Tax

Washington State Lawmakers Consider 1,000% Tax Increase on Tobacco Businesses

Lawmakers in Washington are exploring an unusual way to affect nicotine consumption and increase taxes on tobacco products sold in the state. Instead of increasing the excise tax rate, which is currently $3.025 per pack of 20 cigarettes, sponsors of HB 1550 are suggesting increasing the Business & Occupations (B&O) tax on tobacco manufacturers and…

Read MoreOECD Pillar 2 Provides A Good Model for Biden US Worldwide Tax

The Biden Administration is taking steps to develop a new, global minimum tax on multinational corporations. The initiative, led by Treasury Secretary Janet Yellen, follows…

Read MoreMaking the Expanded Child Tax Credit Permanent Would Cost Nearly $1.6 Trillion

Families with children will see a significant increase in their maximum child tax credit (CTC) in 2021 thanks to the American Rescue Plan Act (ARPA) expanding child-related tax benefits. President Biden is now exploring how to make the ARPA’s temporary expansion of the CTC permanent. Whether and how lawmakers choose to finance a permanent expansion…

Read MoreTCJA Is Not GILTI of Offshoring

Democratic members of Congress are interested in changing tax rules for foreign earnings of U.S. multinational companies. They claim the current rules incentivize U.S. businesses to outsource and offshore what would otherwise be U.S. jobs and investment. However, closer inspection shows these claims do not fit with the way the rules have been working. Some…

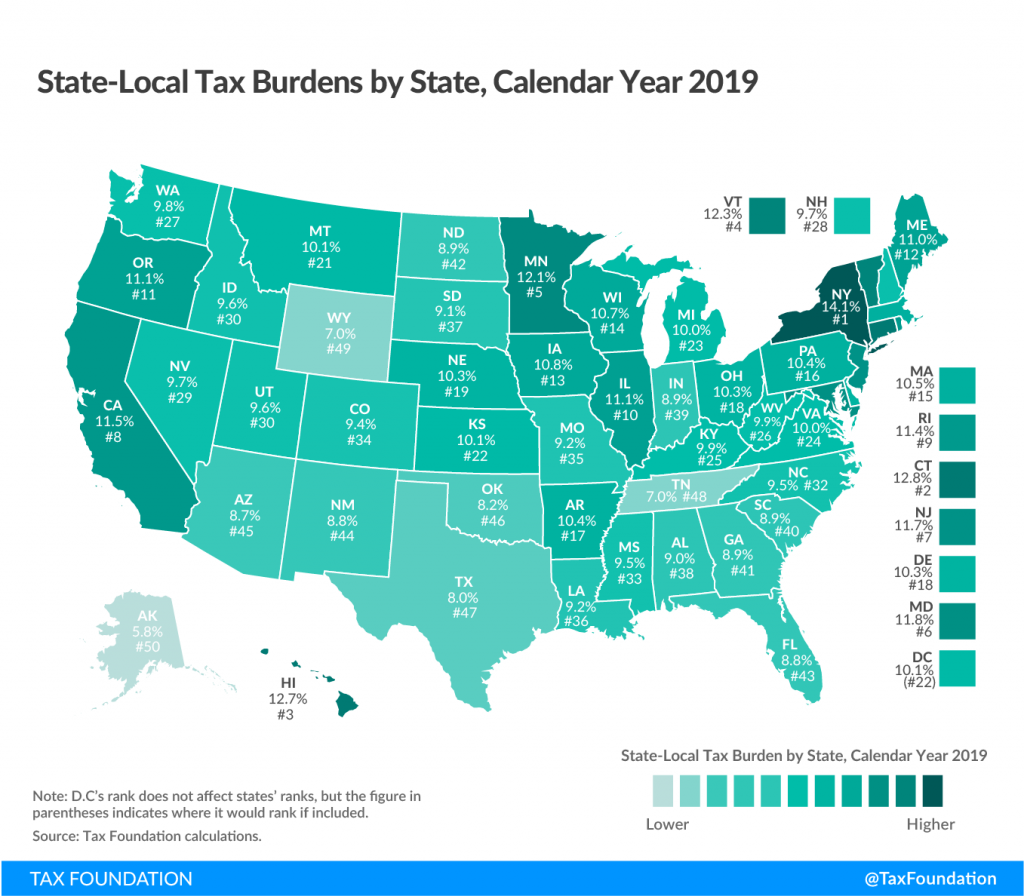

Read MoreState and Local Tax Burdens, Calendar Year 2019

Key Findings In calendar year 2019 (the latest economic data), state-local tax burdens averaged 10.3 percent of national income. Burdens rose slightly over the previous year because tax collections modestly exceeded income growth. Taxpayers remit taxes to their home state and to other states, and about 21 percent of state tax revenue comes from nonresidents.…

Read MoreFour Questions Treasury Must Answer About the State Tax Cut Prohibition in the American Rescue Plan Act

Table of Contents Key Findings Introduction Four Questions: — What constitutes a net tax reduction? — How is a net tax reduction determined to have resulted from a policy change? — Which potential expenditures could be deemed to create fiscal capacity for a net tax cut? — How would offsetting a tax reduction be defined,…

Read MoreBank Taxes in Europe

The 2007-2008 financial crisis triggered a global debate on whether, and if so how, taxation can be used as an instrument to stabilize the financial sector and to generate revenue to partially cover the costs associated with the recent and potential future crises. Three approaches were mainly discussed, namely financial stability contributions (levied on financial…

Read MoreU.S. COVID-19 Relief Provided More Than $60,000 in Benefits to Many Unemployed Families

With passage of the American Rescue Plan (ARP), much of the $6 trillion in relief over the past year was directed to the unemployed in unemployment insurance (UI) benefits and to low- and moderate-income households in stimulus payments and child tax credits (CTC). The unemployment insurance benefits paired existing state-level weekly aid with a federal…

Read MoreWill Pennsylvania Be the First State to Motor Past the Gas Tax?

After Congress passed the American Rescue Plan Act last week, infrastructure spending—and its funding—is taking center stage. For example, the federal excise tax rate on motor fuels has not been changed since 1993, and the tax has not raised sufficient revenue to cover expenditures since 2008. Several states also are in this position and are…

Read More