Dividend Aristocrats with Low Debt

The Occidental Petroleum dividend cut is fresh on my mind. And trust me, the wounds are deep and still open. Sadly, this was not the first time that a major, oil company in my portfolio slashed their dividend in an attempt to clean up their balance sheet. Who could forget Kinder Morgan’s infamous cut in 2015?? There was one underlying theme in both of these dividend cuts: Debt. Both companies had amassed large debt balances; debt balances that eventually became too much to handle in a time of crisis. Large debt balances are not exclusive to oil companies, sadly. Thus today, in the midst of the turbulent market and COVID-19 pandemic, I wanted to talk a little more about debt and then identify dividend stocks with low debt balances. Hopefully, this will help us find some great, undervalued Dividend Aristocrats with low debt balances to invest in!

Growing Debt on Balance sheets

We have lived in a low interest rate environment since the financial crisis. Low interest rates have encouraged individuals and corporations to borrower at cheap interest rates to various forms of investment. There are countless individuals that have locked in 30-year fixed rate mortgages at a rate below 4%. My initial interest rate was 3.89% when we purchased our house in 2017 and I was able to refinance at a rate of 3.40% in 2019 (saving nearly $50 per month in the process). Rates like these are unheard of to people my parents age. When they purchased their first home, interest rates were well over 10%!

Corporations, like individuals, have taken advantage of this low interest rate environment as well. Corporate debt continues to climb to record highs. At the end of 2019, worldwide corporate debt exceeded $13.5 trillion (Source). That is $13,500,000,000,000. Aka, a lot of zeros.

Like individuals, the low rates were supposed to jump start investment, increasing productivity, profitability, and having a very positive impact on the economy. While those activities did happen, cheap debt also allowed some companies to use debt to acquire companies and create a debt heavy balance sheet (Occidental Petroleum, Kraft-Heinz, AT&T, etc.) and to fund share repurchases and even dividend increases. Personally, I have benefited from those two scenarios a lot over the years. Heck, we cheer every dividend increase on this website. However, as we are seeing now, there are some downsides to the inflated corporate balance sheets.

(adsbygoogle = window.adsbygoogle || []).push({}); When Debt can lead to a dividend cut – The Occidental Petroleum Story

Let’s circle back to the cause of my frustration, Occidental Petroleum. On the eve of their dividend cut, Lanny wrote a very detailed piece on Seeking Alpha talking about Occidental’s high dividend yield and their inevitable dividend cut (linked below). In this article, Lanny walked the readers through the perfect storm of events that led the company to their dividend cut.

READ: Occidental Petroleum – An “Accidental” High Dividend Yield

Occidental Petroleum’s acquisition of Anadarko was heavily debt financed. To fund the acquisition, the company issued over $21.8b in new debt. The company managed to pay $7b in debt back before the end of 2019 and was planning on aggressively paying down the issued debt. Assuming a 6% interest rate, this new debt would result in $1.3b of interest expense annually. Remember, that is just off of “new debt” associated with the acquisition. This doesn’t even account for the remaining of the company’s outstanding debt as of the end of the year ($37.4b total, including the debt from the acquisition. This results in a projected annual interest expense of $2.2b (assuming 6%). That is a lot of interest expense right there…and that doesn’t even include principal repayments that will become due starting in 2021!

Lanny then goes on to describe the other half of the perfect storm. Once oil prices collapsed and Occidental’s revenues and income were impacted significantly. Unfortunately, regardless of the price of oil or the economic environment, the company’s debt obligations and interest expense remain the same.

Management was forced to look and find new ways to increase their cash flow. Last year, OXY paid shareholders $2.2b in dividends. The dividend cut was the most sensible way to free up the cash flow to pay their debt obligations and continue their operations. In this battle, the debt holders beat out the shareholders. Hopefully this demonstrates how high debt balances can push companies towards a dividend cut when the company faces adversity.

Dividend Aristocrats with Low Debt

The last section focused on why debt can be a problem. I would be remiss to paint corporate debt only in a bad light. Debt is not always a bad thing, if properly managed. In fact, there are many great companies out there that properly manage their balance sheet and use debt in a prudent manner.

