip Tuesday

File Free at IRS Free File

File Free at IRS Free File If you just want to get your 2019 personal tax return filed, the IRS wants to make it easier to do. At IRS free file if you earn less than $69,000 in 2019, you can log onto IRS.gov to choose your free file product. You can find both federal…

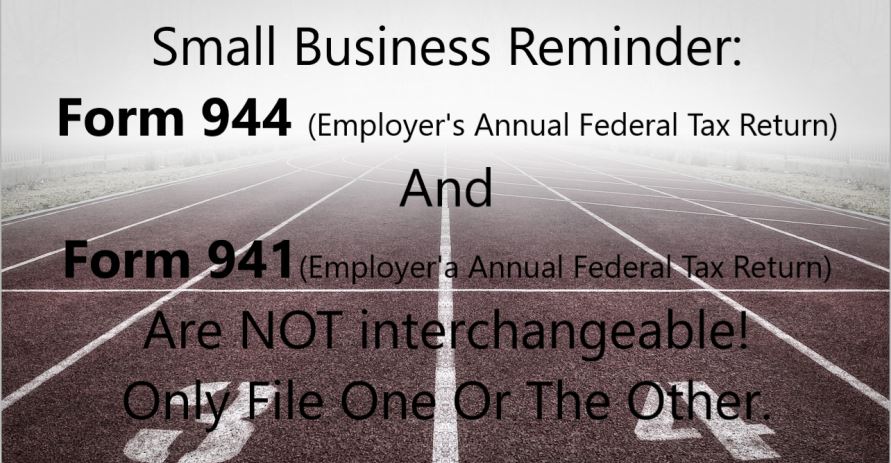

Read MoreBusiness Tax Tip Tuesday

Apparently, the IRS is seeing a problem with small business owner form filing. It has issued a reminder that we are passing along today. A small business files either Form 944, annual tax return OR Form 941, quarterly tax return but NOT both. Want more information? Visit www.businesstaxprep.org to be connected to a tax professional…

Read More