Canadian Tech Is Here To Stay: Donville Kent

Donville Kent January 2021 ROE reporter titled, “Canadian Tech is Here to Stay.”

if (typeof jQuery == ‘undefined’) { document.write(”); }

Q4 2020 hedge fund letters, conferences and more

In December 2020, the Capital Ideas Fund (the “Fund”) finished the year strong with our best monthly return in history at 12.62%.1 Additionally, November and December 2020 mark our two best consecutive months ever and we finished the year 22.35% higher.1 Since inception, just over twelve years ago, our annualized return since, now stands at 17.64%.1

Last year was certainly a rollercoaster and with 2020 behind us, we have so many reasons to be excited for 2021. Due to COVID-19, there is substantial, pent-up demand for the things we have longed for during lockdown. There are also unprecedented fiscal stimulus plans around the world, low interest rates, and unexpectedly high personal savings rates. Once our lives regain some degree of pre-pandemic normalcy, we will see a massive explosion of optimism and economic activity, and we forecast that there will be a sizable market rally. Thus, we believe 2021 and 2022 will be stellar years for the stock market.

Technology has become the most important sector on the TSX

Do you recall a company named Burntsand? My first foray into tech investing began with a Vancouver-based company called Burntsand, which I discovered in late 1999, with Y2K and its expected chaos looming a few months away. Burntsand was all about the internet. If you read its press releases or annual reports at the time, it was practically impossible to discern exactly what they did. Despite this, the stock’s valuation soared through the roof, regardless of how earnings and revenues measured. Burntsand was destined to change the world! And nobody, including myself, seemed to understand why. Oh, welcome to tech investing in the early 2000’s.

