2020 catastrophe bond & ILS issuance hits $8.25bn, spreads continue to rise

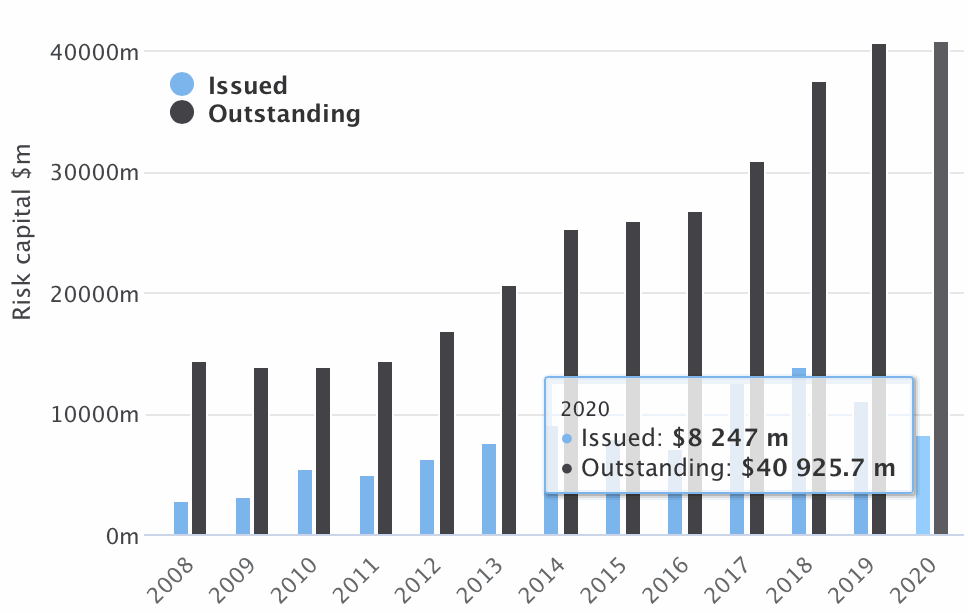

Cat bond issuance has continued apace in recent weeks, with total catastrophe bond and related insurance-linked securities (ILS) issuance for 2020 so far now reaching almost $8.25 billion, according to Artemis’ Deal Directory data.

At the same time, catastrophe bond spreads have continued to rise, as transactions increasingly see their pricing move towards the upper-end of guidance and even higher, while risk levels of new issues have also continued to fall compared to prior years.

The catastrophe bond market has added just over $1 billion of new issuance in less than one month, as when we last updated our readers on 2020 issuance to-date the figure was $7.2 billion on May 29th.

As of today, with the completion and settlement of Allianz Risk Transfer’s new $175 million Blue Halo Re cat bond and the inclusion of a recent private deal from Guy Carpenter’s Isosceles platform, the total issuance year-to-date that we’ve recorded sits just very slightly under $8.25 billion.

Catastrophe bond and related ILS risk capital outstanding is now slightly up for the year-to-date, at just under $40.93 billion, which indicates slight market growth from the almost $40.7 billion size of the outstanding market at the end of December 2019.

The fact the market has grown at all, when it faced such a high level of maturities this year, is testament to the resilience and professionalism of the catastrophe bond fund and investor space and its ability to continue supporting cedents needs for collateralised reinsurance and retrocession even through the challenges presented by the Covid-19 pandemic.

The outstanding market has shrunk in the last few weeks though, on the back of the high levels of maturity, having stood at almost $42 billion in size at the end of May.

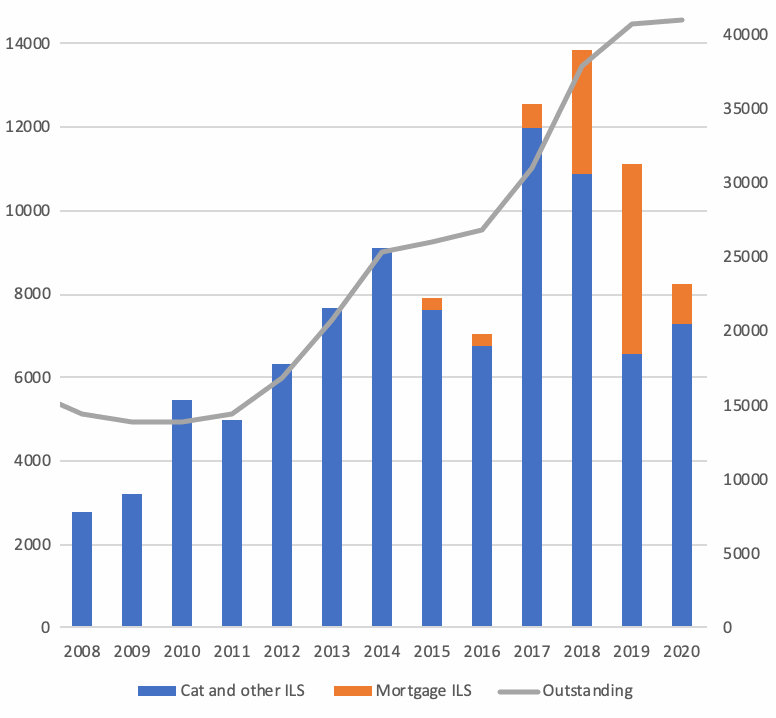

Of the almost $8.25 billion of cat bond and ILS issuance recorded by us so far this year, almost $7.3 billion features property catastrophe risks, while just over $980 million is related to mortgage insurance-linked securities (ILS) arrangements.

