Dividend Income Summary: Lanny’s June 2020 Summary

The stock market continues to rise and dividend income keeps coming in. The uncertainty is still significantly high and the direction the stock market is going does not make sense. However, dividend income continues to fuel the mission to financial freedom.

In June, we set another record for dividend earnings and it shows proof that dividend income is one of the best passive income streams. Time to dive into my June 2020 dividend income results!

Dividend Income

Dividend Income is the fruit from the labor of investing your money in the stock market. Further, Dividend Income is my primary vehicle on the road to Financial Freedom, which you can see through my Dividend Portfolio.

How do I research & screen for dividend stocks prior to making a purchase? I use our Dividend Diplomat Stock Screener and trade on Ally’s investment platform (one of our Financial Freedom Products) – commission free.

Related: Dividend Diplomat Stock Screener

Relates: Financial Freedom Products

I also automatically invest and max out, pre-tax, my 401k through work and my Health Savings Account. This allows me to save a TON of money on taxes (aka thousands), which allows me to invest even more. In addition, all dividends I receive are automatically being reinvested back into the company that paid the dividend. This take the emotion out of timing the market.

Related: Tax Strategy – Part 3 to Reduce Taxes & Increase Investment.

Related: The Power of Dividend Reinvesting

Related: Why I Don’t Time or Predict The Market

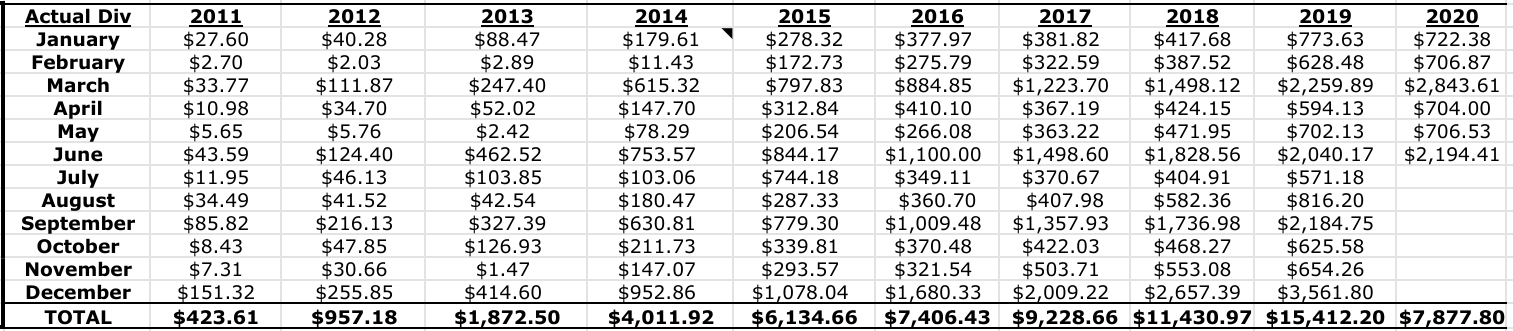

Growing your dividend income takes time, consistency and allow compound interest (aka dividends) to work it’s magic. I have gone from making $2.70 in a single month in dividend income to well over $3,500+ in a single month. That dividend income record was set in 2019. The power of compounding and dividend reinvestment is a wonderful component to the portfolio. Each and every month, whether big or small, I continue to report the passive income that dividend investing provides me. Why?

*Not pictured is my wife’s dividend income above*

*Not pictured is my wife’s dividend income above*

I want to show YOU that dividend investing makes it possible to achieve financial freedom and/or financial independence. We all start somewhere, but consistently investing, compounding (reinvesting) dividends and keeping it simple, allows you to be in a significantly better position than most. Further, if I can grow this portfolio and income stream, YOU can too.

dividend income – June 2020

Now, on to the numbers… In June, we (my wife and I) received a total of $3,273.09 of dividend income. A record dividend income month for us, to say the least! Despite the pandemic from COVID-19, dividend income continues to grow, due to additional investment and reinvestment. Further, though the dividend cuts hurt very bad, I know we did not take the worst of it. Dividend increases have also helped fuel the income growth.

