Tax

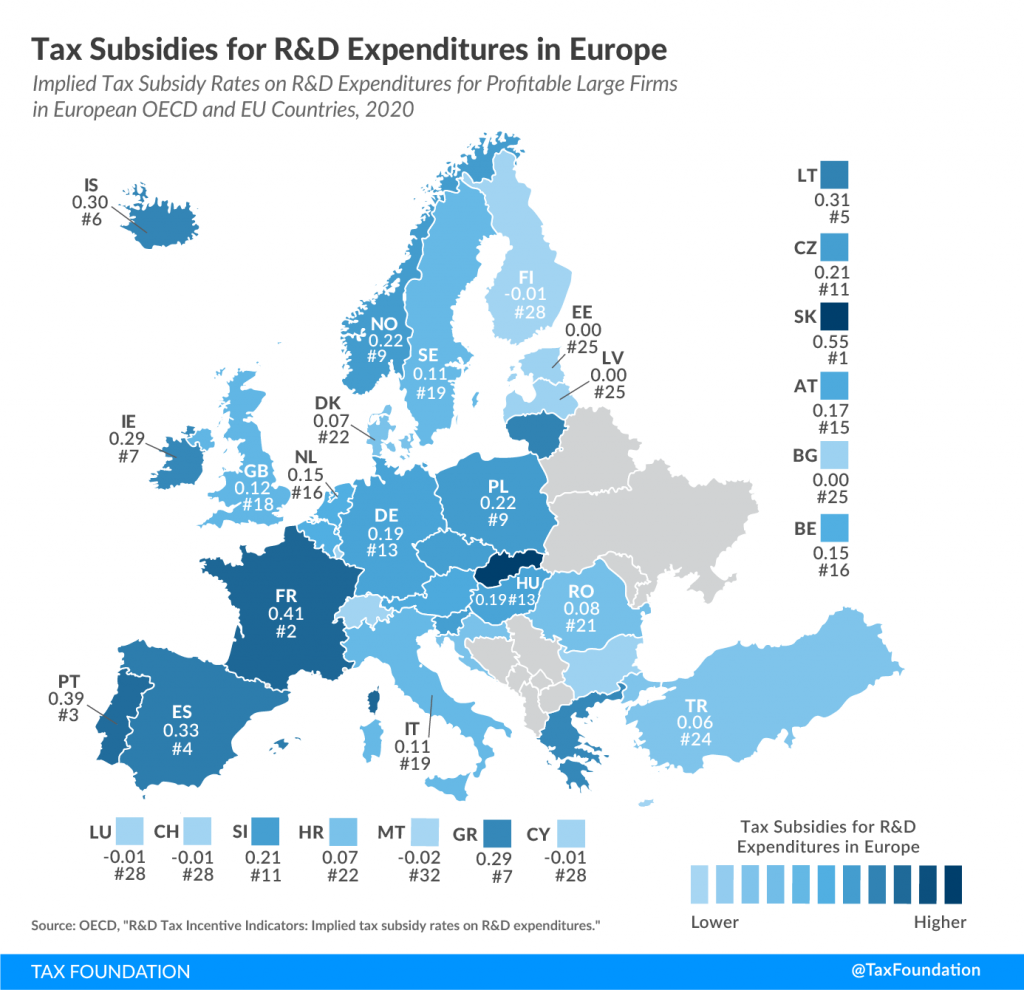

Tax Subsidies for R&D Spending and Patent Boxes in OECD Countries

Table of Contents Key Findings Introduction R&D Tax Incentives for Innovation R&D Tax Subsidies for Innovation in OECD Countries — Tax Preferences for R&D Expenses — Measuring Tax Subsidies for R&D Spending — Patent Boxes in OECD Countries The Impacts of Tax Preferences on Innovation — Cross-border Shifting and Beggar-Thy-Neighbor Effects A Neutral Tax Policy…

Read MoreHow GILTI Are U.S. Industries?

The Tax Cuts and Jobs Act (TCJA) introduced several new rules for taxing the foreign profits of U.S. multinationals, including rules related to Global Intangible Low Tax Income (GILTI) that result in a minimum tax on foreign profits. Both the Biden campaign and some Democratic members of Congress have recommended changes to GILTI, but before…

Read MoreTax Policy Improvements Needed to Help Industries through the Semiconductor Shortage

The Biden administration has responded to recent reports of a global semiconductor shortage with an executive order calling for a 100-day review of supply chains and $37 billion to boost semiconductor manufacturing. Instead of implementing a stopgap industrial policy that picks winners and losers, lawmakers should consider broad improvements to the U.S. tax system that…

Read MoreThe Child Tax Credit Grows Up to Lift Millions of Children Out of Poverty

Last week, President Biden signed the American Rescue Plan (ARP) into law. And the Child Tax Credit (CTC) that began life in 1998 as a…

Read MoreBiden’s Pandemic Relief Bill Is One Of The Biggest One Year Tax Cuts In Modern US History

Talk about playing against type: The tax cuts in President Biden’s American Rescue Plan (ARP) are among the biggest one-year tax reductions in modern US…

