Best VA Loan Lenders of 2020

Interest rates have fallen across the lending spectrum, including mortgages. That also applies to VA loan rates. At this writing, they may be at the lowest levels ever.

If you’re eligible for a VA loan, now is an excellent time to take advantage of these low rates, to either purchase a home or refinance your current mortgage from one of the best VA loan lenders.

You can apply for a VA mortgage through any lender that participates in the program. But some lenders only occasionally originate VA loans, and are only minimally familiar with the guidelines.

For that reason, you should concentrate your efforts on those companies that frequently provide VA loans, and can make the process as effortless as possible.

The 4 Best VA Loan Lenders

Here are the best VA mortgage lenders:

Veterans United Home Loans

Veterans United Home Loans is the largest provider of VA loans in the country. One of the big advantages is that they operate in all 50 states, so you can work with this company no matter where you live. You can begin the loan application process either online or by phone.

Veterans United Home Loans is the largest provider of VA loans in the country. One of the big advantages is that they operate in all 50 states, so you can work with this company no matter where you live. You can begin the loan application process either online or by phone.

One of the big advantages with this company is that it specializes in VA loans. They even engage the services of former senior enlisted leaders from each branch of the armed services, to provide guidance on the specific requirements of active duty military personnel.

Veterans United also offers several valuable programs to help you in purchasing a home. They can provide direct assistance in the process through a network of real estate agents who specialize in working with veterans.

Learn More: Read our full Veterans United Home Loans Review.

Veterans First Mortgage

![]() Veterans First Mortgage is another major lender specializing in VA loans. But they also offer FHA loans, which can be important in connection with veterans. If for any reason you’re unable to qualify for a VA loan, an FHA mortgage can be a viable Plan B.

Veterans First Mortgage is another major lender specializing in VA loans. But they also offer FHA loans, which can be important in connection with veterans. If for any reason you’re unable to qualify for a VA loan, an FHA mortgage can be a viable Plan B.

The company has been providing VA loans since 1985, which gives them a wealth of experience in dealing with these highly specialized loans.

You’ll be assigned a VA loan specialist who will work with you through the entire process, making the experience more stress-free. That will be especially important if you’re taking a VA loan for the first time, and prefer to be walked through the process.

Quicken Loans

Quicken Loans is the largest mortgage originator in the US, operating throughout the country. In addition to providing VA loans, they also offer all other types of mortgages, including conventional, FHA, Jumbo, and USDA loans.

Quicken Loans is the largest mortgage originator in the US, operating throughout the country. In addition to providing VA loans, they also offer all other types of mortgages, including conventional, FHA, Jumbo, and USDA loans.

The availability of the other loan types may be significant in case you can’t qualify for a VA mortgage, or if a VA loan won’t fit your mortgage needs. For example, if you need to get financing for a second home or an investment property, you’ll need a conventional mortgage. A lender that only offers VA loans may not be able to help you with that kind of purchase.

Quicken Loans also rates very highly for customer service, and has the advantage of servicing the loans it originates. That means you’ll be making your payments directly to the same company.

Learn More: Read our full Quicken Loans Review.

Rocket Mortgage

Rocket Mortgage is part of Quicken Loans, serving as its online mortgage lending arm. It offers all the advantages of Quicken Loans, but adds the convenience of an all-online process. That means there’s no need to meet with a loan officer face-to-face. The entire process can be completed online, including uploading of documents. That can lead to fast approvals, and closings with reduced time frames.

Rocket Mortgage is part of Quicken Loans, serving as its online mortgage lending arm. It offers all the advantages of Quicken Loans, but adds the convenience of an all-online process. That means there’s no need to meet with a loan officer face-to-face. The entire process can be completed online, including uploading of documents. That can lead to fast approvals, and closings with reduced time frames.

Like Quicken Loans, Rocket Mortgage also originates many VA loans, as well as other mortgage types.