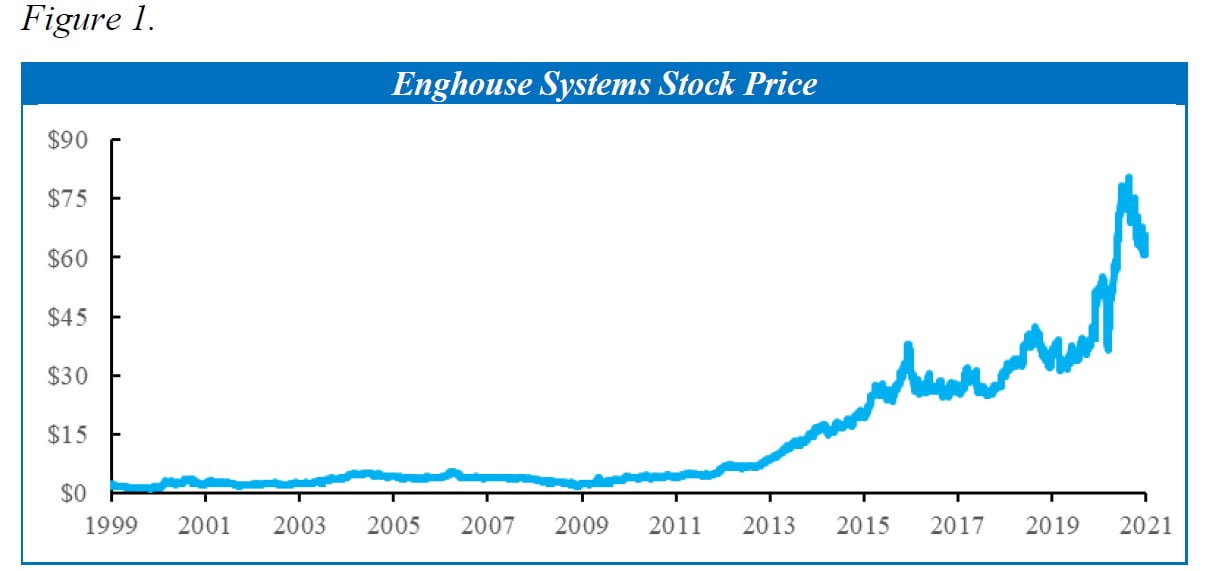

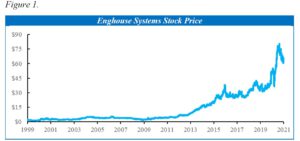

The Canadian tech market has evolved dramatically since the Dotcom days of 1999-2002. Most of the Dotcoms crashed or quietly evaporated with only two Canadian tech giants emerging from the fire, specifically Nortel and Research In Motion (“RIM”; now known as Blackberry). Of course, Nortel eventually died and Blackberry, which peaked a little later, has been withering for more than a decade. But other tech companies from that era, including CGI, Enghouse Systems (figure 1) and Open Text, have continued to prosper. And while there has been a proliferation of new technology companies on the TSX since the Dotcom era, the past eighteen months have witnessed a surge in the number of home-grown technology companies with viable business models on the TSX. In the past year and a half, technology stocks have jumped from perching on the periphery of the TSX to mainstream.

Before 2010, there were five major tech companies on the TSX, specifically: (i) Open Text; (ii) Constellation Software; (iii) Enghouse Systems; (iv) CGI; and (v) RIM. At that time, CGI was the largest of the group. RIM was already losing market share to Apple and the other three were still too small to have much analyst coverage. Nothing really changed until 2014/2015 when Kinaxis and Shopify went public. Still, even with these additions, the Canadian tech sector was relatively small, comprising less than 5% of the TSX’s market capitalization.

