Covid-19 BI markdowns drive private ILS funds to April decline: ILS Advisers

Markdowns due to potential business interruption claims from the Covid-19 pandemic caused some private ILS or collateralised reinsurance funds to decline during the month of April, while pure catastrophe bonds outperformed, ILS Advisers said today.

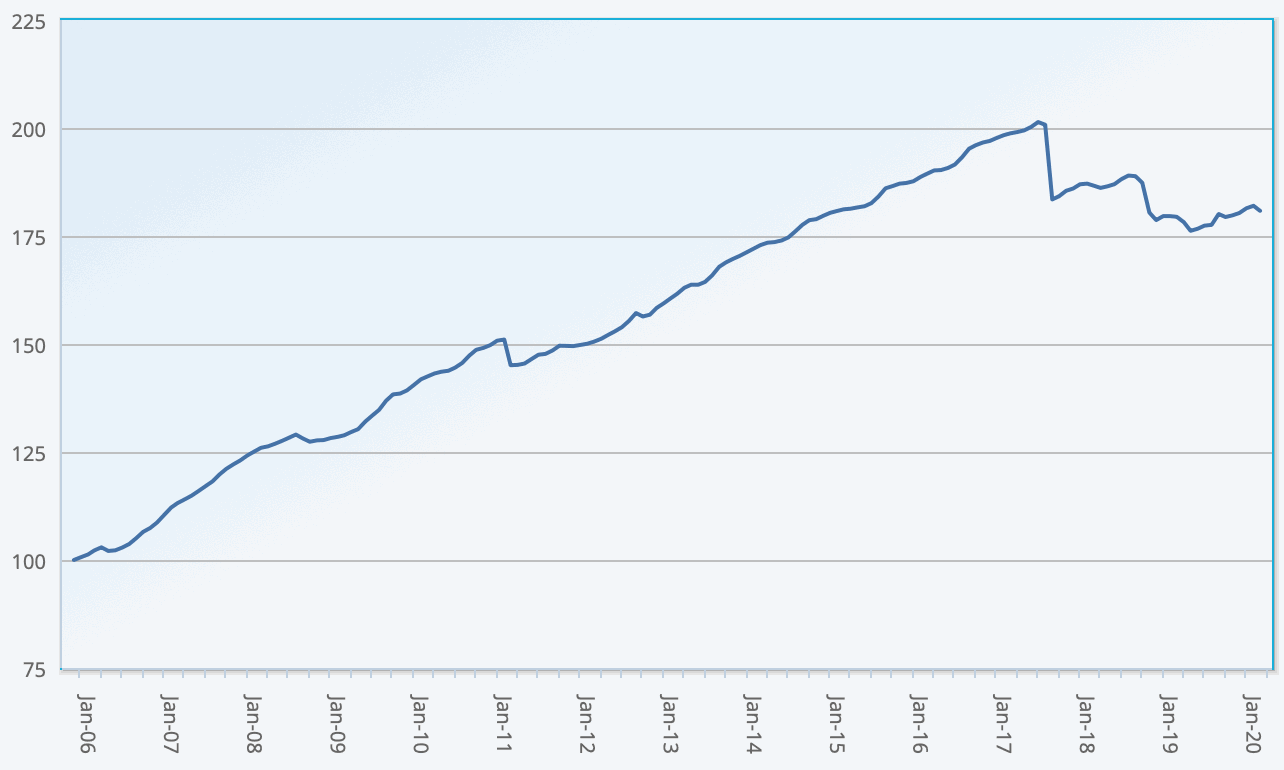

April 2020 saw the average ILS fund return drop to a negative -0.18%, according to the Eurekahedge ILS Advisers Index.

April 2020 saw the average ILS fund return drop to a negative -0.18%, according to the Eurekahedge ILS Advisers Index.

Chief among the causes of the decline was the impact of the Covid-19 coronavirus pandemic, which some insurance-linked securities (ILS) fund managers began to factor into their fund positions over recent months.

As we previously explained, some insurance-linked securities (ILS) fund managers had proactively marked-down some collateralised reinsurance positions, seeing a risk of potential exposure and perhaps even some losses caused by the Covid-19 pandemic.

This actually began in March, but markdowns in that month were very limited, but expanded in April 2020, resulting in the subgroup of ILS funds that invest in private ILS and collateralised reinsurance falling to a decline for the month, according to ILS Advisers.

Meanwhile, the pure catastrophe bond funds fared much better, managing positive performance in April, which is a testament to the asset classes lack of correlation with the pandemic driven financial market declines.

ILS Advisers said that overall its ILS Fund Index was down -0.18% for April, but the difference in performance between sides of the market was distinct.

“Pure cat bond funds as a group were up 0.23%,” Stefan Kräuchi, ILS Advisers Founder, explained. “While the subgroup of funds whose strategies include private ILS decreased by -0.47%.”

“Some private ILS managers have started to incorporate the impact from business interruption claims of the pandemic to their valuations,” he continued.

It wasn’t every ILS fund focused on collateralised reinsurance or retrocession contracts that suffered though, as some also experienced positive returns.

There were also some ILS funds that experienced negative returns in April because of catastrophe loss adjustments for prior year events, as we reported recently here. But we can’t be sure whether they are included in this Index.

Overall, 21 of the ILS funds represented in the Eurekahedge ILS Advisers Index reported positive returns for the month of April 2020, while 12 were negative.

The gap between the best and worst performing ILS fund in April was a huge 4.05%, which reflects two things.

The potential severity of business interruption related markdowns for some ILS funds, but also the very positive returns that some others which didn’t have that exposure have been able to achieve in a month when financial markets remained extremely volatile.

It will be interesting to see if the pandemic related impacts continue into May’s performance, or whether ILS funds have marked as many of the potentially exposed positions as they can as early as possible.

You can track the Eurekahedge ILS Advisers Index here on Artemis, including the USD hedged version of the index. It comprises an equally weighted index of 33 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.

Covid-19 BI markdowns drive private ILS funds to April decline: ILS Advisers was published by: www.Artemis.bm

Our catastrophe bond deal directory

Sign up for our free weekly email newsletter here.

Original Article Posted at : https://www.artemis.bm/news/covid-19-bi-markdowns-drive-private-ils-funds-to-april-decline-ils-advisers/