Tax

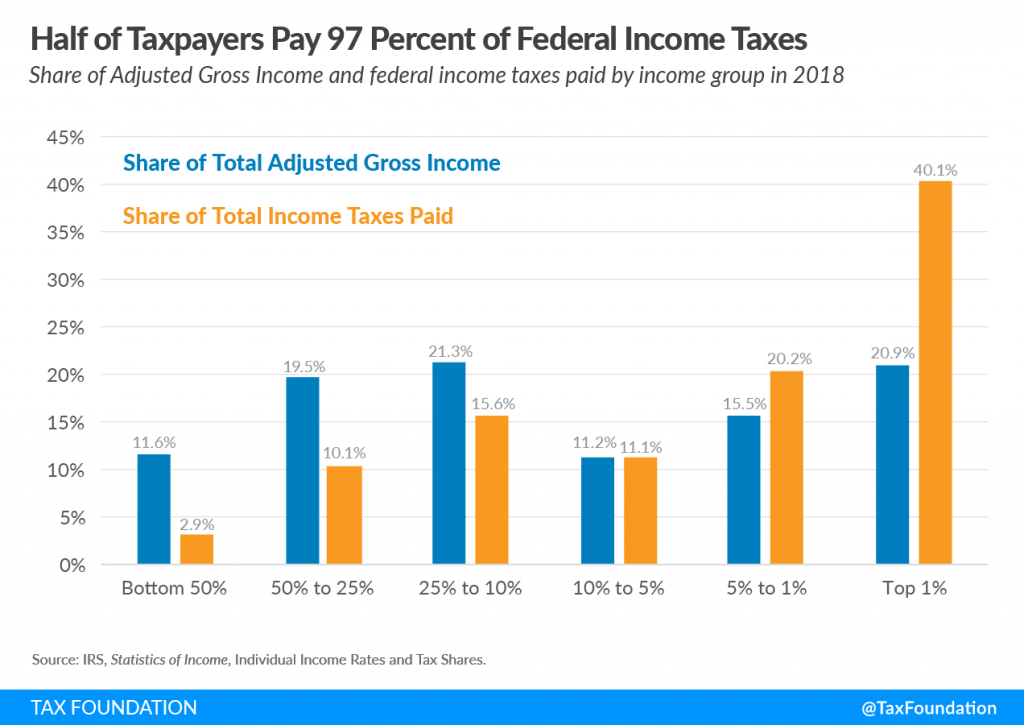

Testimony: Senate Budget Committee Hearing on the Progressivity of the U.S. Tax Code

Note: The following is the testimony of Scott A. Hodge, President of the Tax Foundation, prepared for a Senate Budget Committee Hearing on March 26, 2021, titled, “Ending a Rigged Tax Code: The Need to Make the Wealthiest People and Largest Corporations Pay Their Fair Share of Taxes.” Table of Contents The Rich Bear America’s…

Read MorePresident Biden’s No Tax Hike Pledge Problem

Nobody making under 400,000 bucks would have their taxes raised. Period. Bingo. – Joe Biden, May 22, 2020 Enacting good tax policy is hard under…

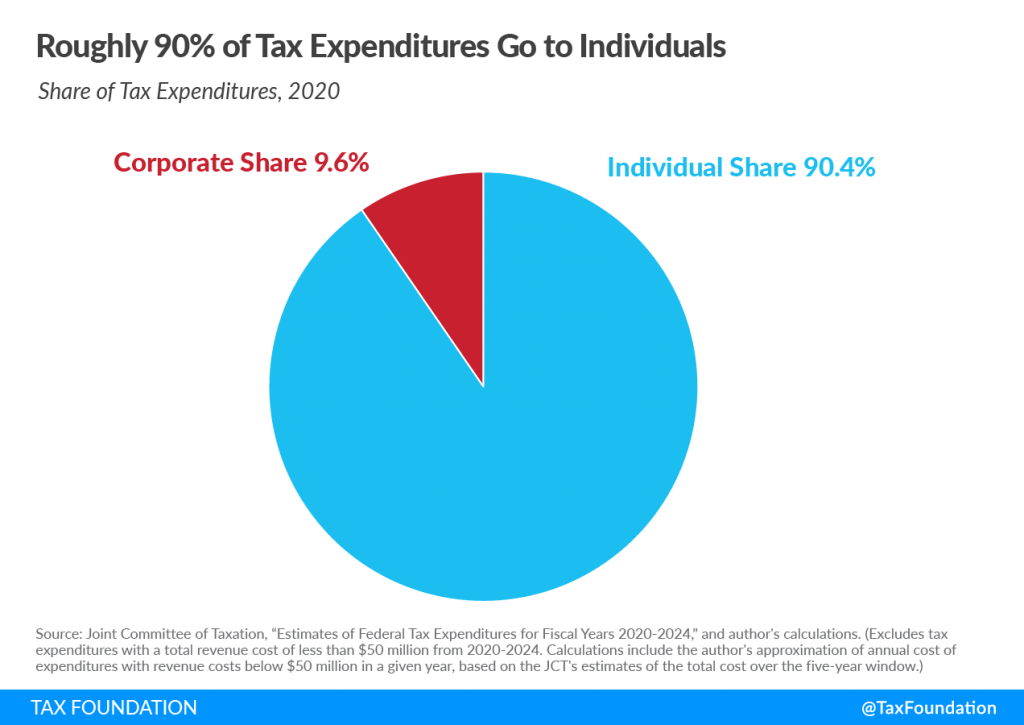

Read MoreHow the CARES Act Shifted the Composition of Tax Expenditures Towards Individuals

