Cat bond & ILS issuance passes $7.2bn, changed investor appetites evident

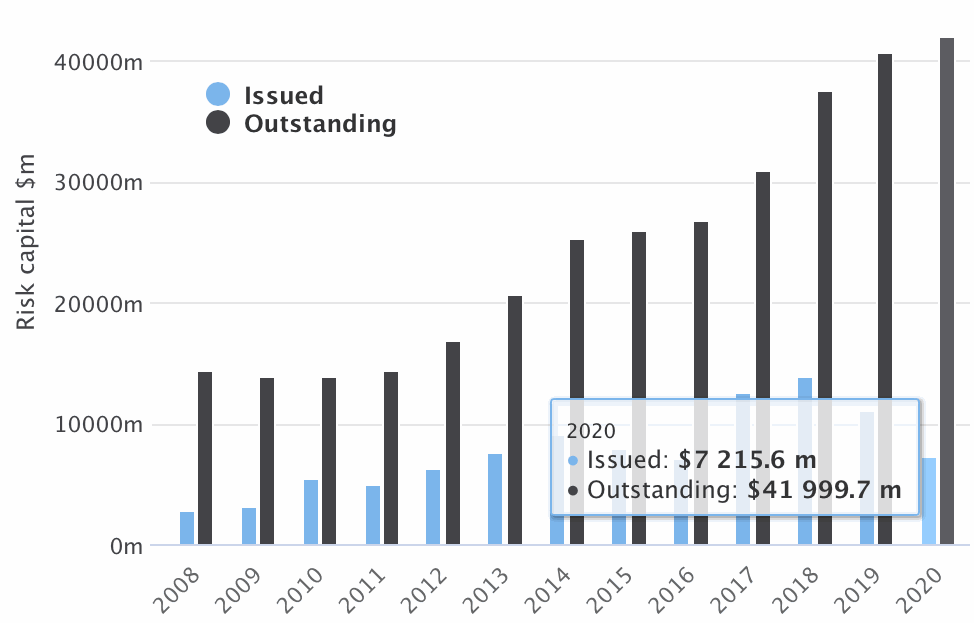

Issuance of new catastrophe bonds has continued to be brisk over the last few weeks, with repeat sponsors helping to drive total catastrophe bond and related insurance-linked securities (ILS) issuance for 2020 to-date above $7.2 billion, according to Artemis’ Deal Directory data.

Catastrophe bonds are the source of the continued brisk issuance, as the mortgage insurance-linked securities (ILS) market has ground to a halt on the financial market uncertainty and volatility created by the Covid-19 pandemic.

But cat bonds have seen robust demand still from the ILS fund and investor base, although appetites have been adjusted somewhat in the wake of the recent years of catastrophe losses and the pandemic related threat.

As of today, Artemis’ Deal Directory counts almost $7.22 billion of new catastrophe bond and related insurance-linked securities (ILS) issuance so far in 2020.

This brisk level of issuance has resulted in the outstanding catastrophe bond and related ILS market ending May at almost $42 billion in size, although this is actually a slight shrinkage on where the figure was earlier this week due to a large maturing transaction.

As we said, catastrophe bond investor appetites have changed somewhat in recent weeks.

