Bert’s February Dividend Stock Purchases

I thought the end of February was insane for the market. During that time, I took advantage of some great deals in the stock market. But if March has proven anything to me, it is the importance of why you cannot try to time the market. Each day presents a new set of twists and turns, as more information and details come to light about the coronavirus and those impacted. The most important thing is we all do our best to stay healthy. Like Lanny this week, who wrote about how his family added $230 in dividend income from purchases in February, I also wanted to take some time and summarize my stock purchases from February.

Why dividend investing?

We’re all racing as hard as we can towards financial freedom. That’s why each individual stock purchase is so important. With each purchase and each dollar invested in our portfolios, we increase our passive income stream by an additional dollar. Each purchase puts us one step closer to breaking the chains and leaving that mind numbing “job” or “career” that causes more stress, anger, frustration than its worth. We share our entire portfolio on our website and show each monthly dividend income summary, so you can see the progress we are making towards achieving our dreams.

See – Our Dividend Stock Portfolios

See- Our Dividend Income Summaries

The hard part is that undervalued dividend stocks ares dividend to come by in 2020. That’s why we use our Dividend Stock Screener to help us find any value that we can. Throughout the last decade, we’ve consistently applied the three metrics of our simple Dividend Stock Screener and tried to act as swiftly as possible when we identify a value.

The Stock Purchases

In hindsight, we purchased more stock than I remembered in February. We had some extra cash in my wife’s brokerage account that we had been waiting to invest. This helped fuel some, but not all of the stock purchases, in her account. Purchases in her account are labelled with a “W.”

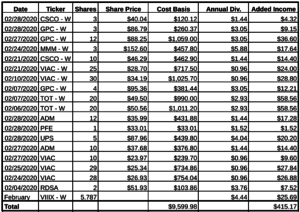

Overall, we invested $9,599 of capital in our accounts, adding $415.17 in dividend income to our portfolio. Here is a detailed listing of the stock purchases below:

We were able to purchase a lot of stocks this last month due to free trades. Honestly, the “free trade” stock brokerage wars in 2019 have proven to be a huge beneficiary to individual investors. Without free trades, many of these trades would not have been able to happen. Saving $3.95 per trade adds up when you make 10+ trades in a month!

I don’t want to summarize each of the purchases. Rather, I’ll focus on some of the companies that represented sizable purchases.

(adsbygoogle = window.adsbygoogle || []).push({}); VIACOMCBS (VIAC)

For those of you that have followed this blog for a while now, this series of purchases really shouldn’t have surprised you. Why? Lanny put a ton of time, legwork, energy, and effort into identifying this undervalued dividend growth stock. After reviewing his work and many discussions, I was sold on the company and ready to being initiating a position of my own. Like Lanny, I do like the companies movie content (Paramount), push into streaming (Pluto TV), NFL TV Rights (CBS), and a portfolio of strong networks (Showtime, CBS, Comedy Central, and so on).

Read – ViancomCBS – A Sleeping Giant and an Undervalued Dividend Growth Stock

The company checks all three boxes of our dividend stock screener, as Lanny summarized in the article linked above.

After running the screener, their valuation and price point were very appealing for me. Hence, we decided to begin initiating positions throughout the month. As the month went on, the company’s stock price continued to fall. Throughout February, we purchased the stock a combined 5 times! The overall purchases were as follows:

Wife’s Portfolio: 55 shares; $1,743.20 cost basis; $52.80 in dividend income added.

My Portfolio: 67 shares; $1,728.60; $64.32 in dividend income added.

For those of you that are curious about the fact that I was able to add 12 more shares for a lower cost basis, that just shows how crazy the end of the month was. The purchases for my portfolio were made in the final week while my wife’s were made earlier in the month. The first purchase was for $34.10 per share and the last purchase of the month was for $23.97. What’s crazier is that the company’s stock price fell even lower in March. We are definitely in some crazy times.

Still, even with the steep price decline, I couldn’t be happier with the additions.

READ: Lanny’s March Watch List – VIAC, PFE, AMNF

Archer Daniels Midland (ADM)

Archer Daniels Midland is a company that I have been looking forward to adding to for several months. The company is a Dividend Aristocrat and announced their annual dividend increase at the end of January. The company took a beating in the first half of 2019 as the trade war was in full swing. Then, the second half of 2019 happened. Their stock price shot up. Since that point, I told myself I would buy back in if I had a chance.