In November 2020, the Joint Committee on Taxation (JCT) released its annual report on expenditures in the tax code, showing a total of almost $1.8 trillion in 2020, up from $1.5 trillion in 2018. Much of that roughly $1.8 trillion was due to tax relief provided by the CARES Act—and reflect the policy choice to…

Read MoreCongress Must Redesign the Charitable Deduction: How to Do It Well

In 2017 and again in 2020, Congress made deficient—but temporary—changes to the federal income tax deduction for charitable giving. By significantly increasing the standard deduction,…

Read MoreAre The American Rescue Plan’s Tax Cliffs Really Such A Big Deal?

Are American Rescue Plan’s Tax Cliffs Really Such A Big Deal? Economists hate cliffs. But the tax cliffs in the ARP may not be so bad.

Read MoreA Neutral Tax Code Counts Unemployment Compensation as Taxable Income

During the pandemic, implementation issues in some states resulted in underwithholding income tax due on enhanced unemployment benefits, and surprise tax bills, for many jobless workers. For instance, in California, when workers opted to withhold 10 percent of their unemployment compensation for taxes, that only applied to state benefits and not enhanced federal benefits. The…

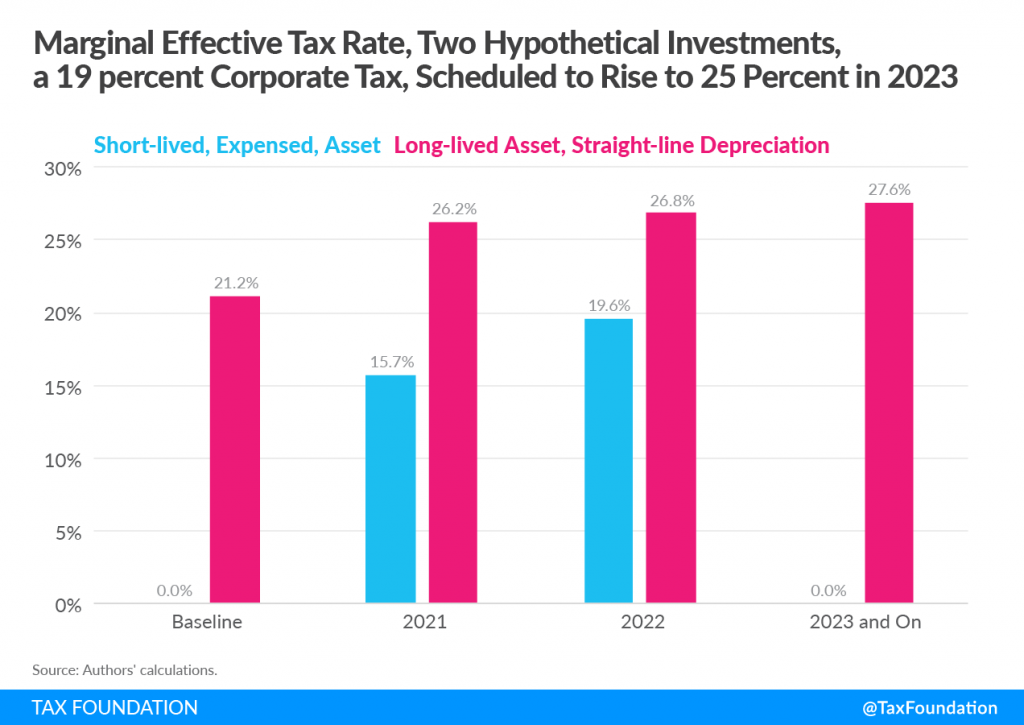

Read MoreMarginal Effective Tax Rates and the 2021 UK Budget

Table of Contents Key Findings Introduction The Impact of a Pending Corporate Tax Rate Increase on Investment Decisions Impacts of the 2021 UK Budget Alternate Corporate Reform Corporate Taxes, Capital Allowances, and Investment Conclusion Key Findings The 2021 UK budget introduces a two-year super-deduction of 130 percent for plant and equipment and a delayed corporate…

Read MoreNew Data Tools and Methods Can Help Federal Policymakers Create More Equitable Tax Policy

On his first day in office, President Biden signed an executive order acknowledging the toll of structural racism in the United States and initiating a…

Read MoreThe EU Determined to Reform the Business Tax

The European Union (EU) recently launched a consultation to reform the EU business tax system, which the European Commission considers is ill-equipped to face the challenges posed by globalization, climate change, digitalization, and population aging. This consultation could lead to proposals for taxes that raise general funds for the EU rather than individual member states.…

Read More