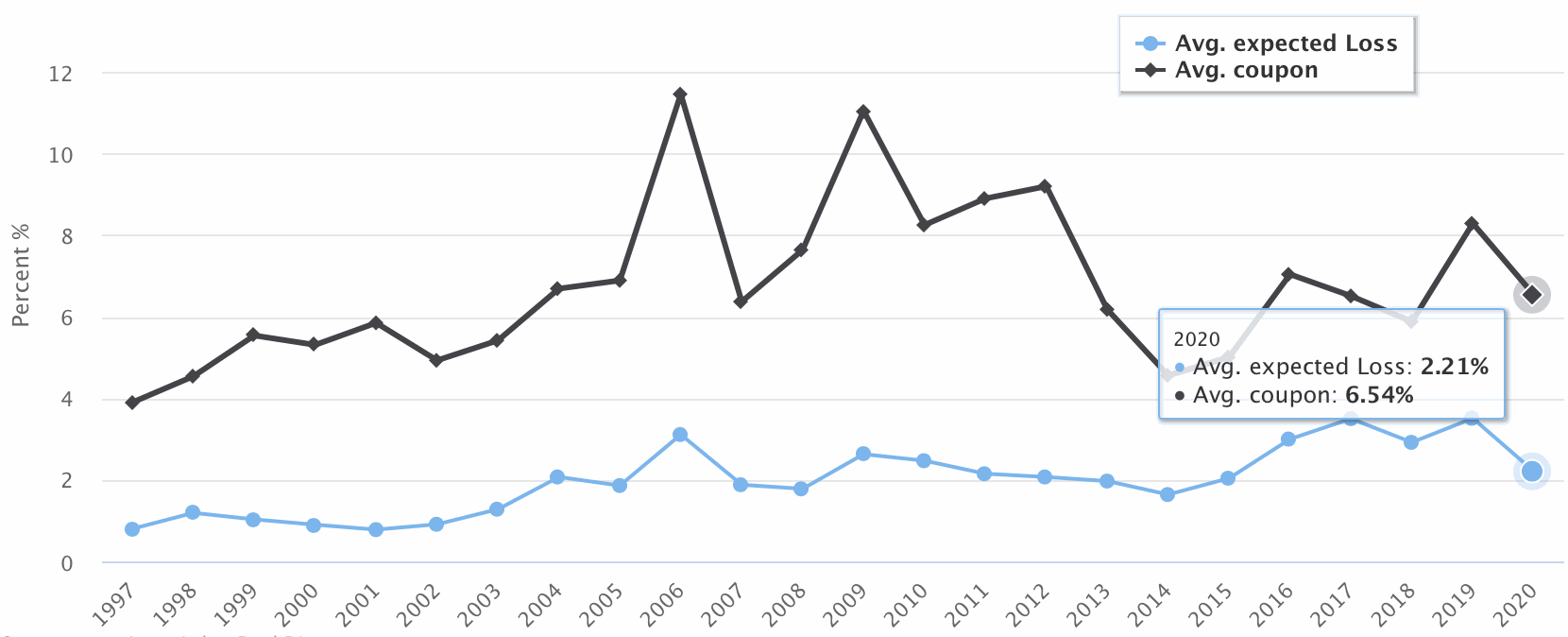

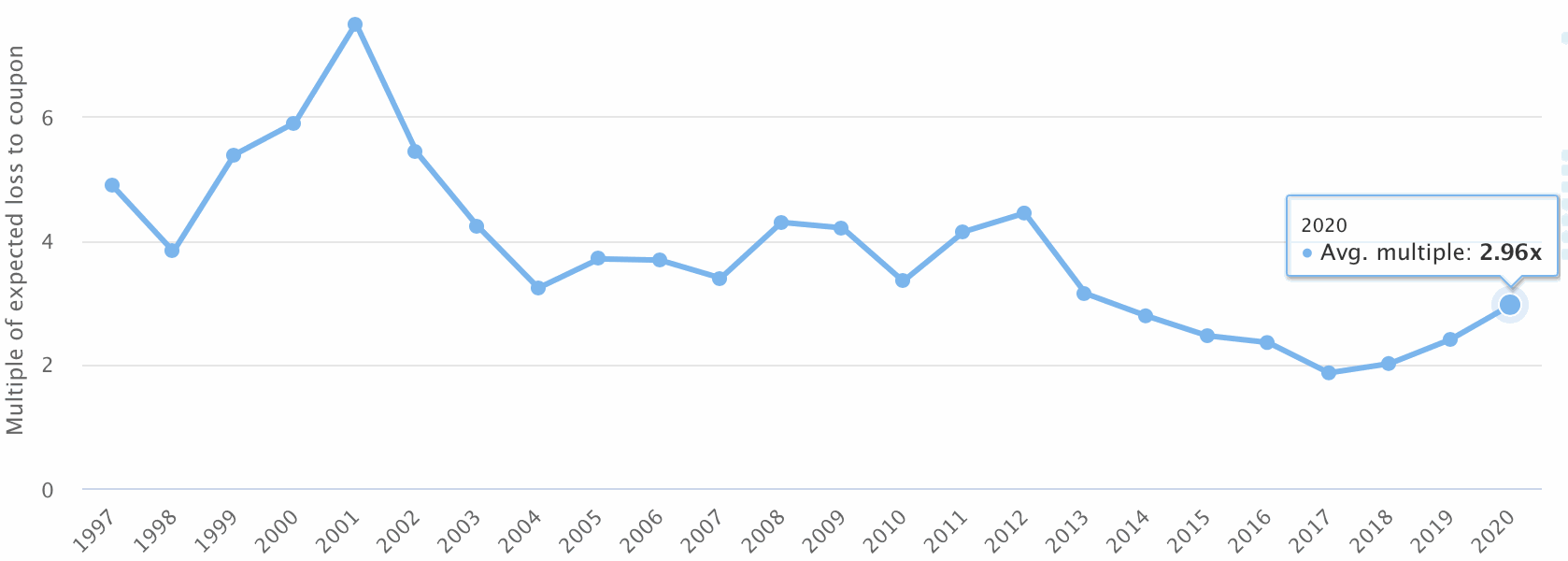

This is particularly evident in two of our charts, the average expected loss of issued transactions and the average multiple at market (coupon / expected loss).