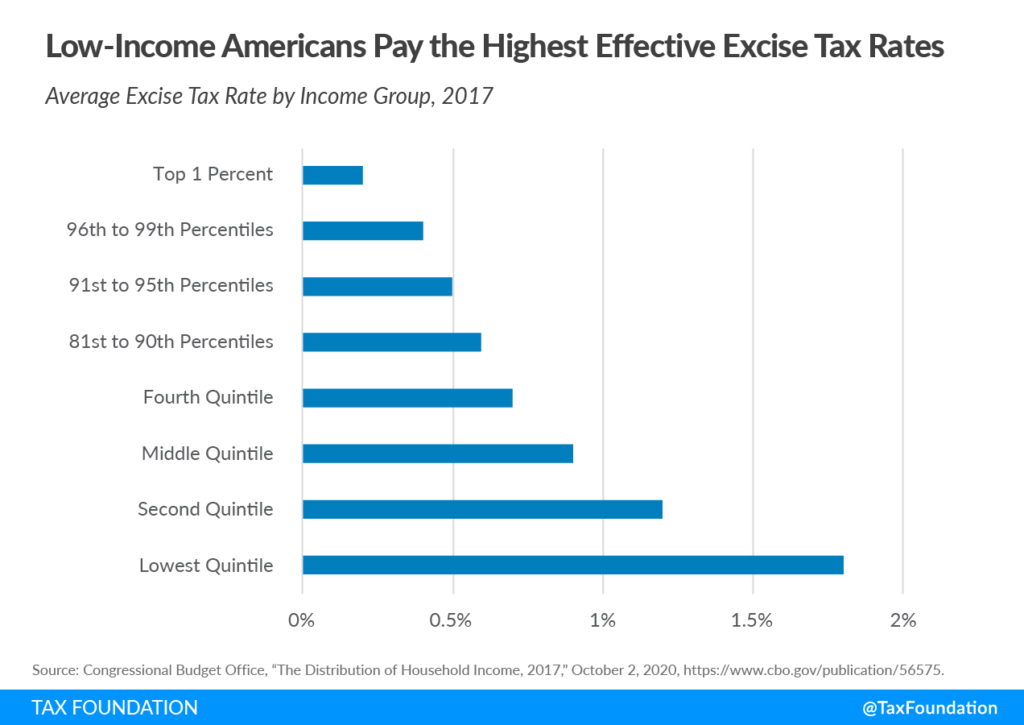

Read MoreExcise Tax Application and Trends

Table of Contents Key Points Introduction A Short History of Excise Taxes — Pigouvian Taxes All Tax Policy is About Trade-offs General Design Considerations — Tax Base — Tax Rate — When to Levy — Revenue Allocation — Regressivity — Principles for Excise Tax Design Traditional Excise Tax Categories — Tobacco — Alcohol — Motor…

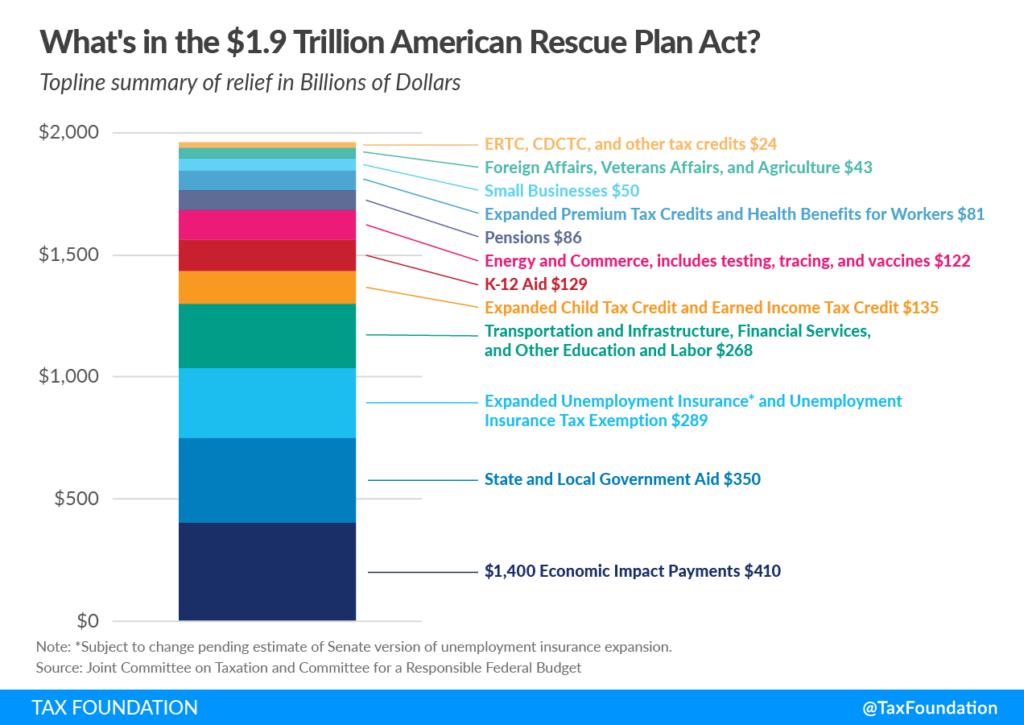

Read MoreThe American Rescue Plan Act Greatly Expands Benefits through the Tax Code in 2021

American Rescue Plan: Details and Summary $1,400 Stimulus Checks (Economic Impact Payments) Unemployment Benefits Child Tax Credit Expansion American Rescue Plan Act of 2021 The United States has provided about $6 trillion in total economic relief to the American people during the coronavirus pandemic, including the $1.9 trillion that was approved when President Biden signed…

Read MoreWhich DC Residents Haven’t Gotten Their Economic Impact Payments Yet?

In March 2020, Congress started down the rather unusual but not unprecedented path of sending people checks to help them deal with effects of the…

Read MoreWyden’s Energy Tax Proposal a Mixed Bag

With the $1.9 trillion American Rescue Act package signed into law, lawmakers are looking for the next issue to tackle. As the Biden administration turns toward infrastructure, Sen. Ron Wyden (D-Or.) has suggested including reforms to the way the tax code subsidizes energy production in such a package. Wyden introduced the Clean Energy for America…

Read More