Reasons For The Rise Of The Canadian Tech Sector

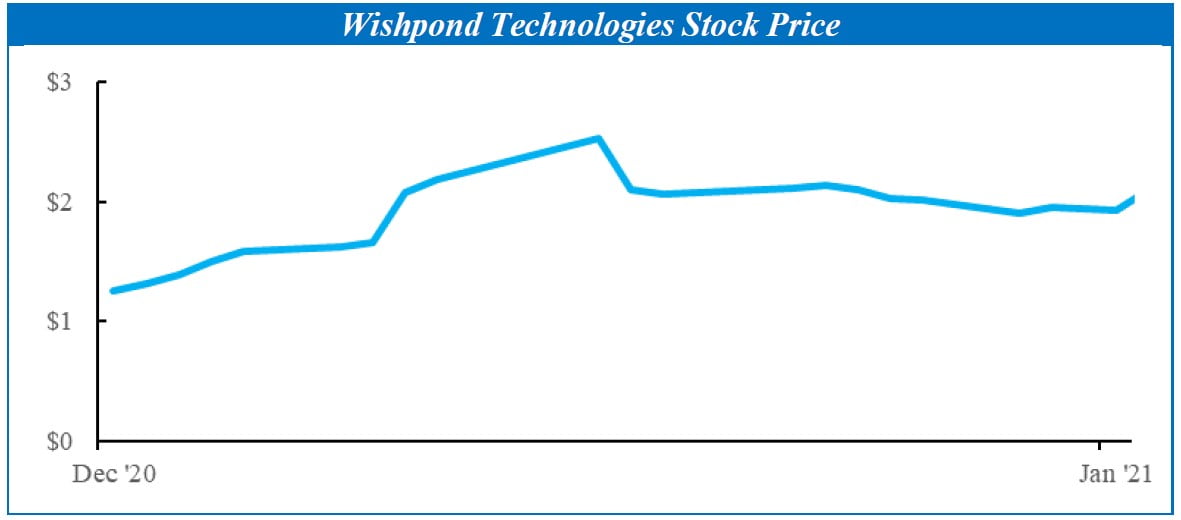

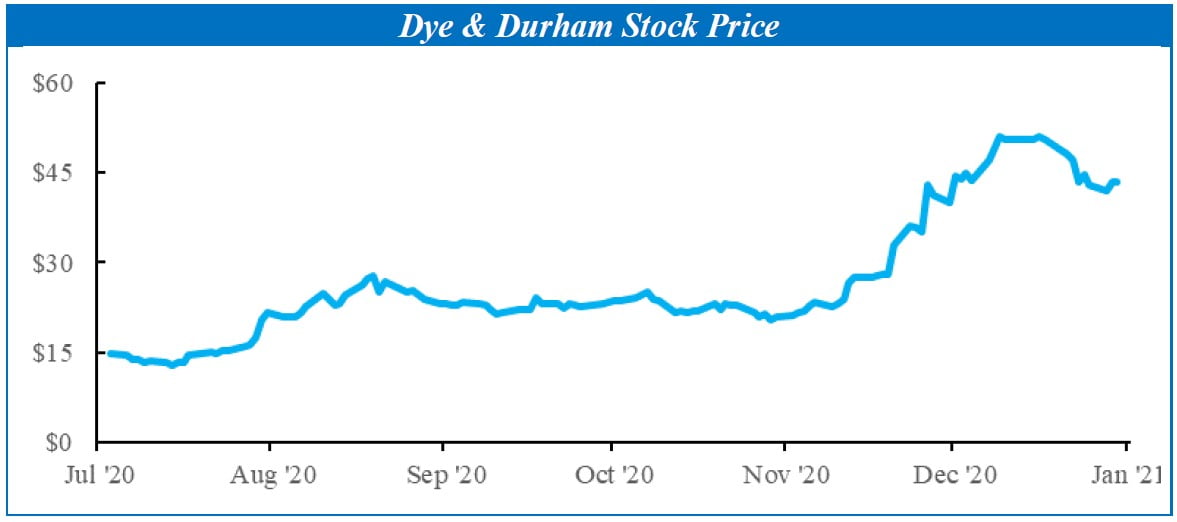

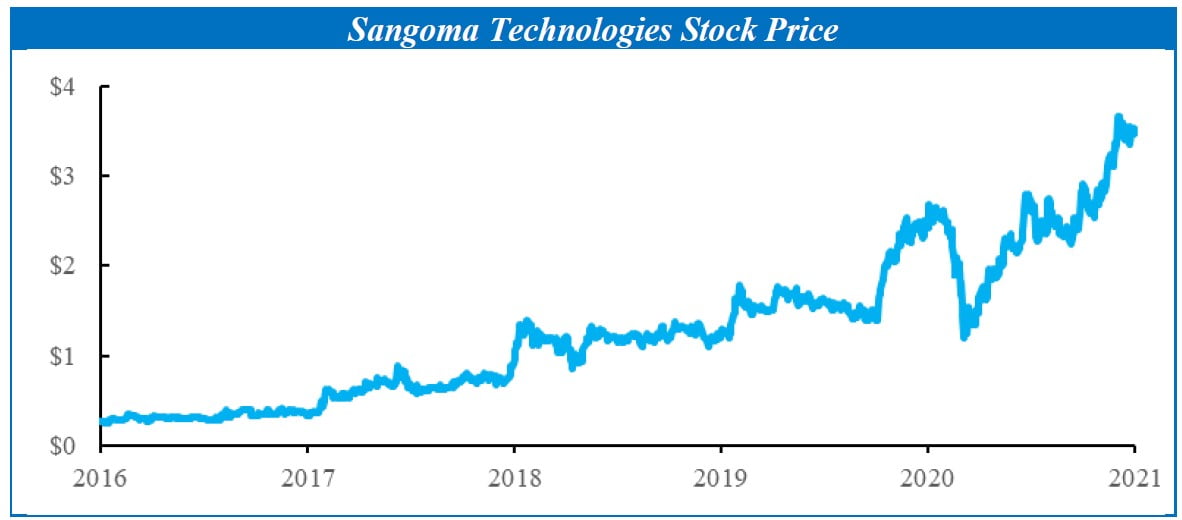

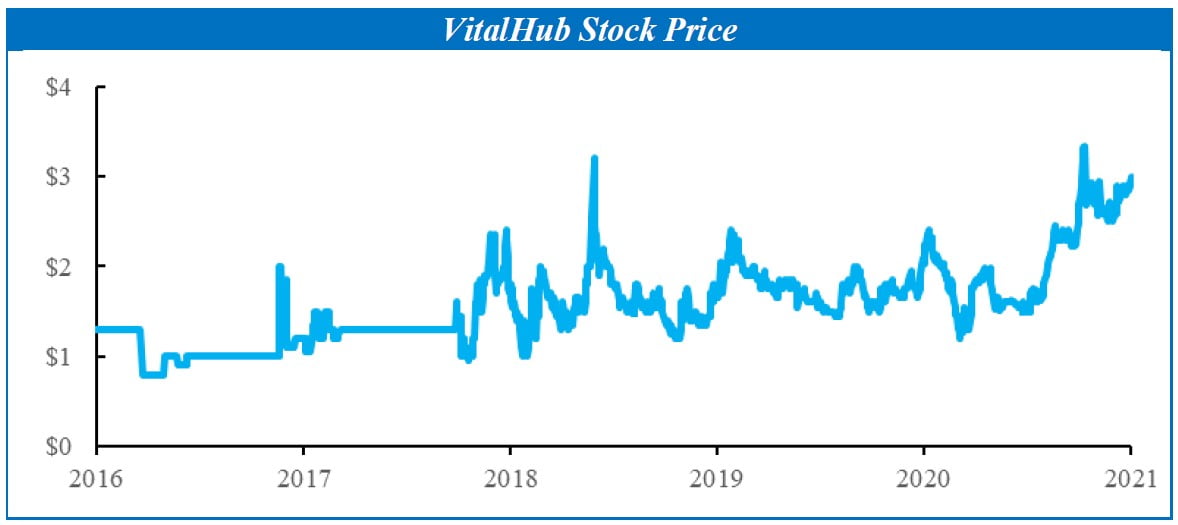

Things really started to change in 2019/2020 for two major reasons. First, the IPOs of Lightspeed, Docebo, Dye & Durham, Nuvei, Pivotree, BBTV, AdCore, WeCommerce, and Wishpond gave the TSX a critical mass of mid cap tech stocks that were focused on the digital economy, growing quickly and well capitalized (figure 2). Second, smaller companies that had been listed for a while but had not quite solidified their action plans began to mobilize. This list includes companies like Prontoforms, Sangoma, MediaValet, and Vitalhub. Over the course of eighteen months, the number of high-quality tech stocks jumped from just six or seven to more than twenty.

Earlier this month, we listened to an interview with famed tech investor Marc Andreessen. His main takeaway was that the Dotcom bust of the 2000’s destroyed any public market appetite for high growth tech stocks. However, the technology sector continued to innovate and grow and as a result, there is a 20-year backlog of tech companies that are now starting to go public.

Today, the market is receptive to high growth stocks. A major caveat here is the quality of these tech companies. They provide real services, frequently mission-critical services, and generate attractive economics for shareholders. Last year, our July 2020 newsletter discussed how tech infrastructure and costs have reached a point where technology that previously was not economically feasible is now achievable. As a result, we have seen a substantial increase in deal flow, and it seems like we are evaluating at least one or two IPOs each week. We participated in several IPOs in 2020 and we are seeing a healthy pipeline for 2021.

Following the excellent performance of tech stocks in 2020, we believe this trend will continue into 2021 for three reasons. (i) We estimate that the leading tech companies on the TSX will grow at more than 30% annually2, compared to the rest of the companies on the TSX, which are growing at perhaps 7%.2 (ii) The digital transformation that began many years ago and accelerated sharply in 2020 due to the pandemic will only evolve faster and faster in 2021. (iii) With more than 150 micro cap tech stocks on the TSX, we expect at least five transformations to occur in 2021 as well as another five significant IPOs.

Looking beyond just 2021, there are some prognosticators who believe that the TSX, like most stock markets, will be dominated by tech companies a decade from now and we could not agree more. Some have suggested that this sector could account for 50% of the TSX’s market capitalization in ten years’ time. If such a prediction is even remotely accurate, it implies that the Canadian tech sector will easily be the largest driver of Canadian wealth for the next decade. To help you take advantage of this shift, here are some of our best tech investment ideas below.