So, excluding the mortgage ILS issuance, 2020 has already seen stronger property catastrophe bond and other ILS issuance than last year, as the chart above shows.

Impressively, issuance of catastrophes bonds and related insurance-linked securities (ILS) transactions that we record in our Deal Directory is set to reach somewhere around $13.27 billion for the 12-months to June 30th 2020, according to our data.

While that’s not a record, it’s not all that far off, and could be the second or third most active 12-month period of issuance on record for the catastrophe bond and related ILS market.

Another data point of interest, is that excluding the mortgage ILS deals we’ve recorded almost $10.4 billion of catastrophe bond and other ILS over that 12-month period of Q3/4 2019 and Q1/2 2020, which again could be the third highest figure for 12-months the market has ever seen (on our data).

For the half-year, the first-half of 2020 looks set to become the third-highest level of catastrophe bond and related ILS issuance on record (for any half-year). 2020 is also the third year out of the last four where issuance has surpassed $8 billion, an impressive track record for recent history.

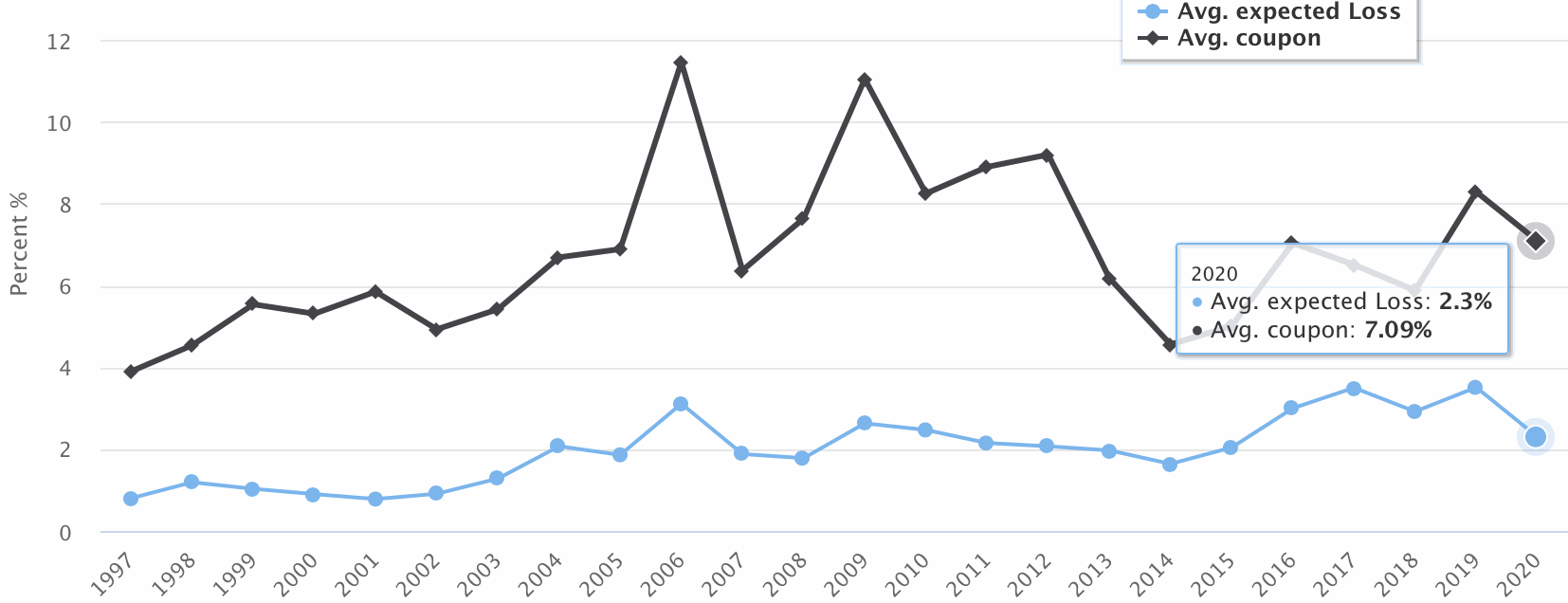

While issuance of new catastrophe bonds has continued apace in recent weeks and through 2020 so far, the increased spreads and returns available to investors in the space are also apparent.

With reinsurance rates broadly firming, recent catastrophe bond issues have seen pricing rise, resulting in particularly attractive spreads, something else that is evident in Artemis’ data.

As the chart below shows, the average coupon of issuance so far in 2020 that we have this data point for is 7.09%, while the average expected loss is 2.3%.