Learn More: Read our full Rocket Mortgage Review.

What Is A VA Loan?

VA loans are a special program created by the US government and managed by the Department of Veterans Affairs. They exist to provide home financing specifically for eligible active duty members of the military, as well as veterans. Members can come from any branch of the military, including the Army, Navy, Air Force, Marines, Coast Guard, the National Guard and the Reserves.

VA loans are not actually made by the Veterans Administration. Instead, the loans are provided by private institutions, like banks and mortgage companies. Mortgage insurance provided by the VA, which gives the loan program its name.

That mortgage insurance acts as an inducement for lenders to make loans to eligible veterans, with less concern for the losses that might be sustained from foreclosures.

What Are The Benefits of a VA Loan?

VA loans have many benefits, some of which are unique to this particular loan type:

- No down payment requirement: Up to certain very generous loan limits, VA loans offer 100% financing.

- No monthly mortgage insurance premium: Both conventional and FHA mortgages require a monthly premium. VA loans don’t. Instead, you’ll pay an upfront mortgage insurance premium that’s added to your loan amount and financed over the term of the loan. This will result in a lower monthly house payment than you might otherwise have.

- Seller-paid closing costs: VA allows property sellers to pay closing costs equal to as much as 4% of the loan amount/purchase price. Since closing costs typically average between 2% and 4%, it’s likely you won’t need to come out of pocket for closing costs at all. In combination with the 0% down payment requirement, VA loans are true 100% financing arrangements.

- Interest rates on VA loans are often lower: The rate advantage may be small, perhaps only 1/8 or ¼ of a point. But it will still result in a slightly lower monthly payment than would otherwise be the case.

How Do VA Loans Work?

VA loans have several “moving parts”, each of which is described below:

Loan Types and Terms

VA loans are available in terms ranging from 15- to 30-years. They’re also available in both fixed-rate and adjustable-rate mortgages (“ARMs”).

As the name implies, a fixed rate mortgage has a fixed interest rate and monthly payment throughout the term of the loan.

An ARM will typically come with a fixed rate/fixed monthly payment for the first five years, then adjust each year thereafter. The new rate and payment can be either higher or lower than the initial rate and payment.

But to limit how much borrowers will pay on an ARM, “caps” are included in the loan. With a VA loan, the rate can increase by no more than 1% in any one year, or 5% over the life of the loan.

For example, if your initial rate is 3%, the highest the rate can be after the first adjustment is 4%. Over the life of the loan, the maximum interest rate will be 8% (3% + 5%).

Whether you take a fixed-rate or adjustable-rate mortgage, the loan will be completely paid off at the end of the loan term.

VA Funding Fee

FHA mortgages require mortgage insurance that includes both an upfront fee (that’s typically added to your mortgage loan balance), and a monthly premium that’s part of your new monthly payment. Conventional mortgages have private mortgage insurance, which adds a monthly premium to your house payment, but does not require an upfront amount.

The VA imposes a “Funding Fee”, which is an upfront charge added to the loan amount, and financed over the term of the loan. There is no monthly mortgage insurance premium.

The purpose of mortgage insurance is to is to provide assurance to the mortgage lender that at least part of the loan will be reimbursed upon foreclosure.

In the case of VA loans, the Veterans Administration insures 25% of the loan amount. If you default on a $200,000 loan, the VA will pay the lender $50,000. Presumably, the remaining $150,000 will be covered out of the proceeds of the sale of the property.

