Cedants increasingly favour catastrophe bonds, Moody’s survey finds

Reinsurance cedants and buyers are increasingly looking to catastrophe bonds as options for accessing alternative sources of reinsurance capital, a new survey from rating agency Moody’s has found.

Polling reinsurance buyers at property and casualty insurers, the survey asked for their plans with respect to insurance-linked securities (ILS) and alternative capital, finding that many cedants are considering using increasing amounts of capital markets backed capacity.

Around 30% of those polled said they are “somewhat likely” to increase their participation in alternative capital within their reinsurance program for 2021.

At the same time, the remaining roughly 70% said they were unlikely to increase use of alternative capital in 2021.

Moody’s notes that, “While cedants were hesitant about increasing their participation in alternative capital, they continued to focus on parts of their book where alternative capital can add value, or alleviate pressure from rising reinsurance prices.”

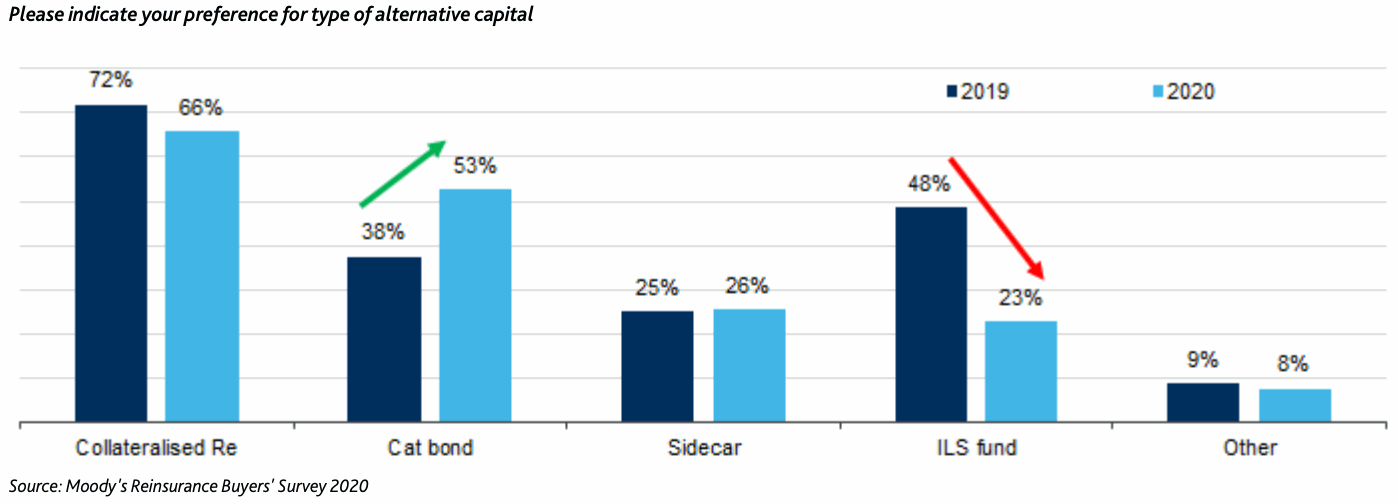

Of the range of alternative reinsurance capital instruments, the ones that came our most favourably in the survey results were catastrophe bonds.

Collateralised reinsurance is still the alternative capital structure cedants prefer, although a little less than a year ago as it is now favoured by 66% of respondents, down from 72% in 2019.

Moody’s notes a shift in preference from insurance-linked securities (ILS) funds in favour of catastrophe bonds though, which it puts down to the fallout from recent major catastrophe loss years.

“A number of ILS fund managers suffered reputational damage – along with financial losses – following the large natural catastrophe claims in 2017 and 2018. This has made cedants more discerning in their choice of ILS fund manager.

“At the same time, the expectation of rising natural catastrophe risk and reduced availability of traditional reinsurance capacity for peak zone natural catastrophe risk is making cat bonds, which at times offer better pricing, more attractive to cedants,” Moody’s explained.

Of course, the above is not really getting across the use of comparable structures, given that most collateralised reinsurance actually comes from ILS funds themselves, or is backed by capital from ILS funds.

Cedants increasingly favour catastrophe bonds, Moody’s survey finds was published by: www.Artemis.bm

Our catastrophe bond deal directory

Sign up for our free weekly email newsletter here.

Original Article Posted at : https://www.artemis.bm/news/cedants-increasingly-favour-catastrophe-bonds-moodys-survey-finds/