Towards the end of February, as the coronavirus news really started to spread and the impact in the market impact was felt, their stock price fell once again. Suddenly, the stock was trading in the $35-$38 per share range once again. At that time, I knew I had to add to my position. But just to be certain, I ran ADM through our stock screener.

My Portfolio: 22 shares; $808.68 cost basis; $31.86 in dividend income added

It is crazy to me that ADM is now yielding over 4.00%. To me, it is a great opportunity to add a Dividend Aristocrat at a very strong dividend yield. I may look to add in March if their price continues to decline or stay in this price point range.

(adsbygoogle = window.adsbygoogle || []).push({}); Total (TOT)

This was probably the largest surprise purchase for our portfolios. Please note, this was before the price of oil crashed in March! Two purchases of Total were made for my wife’s portfolio at the beginning of February. At this time, Total announced a 6% dividend increase and solid results from the year. Cash flows were up 20% compared to the fourth quarter last year. These results were achieved in an environment in which the price of oil decreased. So to me, increased cash flow, increased dividend, were a few strong indicators in a sector that showed signs of trouble with some of the other major integrated oil companies.

Total was also attractive because it allowed me to diversify away from my other, major integrated oil purchases. I own Exxon, Chevron, Shell, BP, KMI, Occidental Petroleum, and Schlumberger. Total is headquartered in France. So investing in them allows me to diversify away from the rest of my US and British holdings. While the company is still major, integrated oil, it was different than they other 7 I just referenced. A nice change of pace. Plus, the dividend yield is very nice.

Both purchases were made at the beginning of February. Here are the totals:

Wife’s Portfolio: 40 shares, $2,001.20 cost basis, $117.12 in dividend income added.

Unfortunately, I don’t think anyone could have predicted what occured in March. Still, even though I am starting a large unrealized loss position in the face, I am still happy about my investment in this major, integrated, foreign oil company. It will help diversify me away from my domestic oil exposure. Overall, after these next few months, it may be time to take a step back and revisit my future purchases of oil companies all together.

READ: Occidental Petroleum: An “Accidental” High Dividend Yield

Genuine Parts Company (GPC)

We continued to build our position in my wife’s portfolio for Genuine Parts Company. I spoke in detail about this purchase last month’s purchase summary. But overall, I love this company based on their strong dividend growth history (63 consecutive years), their strong position in the secondary auto parts industry, and their other strong consumer brands. Their last dividend increase was just announced in February too! This is the exact type of company that I think of when I think of long-term dividend growth investing.

Read: Dividend Increases Announced in February 2020

We added 4 shares at the beginning of the month. Then, as prices really fell, we added another 15 shares at the end of February. I couldn’t believe their stock price fell below $90 per share at the time, so I had to add to her position. Heck, now that their stock price is trading in the low to mid $80 per share range, I may have to add to my wife’s position more in March!

Wife’s Portfolio: 19 shares; $1,700.81 cost basis; $57.96 in dividend income

Summary

Hopefully you can see that even though I didn’t summarize each individual company in this article, I am very happy with the stocks we were able to add. It was great to put a lot of capital to work in the market in February and add over $400 in dividend income accordingly. In my February dividend income summary, I hinted that I added a lot of dividend income via stock purchases. Hopefully this didn’t disappoint those of you that were eagerly awaiting.

Let’s address the elephant in the room though. Am I upset that prices fell after our purchases? No, not really. Because at the time of each purchase, I reviewed the information that was available and made a decision based on the numbers presented in front of me. There is no way that I could have predicted the severity of the coronavirus outbreak or a crash in the oil market. Each day, we have to do the best with the information that is readily available to us. Again, that is why you cannot time or predict the market.

Did you purchase a lot of stock in February? What positions did you add? What did you think about my Total purchase? Or was that crazy given my current exposure to oil? What is your take on the oil market? Lastly, do you think GPC is a great buy at their current prices?

Bert

(adsbygoogle = window.adsbygoogle || []).push({});

The post Bert’s February Dividend Stock Purchases appeared first on Dividend Diplomats.