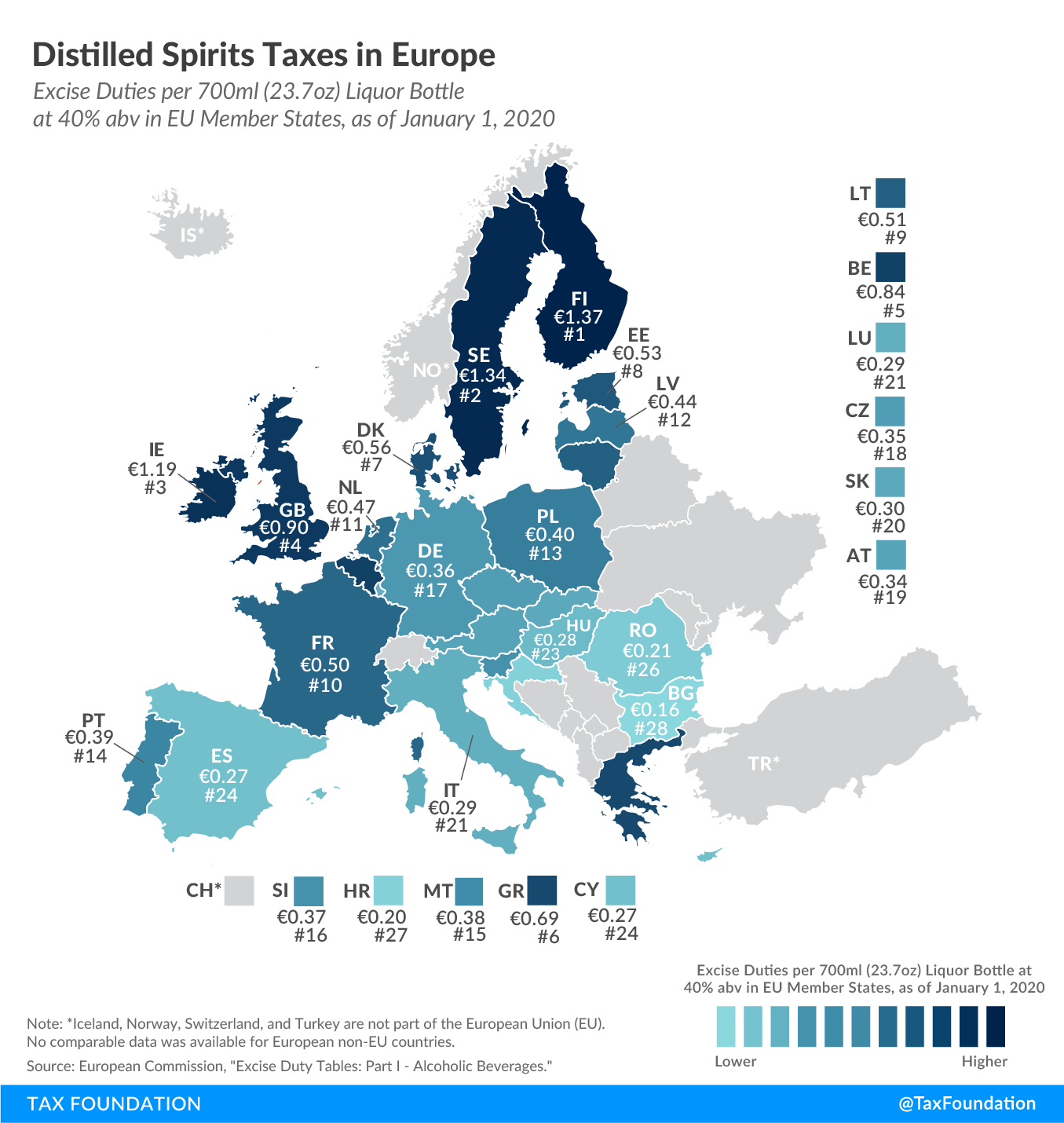

Distilled Spirits Taxes in Europe

All European Union (EU) countries levy excise duties on distilled alcohol; excise tax is applied to the cost of goods on purchase.

