Commercial property insurance rates up 19% in Q2 2020. Covid-19 a driver

Commercial property insurance pricing around the globe saw further increases in the second-quarter of 2020, with rates rising 19% for the period, driven by Covid-19 and other large losses in the period, according to Marsh.

Broker Marsh’s latest commercial insurance market survey found that, on average, rates have risen by a record amount in Q2, with a 19% overall increase seen.

Global commercial property rose 19%, global financial and professional lines were up by a huge 37%, while global casualty pricing was up 7% on average, the broker said.

Dean Klisura, President, Global Placement and Advisory at Marsh, commented, “While pricing movements this quarter were impacted by losses related to COVID-19, other large losses contributed to overall pricing pressures. As insurers continue to work through claims in property and D&O, and with the full cost of COVID-19 still developing, upward pressure on pricing is anticipated for the balance of 2020.”

Rates were up by 18% in the U.S., 31% in the UK, 15% in Continental Europe and 31% in the Pacific region, with property cited as a driver for each, as well as directors & officers (&) coverage.

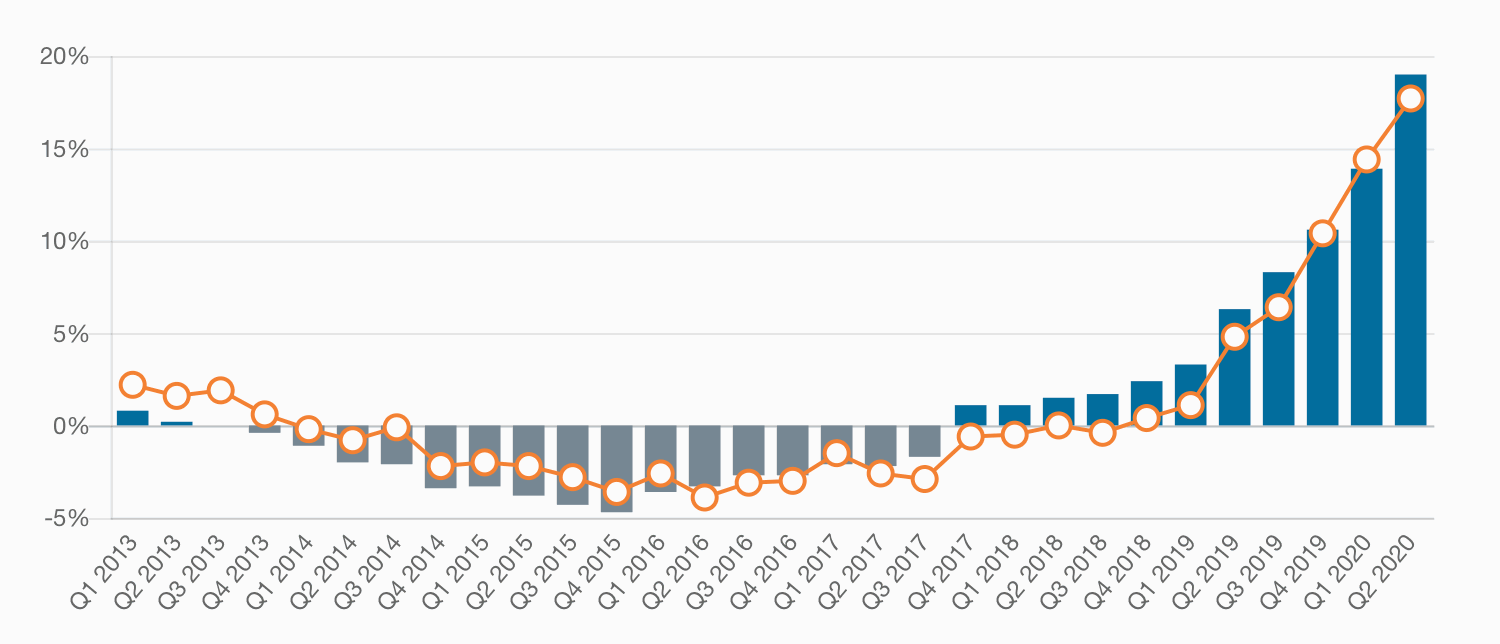

The chart below shows how U.S. commercial insurance rates have been moving, versus the global composite rate movement (the line on the chart).

The hard market in U.S. commercial insurance just keeps on getting firmer it seems, now outpacing global insurance rates by almost 2% in the last quarter.

All of this bodes well for sustained firming in reinsurance as well, given the need for rates to at least keep up with primary line pricing to a degree.

It is the eleventh consecutive quarter that global pricing has risen, according to Marsh’s survey, with the largest year-on-year rise since the broker began tracking rates.