Tech Ideas

Our methodology ranks stocks on a growth to value scale and the stocks below have the most attractive metrics for 2021.

Wishpond Technologies (WISH) provides digital marketing solutions and cloud-based software that assist SMEs with a range of marketing initiatives, including lead generation, sales conversion, and analytics. WISH went public in December 2020 at $0.75/share and now trades at $2.10/share. The Fund represented a large portion of the IPO proceeds and has continued to add more to its position ever since. The company has announced two acquisitions since going public and we expect a larger one at the beginning of 2021. At this time, WISH’s market cap is perched at $100 million, a noteworthy threshold as surpassing this mark will certainly attract more investors.

Dye & Durham (DND) went public in July 2020. The Fund participated in the IPO at $7.50/share and bought a lot more once the stock started free trading. We continue to have the highest conviction in DND. It would be hard to find another company achieving this much growth while demonstrating tremendously high EBITDA margins. The company recently announced that it will acquire a majority stake in Courthouse Solutions as well as acquire DoProcess, adding to its flurry of M&A activity last year.

Sangoma Technologies (STC) continues to effectively illustrate its value proposition to clients as a one-stop shop for communication software and services, specifically targeting middle market companies. STC intends to list on an exchange in the US and shift to reporting in USD, which would expand the universe of potential investors, thus driving STC’s multiple higher. The company is also expected to make one or two sizeable acquisitions with its substantial cash reserves. We expect its business to double in size in just over three years, which will draw larger investors as well as potential acquirers. The business proposition is occasionally still misunderstood due to STC’s previous reputation as a pure hardware business. However, if the company continues to execute successfully, this stock should see a significant re-rating.

VitalHub (VHI) announced notable customer wins since the quarter ended and we expect VHI to continue reporting strong earnings. This pandemic has highlighted how critical it is for hospitals to be efficient with their resources, giving VitalHub the opportunity to make a real difference with hospitals and their operations. Cash reserves are equivalent to 25% of the company’s market cap and we expect VHI to use this cash to double the size of its business, similar to what they did in 2020. Organic growth will surprise to the upside.

Organizational Updates

This month, we welcomed Sarah Cheng to the Donville Kent team as a VP, Investor Relations & Business Development. Sarah has more than 10 years of experience, focused primarily on investor relations for private equity funds. Most recently, she was the Director, Investor Relations at Whitehorse Liquidity Partners in Toronto, spearheading the implementation of various processes and infrastructure within the investor relations function while managing the capital raise for the firm’s third fund. Previously, Sarah held investor relations roles at Apollo Global Management in New York and Marlin Equity Partners in Los Angeles. She obtained an MBA from Columbia Business School and an HBA from Ivey. Sarah will be a great addition to the team.

Final Thoughts

Although the pandemic is not over yet, we are starting to see a clearer picture of what the new normal will look like. We are happy to report that many of our portfolio companies are performing well and are entrenched in strong competitive positions with catalyst events on the horizon. We cannot wait to see how 2021 unfolds and are excited about the prospect of 2021 being a stellar year for the stock market amidst the new normal economy.

As always, we are happy to host virtual meetings with investors upon request and will also be hosting webinars and participating in online conferences in the coming weeks. We encourage you to reach out with any questions or concerns. Thank you for your continued support of Donville Kent.

J.P. Donville & Jesse Gamble

info@donvillekent.com

.fb-background-color { background: !important; } .fb_iframe_widget_fluid_desktop iframe { width: 100% !important; }

(adsbygoogle = window.adsbygoogle || []).push({});

(function() { var sc = document.createElement(“script”); sc.type = “text/javascript”; sc.async = true;sc.src = “//mixi.media/data/js/95481.js”; sc.charset = “utf-8”;var s = document.getElementsByTagName(“script”)[0]; s.parentNode.insertBefore(sc, s); }());

The post Canadian Tech Is Here To Stay: Donville Kent appeared first on ValueWalk.

Original Article Posted at : https://www.valuewalk.com/canadian-tech-here-stay-donville-kent/