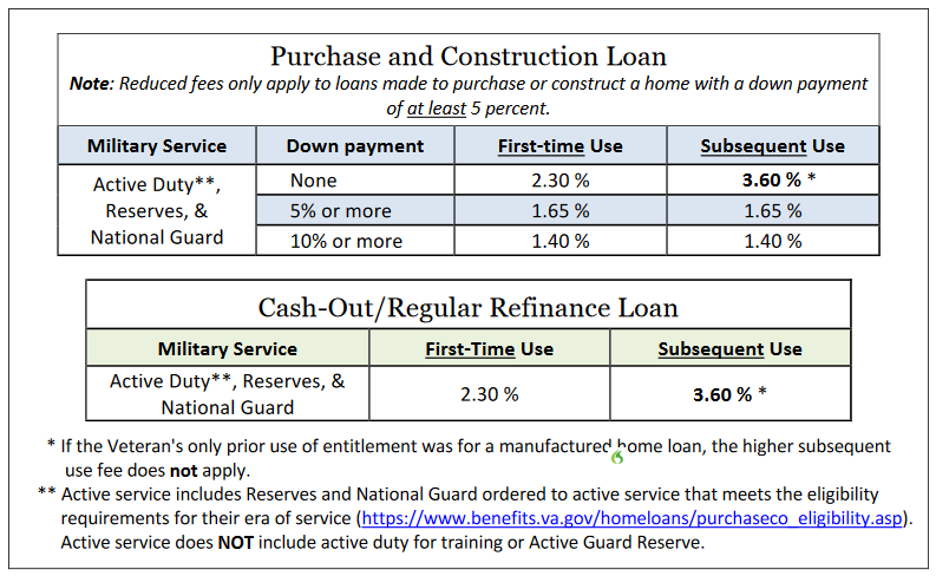

The amount of the VA Funding Fee will depend on the type of loan, the amount of the down payment made, and whether it’s a first time for subsequent use of your VA eligibility:

Maximum Loan Amount

Technically speaking, there’s no longer a maximum VA loan amount. However, to get 100% financing, the maximum loan amount ranges between $510,400 and $765,600, depending on the county where the property is being purchased.

These limits will apply only to veterans with one or more outstanding VA loans, or to those who have defaulted on a previous VA loan. But if you still have your full entitlement, and you’ve never defaulted on a previous VA loan, the loan amount can be as high as a lender is willing to grant. However, if you do exceed those limits, you’ll need to come up with 25% of the difference as a down payment.

For example, let’s say the property you’re purchasing is located in a county with a $600,000 loan limit. You can purchase a property for $800,000, but you’ll need to make a $50,000 down payment.

The $50,000 is 25% of the $200,000 that the purchase price will exceed the $600,000 county limit.

Loan amounts in excess of the published county limit are commonly referred to as VA Jumbo loans.

Eligible Property Types

Eligible property types for a VA loan are restricted to 1 – 4 family residential properties that will be owner-occupied either by the veteran or a member of the veteran’s immediate family.

Unlike conventional mortgages, VA loans are not available for financing second homes for investment properties.

All properties must meet minimum local standards for safety and livability, including proper functioning of the major components of the home.

How to Qualify for a VA Loan

While VA loans are specifically designed for eligible active duty and retired members of the military, each borrower will need to qualify based on his or her own merits. Several factors go into this determination.

Eligibility

Eligibility begins with the Certificate of Eligibility (COE). If you don’t have it available, your lender should be able to assist you in obtaining it. The COE should be available if you were not dishonorably discharged, and you meet the minimum active duty service requirement based on when you served.

You can check the eligibility requirements directly with the Veterans Administration, but below are the most common situations:

- You’re eligible if you have been on active duty for at least 90 continuous days.

- If you served between 1980 and August 1, 1990, you’ll need 24 months or at least 181 days on active duty.

- Between August 2, 1990 and the present, at least 90 days of active duty, or at least 90 days of your discharge for a hardship, reduction in force, or for convenience of the government, or less than 90 days if your discharge is for a service-connected disability.

Different service requirements apply to earlier time periods.

Credit Score Requirements

VA loans have no stated minimum credit score requirements. However, most lenders impose a minimum FICO credit score requirement of 620. Some will make loans to eligible veterans with lower scores, but will charge a higher interest rate if they do.