Both clearly show that investors are craving lower risk deals, with the average expected loss of issuance this year so far having fallen to 2.21%, the lowest we’ve recorded since 2015, as shown below.

At the same time the average coupon has also fallen, as the above chart shows. But not as fast as the EL, so the multiple at market of expected loss to coupon has risen significantly and stands at the highest level seen since 2014, again reflecting investors changed appetites for risk, particularly a reduced appetite for riskier layer cat bonds (as shown below).

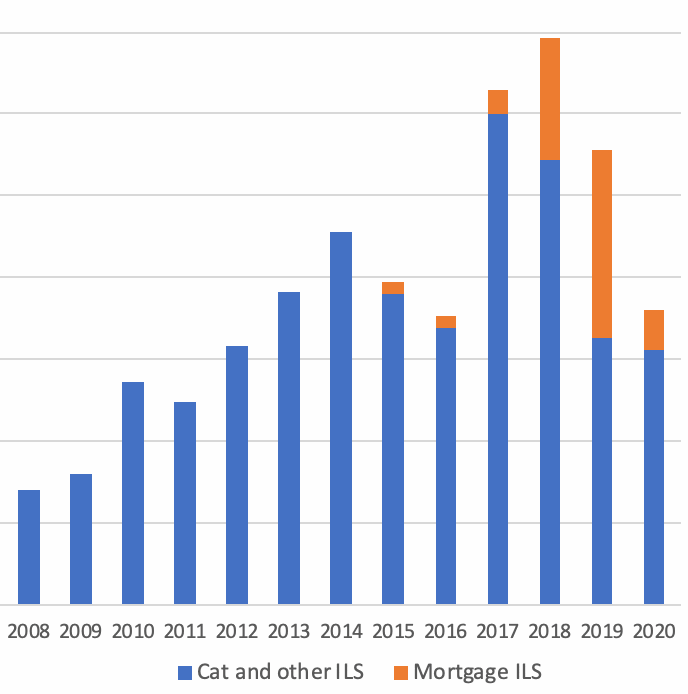

As we said earlier in this article, it is property catastrophe risks that are the focus of the cat bond and related ILS market at the moment, as the mortgage ILS market is currently locked-up due to the Covid-19 related capital market volatility.

But catastrophe bonds have certainly made up for it so far and issuance of property cat bonds for the year-to-date in 2020 stands at a very impressive $6.23 billion, only slightly behind the full-year 2019 figure of $6.54 billion.

The impressive rate of issuance so far is partly driven by maturities, are often renewed as the reinsurance and retrocessional protection they provide is core to cedent programs. But also the dynamics of the reinsurance market has driven some issuance and the added uncertainty posed by the pandemic could drive more through the rest of the year, as cedents look to capital market sources of reinsurance to complement their traditional programs.

The chart below shows total catastrophe bond and related ILS issuance by year, according to according to Artemis’ Deal Directory data and breaks out catastrophe risk and other lines issuance, versus mortgage ILS.

You can clearly see the influence of buoyant mortgage insurance-linked securities (ILS) issuance over the last few years as that market took off.

But this year, the catastrophe and other lines bond issuance is dominating and looks set to make up the majority of issuance for the first-half of 2020.

Of course that will likely change, as mortgage ILS issuance springs back to life, perhaps as soon as the third or fourth-quarter.

There’s still one month to go for issuance to pick up even further before the end of the first-half of 2020. With some $2 billion of catastrophe bond maturities still scheduled for June, there is a significant amount of ILS capital still set to come available and be put back to work.

Analyse every catastrophe bond using the Artemis Deal Directory, Artemis Dashboard and our statistics and charts.

For full details of first-quarter 2020 cat bond and related ILS issuance, including a breakdown of deal flow by factors such as perils, triggers, expected loss, and pricing, as well as analysis of the issuance trends by month and year.

For full details of first-quarter 2020 cat bond and related ILS issuance, including a breakdown of deal flow by factors such as perils, triggers, expected loss, and pricing, as well as analysis of the issuance trends by month and year.

Download your free copy of Artemis’ Q1 2020 Cat Bond & ILS Market Report here.

For copies of all our catastrophe bond market reports, visit our archive page and download them all.

Cat bond & ILS issuance passes $7.2bn, changed investor appetites evident was published by: www.Artemis.bm

Our catastrophe bond deal directory

Sign up for our free weekly email newsletter here.

Original Article Posted at : https://www.artemis.bm/news/cat-bond-ils-issuance-passes-7-2bn-changed-investor-appetites-evident/