The standard size of a liquor bottle in the EU is 700ml (23.7 oz). Many spirits, such as vodka, gin, rum, and whiskey, contain alcohol content in the range of 40 percent. The average EU excise duty on a 700ml bottle of liquor containing 40 percent alcohol is €0.51 (US $0.57).

The highest excise duties are applied in Finland, Sweden, and Ireland, where the rates for a standard-size bottle of liquor are €1.37 ($1.53), €1.34 ($1.50), and €1.19 ($1.33), respectively.

The lowest rate is applied in Bulgaria, where excise of €0.16 ($0.18) is charged for a 700ml bottle containing 40 percent alcohol, followed by Croatia, which charges excise of €0.20 ($0.22). Romania, which charges €0.21 ($0.23), has the third-lowest EU excise duty.

In 2016, the Czech Republic, Germany, and Lithuania consumed the most (recorded) liters of alcohol per adult (15+) in the EU. All three countries have excise duties at or below the EU average.

| Excise duty per liter of pure alcohol | Excise duty per 700ml containing 40% alcohol | |||

|---|---|---|---|---|

| EUR | USD | EUR | USD | |

| Austria (AT) | € 1.20 | $1.34 | € 0.34 | $0.38 |

| Belgium (BE) | € 2.99 | $3.35 | € 0.84 | $0.94 |

| Bulgaria (BG) | € 0.56 | $0.63 | € 0.16 | $0.18 |

| Croatia (HR) | € 0.72 | $0.80 | € 0.20 | $0.22 |

| Cyprus (CY) | € 0.96 | $1.07 | € 0.27 | $0.30 |

| Czech Republic (CZ) | € 1.25 | $1.40 | € 0.35 | $0.39 |

| Denmark (DK) | € 2.01 | $2.25 | € 0.56 | $0.63 |

| Estonia (EE) | € 1.88 | $2.11 | € 0.53 | $0.59 |

| Finland (FI) | € 4.88 | $5.46 | € 1.37 | $1.53 |

| France (FR) | € 1.79 | $2.00 | € 0.50 | $0.56 |

| Germany (DE) | € 1.30 | $1.46 | € 0.36 | $0.41 |

| Greece (GR) | € 2.45 | $2.74 | € 0.69 | $0.77 |

| Hungary (HU) | € 1.00 | $1.12 | € 0.28 | $0.31 |

| Ireland (IE) | € 4.26 | $4.77 | € 1.19 | $1.33 |

| Italy (IT) | € 1.04 | $1.16 | € 0.29 | $0.32 |

| Latvia (LV) | € 1.56 | $1.75 | € 0.44 | $0.49 |

| Lithuania (LT) | € 1.83 | $2.05 | € 0.51 | $0.57 |

| Luxembourg (LU) | € 1.04 | $1.17 | € 0.29 | $0.33 |

| Malta (MT) | € 1.36 | $1.52 | € 0.38 | $0.43 |

| Netherlands (NL) | € 1.69 | $1.89 | € 0.47 | $0.53 |

| Poland (PL) | € 1.43 | $1.61 | € 0.40 | $0.45 |

| Portugal (PT) | € 1.39 | $1.55 | € 0.39 | $0.43 |

| Romania (RO) | € 0.75 | $0.83 | € 0.21 | $0.23 |

| Slovakia (SK) | € 1.08 | $1.21 | € 0.30 | $0.34 |

| Slovenia (SI) | € 1.32 | $1.48 | € 0.37 | $0.41 |

| Spain (ES) | € 0.96 | $1.07 | € 0.27 | $0.30 |

| Sweden (SE) | € 4.78 | $5.35 | € 1.34 | $1.50 |

| United Kingdom (GB) | € 3.23 | $3.62 | € 0.90 | $1.01 |

| Average | € 1.81 | $2.03 | € 0.51 | $0.57 |

|

Source: European Commission, “Excise Duty Tables: Part I – Alcoholic Beverages,” 2020, https://ec.europa.eu/taxation_customs/sites/taxation/files/resources/documents/taxation/excise_duties/alcoholic_beverages/rates/excise_duties-part_i_alcohol_en.pdf. |

||||

Original Article Posted at : https://taxfoundation.org/eu-excise-duty-on-alcohol-eu-distilled-spirits-taxes-2020/