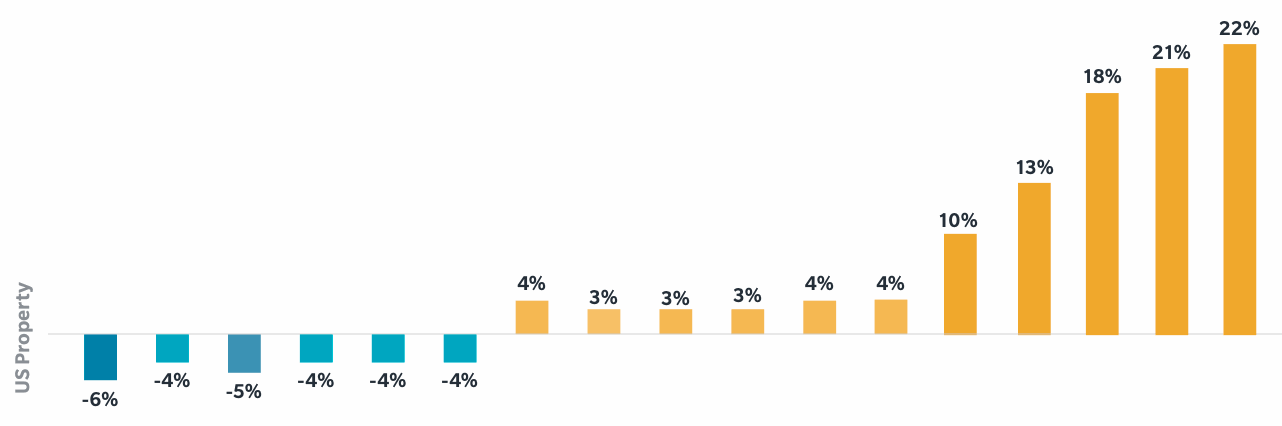

U.S. commercial property insurance pricing actually accelerated slightly in Q2, increasing by 22% in the second quarter, with many accounts experiencing even higher increases, according to Marsh.

That’s slightly faster than the 21% rise cited for Q1 2020.

Another interesting dynamic emerged in Q2, as more submissions flowed to London and Bermuda than prior quarters, as U.S. commercial insurance clients looked for options in global insurance and reinsurance markets.

Mid-size to large risks saw the highest increases it seems, with smaller accounts rising more slowly.

You can see the acceleration in U.S. commercial property insurance rates below:

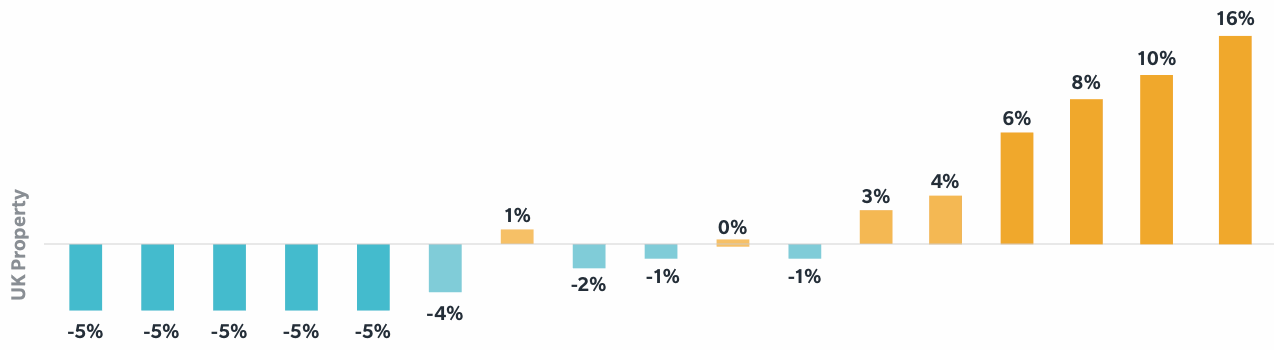

Commercial property insurance pricing also accelerated in the UK, rising 16% in the quarter, up significantly on the 10% rise seen in Q1 2020 in this country.

Marsh cites “growing momentum” for rate increases in the UK, with again larger accounts leading the way.

UK commercial property insurance rate rises by quarter can be seen below:

There were increases for commercial property insurance rates in Latin America as well, where property rates accelerated as well to a 14% rise in Q2 2020.

In Continental Europe, commercial property insurance rates rose 20% on average in the second-quarter, a more than doubling of the 9% seen in Q1, with losses and Covid-19 also driving the trend.

In addition, complex property placements and catastrophe exposed programs rose some of the highest, which again bodes well for European property catastrophe reinsurance firming.

There was increased demand seen for alternative structures and the wholesale markets in London and Zurich saw greater demand, Marsh noted.

Continental Europe commercial property insurance rate trends can be seen below:

The Asia and Pacific regions also saw increases in property insurance rates during the second-quarter, although Asia was only at 12%, which perhaps reflects the fact this market had been firming first and more consistently than others.

China bucked the trend though, as abundant capacity kept rates flatter.

Catastrophe exposed property business in Asia saw double-digit rate increases, again promising for the trajectory of catastrophe reinsurance rates in the region.

The movement in commercial property insurance rates remains promising for reinsurance and also for ILS strategies that look to access risk from the primary market.

It also stands to reason that homeowners insurance rates will begin to follow-suit, although it is unlikely this will be at similar paces as seen in commercial markets.

ILS funds already access some primary U.S. property insurance, including commercial lines, more directly through their partnerships with MGA’s and other underwriting agencies.

With rates accelerating further, this strategy is likely to continue presenting attractive margins where the volatility in the portfolios can be controlled and major catastrophe losses remain less prevalent.

Commercial property insurance rates up 19% in Q2 2020. Covid-19 a driver was published by: www.Artemis.bm

Our catastrophe bond deal directory

Sign up for our free weekly email newsletter here.

Original Article Posted at : https://www.artemis.bm/news/commercial-property-insurance-rates-up-19-in-q2-2020-covid-19-a-driver/