Exactly how high the rate will be will depend on your credit score and other details of your overall qualifications.

Debt-to-Income (DTI) Requirements

Generally speaking, VA loans are permitted with a DTI of up to 43%. DTI is your total fixed monthly payments divided by your stable monthly income.

Fixed monthly payments include your proposed monthly house payment, plus monthly payments for auto loans, student loans, credit cards, child support, alimony, and other recurring payments.

It does not include payments for utilities, insurance premiums (including health insurance), retirement contributions, and other variable or optional monthly costs.

If your overall credit qualification is strong, the lender may permit a DTI of up to 50%, but that will increase the interest rate you’ll pay on your loan.

In rare cases, a DTI exceeding 50% may be permitted, but it will result in an even higher interest rate and monthly payment. The lender may also require strong compensating factors, such as making a down payment, a decrease from your previous house payment, or a large amount of savings after closing.

Cash Requirements

Since VA loans require no down payment up to the county maximum loan limit, and closing costs can be paid by sellers, it’s very likely you won’t need any money up front at all.

The main exception will be either 1) where the seller refuses to pay your closing costs, or 2) the purchase price of the property you’re buying exceeds the maximum county loan limit, requiring you to come up with a down payment equal to 25% of the excess amount.

In most other situations, you should be able to purchase a home with no cash upfront whatsoever.

Factors Affecting VA Loan Interest Rates

Base interest rates for VA loans are determined by market interest rates. Mortgage rates in general are based on the 10-year U.S. Treasury note. That rate serves as a base, and a margin is added to it to compensate the bondholders who ultimately fund the loans.

But apart from the market-driven base rate, there are several factors that will affect the rate you’ll pay. Some of those factors were mentioned in the above section, but we’ll list them again here:

- The amount of your loan. Loans below $250,000 will include a slight rate increase, as will loans that exceed the local county limit.

- Credit scores. The rate you see published by any lender will probably be for someone with a credit score of 700 or higher. Lower scores will result in higher rates.

- A DTI greater than 43%, or greater than 50%.

- The length of your rate lock. The longer the lock, the higher the rate.

- Lender paid closing costs. If a seller won’t pay some or all your closing costs, your lender may pay them in exchange for a slightly higher interest rate.

- The term of your loan. 30-year loans have higher rates than 15-year loans.

Are VA Loan Rates Different Between Purchases and Refinances?

The VA offers a unique refinance program referred to as the Interest Rate Reduction Refinance Loan, or simply IRRRL. The advantage with this loan is that it requires less documentation. For example, since you’re replacing an existing VA loan on which you are already making payments, the lender won’t verify your credit, employment or income. They may not even perform a property appraisal.

Because of the simplicity of IRRRLs, rates are often lower than other loan types, including VA loans for purchases. What’s more, the VA Funding Fee on IRRRLs is just 0.5%, which is lower than the fee for other VA loan types. And since documentation is extremely limited, you can complete an IRRRL in a lot less time than it will take for a purchase mortgage.

A critical element with an IRRRL is that you cannot take cash out with the new loan. You’re simply replacing the existing VA mortgage with a new one with a lower interest rate. However, the program does allow you to add loan closing costs to the new loan amount.

To do an IRRRL you must be refinancing an existing VA mortgage. Conventional and FHA mortgages are not allowed. You also cannot have more than one 30-day late payment on your current mortgage within the past year. The rate on the new loan must be lower than your current rate, unless you are refinancing from an ARM to a fixed-rate loan. The property must also continue to be your primary residence.

Is A VA Loan Best For You?

VA loans are one of the very best mortgage types available. If you’re an eligible veteran or active duty member of the military, you should absolutely take advantage of this program for your home financing needs.

The post Best VA Loan Lenders of 2020 appeared first on Better Credit Blog | Credit Help For Bad Credit.

Original Article Posted at : https://bettercreditblog.org/best-va-loan-lenders/