There are many great, dividend paying stocks with low debt levels. So this article is going to identify a population of great dividend stocks with low debt balances. Lanny hit one point on the head in his last watch list. His watch list was designed with the coronavirus and turbulent markets on his mind. Focus on quality, quality, and more quality. There are plenty of great dividend growth stocks that have paid an increasing dividend over an extended period of time.

Read: Lanny’s Coronovirus Dividend Stock Watch List

That is why I am developing my list with the following two criteria in mind: Dividend History and Debt. My goal is to keep it short and simple while providing us with a comprehensive list to use as we build our own watch lists going forward.

Criteria #1: Dividend Aristocrat – For this list, I am focusing exclusively on Dividend Aristocrats. A Dividend Aristocrat is company that has increased their dividend for 25 consecutive years. That would encompass companies that increased their dividend through the dot.com bubble and the financial crisis. We are currently in a unique economic situation with a new set of challenges. However, focusing on Dividend Aristocrats will allow me to identify the cream of the crop. The companies that have demonstrated that they know how to navigate tough economic waters while still increasing their dividend.

Criteria #2: Debt to Equity Ratio Less than .5X – The debt to equity ratio is calculated exactly how it reads, by taking a company’s total debt balance and dividing it by its total equity. Taking a step back, there are two ways that a company can finance their operations. By issuing debt or issuing equity. Both methods have pros and cons. The point of this article is not to discuss the merits of each. Rather, it is to identify companies that have used less debt to finance their operations and thus, are less prone to dividend cuts like Occidental Petroleum. A dividend cut caused by a sudden decrease in revenue, leaving the company unable to cover both their debt obligations. Using a debt to equity ratio threshold of .5X or lower indicates that a company uses a blend of debt and equity financing that is manageable and is less likely to lead to a bloated balance sheet.

READ: Our Top 5 Foundation Stocks for a Dividend Investor’s Portfolio – T, JNJ, PG, ED, and MCD

(adsbygoogle = window.adsbygoogle || []).push({}); The List – Dividend Aristocrats with Low Debt

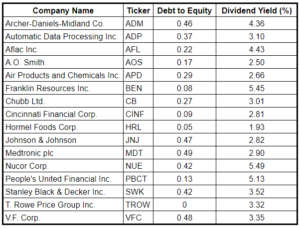

I’m sure you are all eager to see how the list itself. Without further ado, here are the list of Dividend Aristocrats with low debt:

Note: Information in the chart is as of 3/18/20 close. Information obtained from www.finviz.com.

The list was eye opening for me for a few reasons.

First, of the 17 companies on this list, only 5 of the companies had dividend yields over 4%. It isn’t surprising though. The dividend yields for companies like Johnson and Johnson will not knock you off your feet. However, you know what will? The fact that the company has managed their balance sheet well and they have increased their dividend for 57 consecutive years.

Second, I own several of the companies on this list. ADM has been one of my favorite stock purchases over the last few months. JNJ is one of our Top 5 Foundation stocks and one of the three companies on Lanny’s last watch list.

Third, this is a general statement, but I can’t help but think of it every time I review this list. Man there are some great paying dividend growth stocks with very management debt to equity ratio and strong dividend yields!

See – Our Dividend Stock Portfolios – We Share our FULL Portfolios on our Website

Summary

Debt isn’t necessarily a bad thing. I hope that isn’t your takeaway from this article. However, poorly managed debt balances may have bad ramifications for dividend investors when times become tough. We are seeing this firsthand today. It is funny to me that this concept is not different than a family’s personal budget. In today’s tough economic environment, I wanted to help investors find quality Dividend Aristocrats with low debt balances. Now, let’s dust off our sleeves, build our watch lists, and continue pushing ourselves one step closer to financial freedom!

Do you consider debt when investing? If so, what metrics do you use and what are your thresholds? Do you think a .5X debt to equity ratio is too low and eliminates too many companies?

Bert

The post Dividend Aristocrats with Low Debt appeared first on Dividend Diplomats.