Coronavirus fears weigh on S&P/TSX Composite Index (OSPTX)

September 29, 2020 Update: The S&P/TSX Composite Index (INDEXTSI: OSPTX) nudged lower today amid new coronavirus-related lockdown measures on restaurants and bars in Canada. Meanwhile, energy stocks declined alongside oil prices as market watchers grew concerned about demand due to the growing number of COVID-19 infections around the globe.

On the S&P/TSX Composite Index (INDEXTSI: OSPTX), the energy sector declined 2.5% as U.S. crude oil prices slipped 2% per barrel and Brent crude declined 1.6%. Producer prices in Canada increased 0.03% from July to August amid higher prices for primary non-ferrous metal products.

The financials sector in the index declined 0.7%, and industrials slipped 0.2%. The materials sector actually gained amid higher gold futures, adding 0.6% with a gain of 0.7% on gold futures. The biggest gainers on the index were MAG Silver Corp and OceanaGold Corp.

The biggest decliner in the index was Aurora Cannabis, which fell after Jefferies analysts slashed their price target for the stock. The second largest decliner was Crescent Point Energy. Bank of Nova Scotia, Canadian Imperial Bank of Commerce and Suncor Energy saw the highest trading volumes on the index, according to data from Reuters.

S&P/TSX Composite Index (OSPTX): What you need to know

The Toronto Stock Exchange (INDEXTSI: OSPTX) is one of the world’s largest stock exchanges by market capitalization. More than 1,500 companies are listed on the exchange. Between 1977 and 2002, the main index of Toronto Stock Exchange was the TSE 300, which consisted of 300 largest companies by market capitalization. American financial services firm Standard & Poor’s (S&P) took over the index in 2002, and replaced it with the S&P/TSX Composite Index.

What is the S&P/TSX Composite Index (OSPTX)?

The S&P/TSX Composite Index (INDEXTSI: OSPTX) is the Canadian equivalent of America’s S&P 500 index. It includes 250 (not 300) of the largest companies listed on the Toronto Stock Exchange. The index represents about 70% of the total market capitalization of Toronto Stock Exchange. It’s often seen as the barometer for Canada’s economic health. The TSX’s total market cap is US$2,007.93 billion.

Just like S&P 500, it’s a market cap-weighted index, meaning companies with larger market capitalization have a higher weightage in the index. The S&P/TSX Composite Index is the benchmark against which fund managers tracking the Canadian markets compare their results. Index funds and exchange-traded funds (ETFs) rely on the index to construct their portfolios.

Constituents

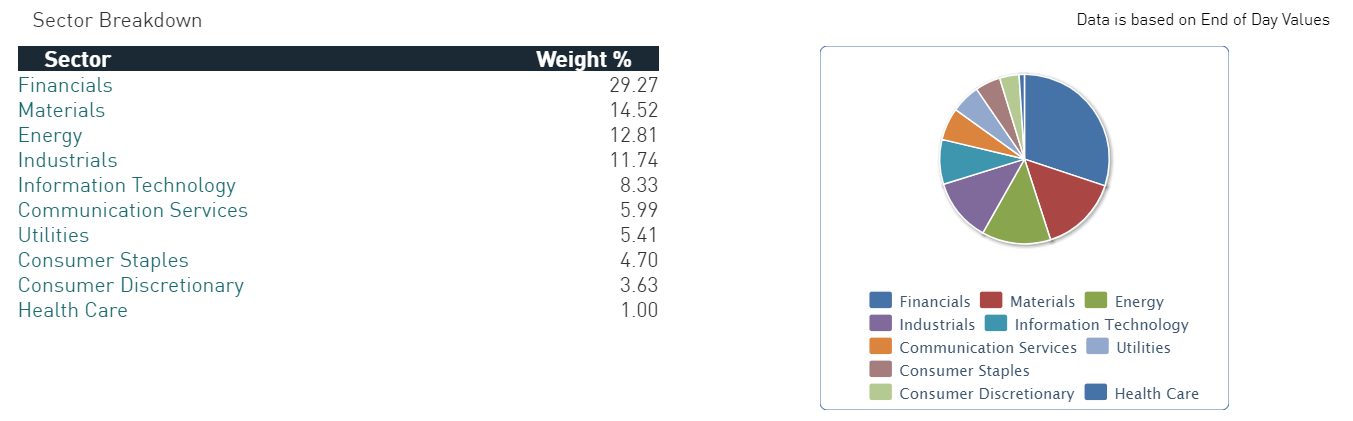

Canada is rich in natural resources. So, sectors such as minerals and energy have had a high weightage in the index. However, the index’s reliance on natural resources sector has declined over the last several years due to the growing technology and financial services sectors.

The financial services sector constitutes 29.27% of the index. Materials and energy sectors have 14.52% and 12.81% weightage, respectively. Industrials account for 11.74%.

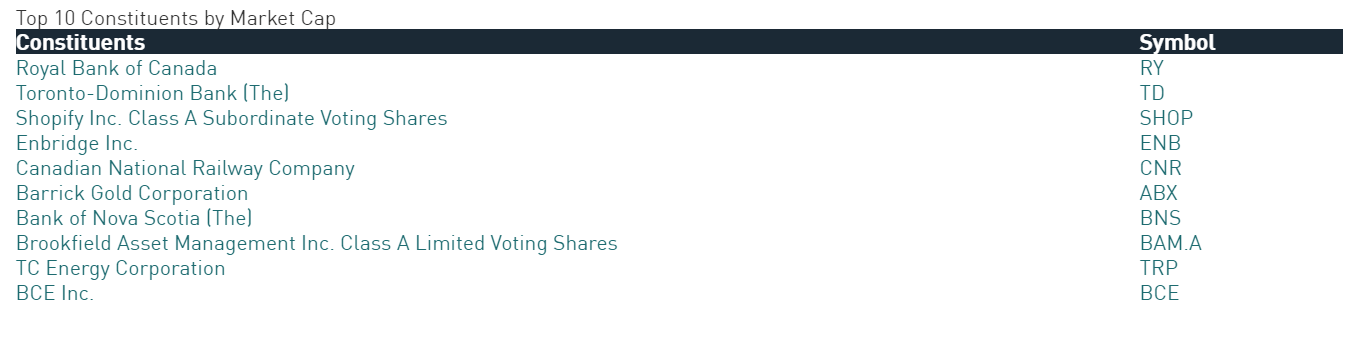

The largest constituents by market capitalization are the Royal Bank of Canada, The Toronto-Dominion Bank, and Shopify.

How to get included

Companies listed on the Toronto Stock Exchange can be included in the S&P/TSX Composite Index only if they meet the eligibility criteria. To be eligible for inclusion, a company’s stock must represent at least 0.05% weight of the index. The security must also have a minimum C$1 share price over the previous three months.

What’s more, the stock must be incorporated under Canadian laws and listed on the Toronto Stock Exchange. Lastly, a security’s trading volume must be higher than 0.025% of the total volume for the index. The index providers have capped the maximum weightage at 15%, meaning no company is permitted to exceed 15% of the total trading volume.

Even if a company is included in the index, its membership is periodically reviewed. Depending on the trading volume, liquidity, and market capitalization, a security can be dropped from the index.

The post Coronavirus fears weigh on S&P/TSX Composite Index (OSPTX) appeared first on ValueWalk.

Original Article Posted at : https://www.valuewalk.com/2020/04/sp-tsx-composite-index/<\p>