As a result, the spread between average coupon and average expected loss has risen to 4.79% at this time, up from 4.33% on May 29th, reflecting the increasing returns above expected loss that cat bond funds and investors can earn with this year’s issuance.

A higher spread above expected loss is one of the indicators of a catastrophe bond market delivering higher investor returns from its recent issuance.

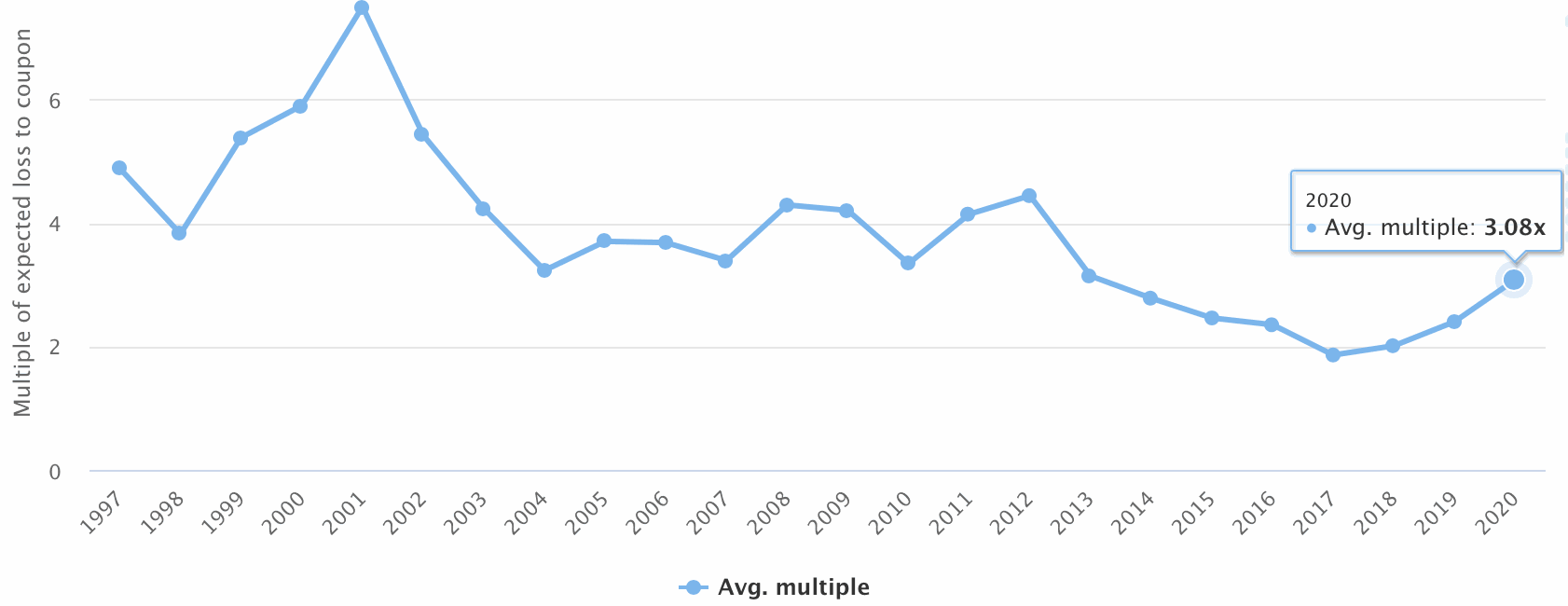

At the same time and as you’d expect, the average multiple at market, of expected loss to coupon, for 2020 cat bond and ILS issuance has continued to rise in the last few weeks.

On May 29th the average multiple of 2020 issuance stood at 2.96 times the expected loss, but with recent issues delivering higher returns and spreads the average multiple has increased to 3.08 times the expected loss as of today.

The average multiple of catastrophe bond issuance this year is now approaching the level last seen in 2013, reflecting the extremely attractive environment for catastrophe bond investments and the return of new issues in 2020.

The impressive rate of issuance continues to be partly driven by maturities, with significant amounts of ILS fund capital available to be reinvested right now, but also by reinsurance and retrocessional market dynamics, and the need for capital in all its forms for certain companies that have been impacted by Covid-19 pandemic but now want to capitalise on the firming rate environment.

Analyse every catastrophe bond using the Artemis Deal Directory, the Artemis Dashboard and our statistics and charts.

For full details of first-quarter 2020 cat bond and related ILS issuance, including a breakdown of deal flow by factors such as perils, triggers, expected loss, and pricing, as well as analysis of the issuance trends by month and year.

For full details of first-quarter 2020 cat bond and related ILS issuance, including a breakdown of deal flow by factors such as perils, triggers, expected loss, and pricing, as well as analysis of the issuance trends by month and year.

Download your free copy of Artemis’ Q1 2020 Cat Bond & ILS Market Report here.

2020 catastrophe bond & ILS issuance hits $8.25bn, spreads continue to rise was published by: www.Artemis.bm

Our catastrophe bond deal directory

Sign up for our free weekly email newsletter here.

Original Article Posted at : https://www.artemis.bm/news/2020-catastrophe-bond-ils-issuance-hits-8-25bn-spreads-continue-to-rise/