Related: Dividend Cuts: Pandemic Impact on Lanny’s Portfolio

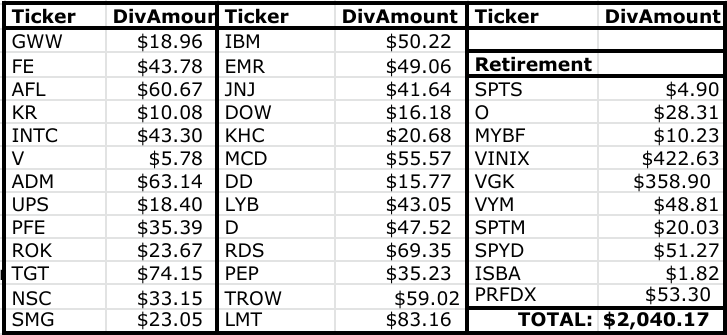

Here is the breakdown of dividend income for the month of June, between taxable and retirement (far right column) accounts:

It’s a sad sight to see the oil & gas giant, Shell (RDS), only produce a dividend of $30.12 vs. $85+ in dividends per quarter I used to receive. However, Exxon Mobil (XOM), in my wife’s account, brought in almost $50, since they were able to maintain their dividend. Further, Discover Financial (DFS) announced they will maintain their dividend, despite the federal reserve bank putting the hammer on the banking industry.

Related: Fed Drops the HAMMER on TOO Big to FAIL

Secondly, Vanguard index funds and ETFs came through with a big punch. Despite dividend cuts, their dividends for the quarter were fairly solid and I am pleased with the second quarter dividends from them. Vanguard continues to be significant brokerage firm that has low expense ratios and a magnitude of easy to understand investment options.

Related: Vanguard: Who and What are They

Lastly, July is here and the earnings announcements from public companies will be rolling in. We will see their second quarter performance and had strength in numbers during a time of crisis. This could lead to stock market swings and, therefore, we must be ready to make investments when we see value! I’ll be sure to review stocks to buy in a post-pandemic world and our Top 5 Foundation Dividend Stocks, no doubt!

Related: Stocks to Buy in a Post-Pandemic World

Related: Top 5 Foundation Dividend Stocks and watch our video: Top 5 Foundation Stocks VIDEO

As for our retirement accounts, we received a total of $1,763.24 or 54%. The other 46% was from the individual taxable portfolio that can be used for everyday expenses. I need to keep bolstering the taxable account, as that passive income stream can be accessed today/right now. However, I continue and will always maximize the 401k and IRA, as that continues to pay-off in dividends, literally.

Related: Maximizing your Roth for 10 Years… Then Set It & Forget It!

(adsbygoogle = window.adsbygoogle || []).push({}); Dividend Income Year over Year Comparison

2019:

2020:

Dividend income, year over year is higher by $557.54 (including my wife’s dividend income of $675.38 last year with mine). This is a 20.5% growth rate from prior year. This time next year, we could be pushing $4,000+ in passive dividend income!

If you can see, the list is longer, primarily by showcasing my wife’s dividend income results, as well. However, there are a few notable increases. Look at Pfizer (PFE), one of the pharmaceutical giants. I earned $47.95 this year vs. $35.39 last June. That’s a significant increase due to new investment and dividend growth.

Norfolk Southern (NSC) went from $33.15 to $36.98 or an 11.55% growth. Here’s the exciting part. I never specifically purchased more shares. This is due to two reasons and two reasons only. First, Norfolk increased their dividend by 9.3% and then through dividend reinvesting. Ah, compounding at it’s finest! Additionally, Norfolk (NSC) is set to increase their dividend THIS MONTH.

Related: Dividend Increases Expected in July 2020

Norfolk (NSC) wasn’t the only one in this position. T. Rowe Price (TROW) also grew from $59.02 to $71.96 or 22%. Again, this was fueled by an 18.4% dividend increase announced in December 2019. The last portion of the income growth was due to dividend reinvestment over the last 2 quarters.

Lastly, not a single individual stock paid over $100. Therefore, the spread and diversification among companies and industries is incredible to see. Time to beef up positions and make sure I CRUSH $4,000 by next June. LET’S GO!

Dividend Increases

After a tough month in May, where literally I had 0 dividend increases, June changed that. Three companies increased dividends during June and they all were fairly spot on/solid. See the three dividend monsters below:

Related: The Impact of The Dividend Growth Rate!

Realty Income (O) and Target (TGT) came in with what was an expected dividend increase. Now, grocery stores, such as Kroger (KR), have been killing it. Therefore, they continued with their consistency and announced a significant 12.50% dividend increase. This added over $10 in forward income alone.

Related: Dividend Increases Expected in July 2020

In total, dividend increases created a total of $22.05 in additional passive dividend income. I would need to invest $630 at a 3.50% dividend yield in order to add that income. Thank you for the increases, as I didn’t have to come up with the capital to create that form of income!

(adsbygoogle = window.adsbygoogle || []).push({}); Dividend Income Conclusion & Summary

The name of the game is to apply what you learn through financial education. The next steps are to maximize every dollar for investment opportunities and live life on your own terms. My plan is to demonstrate that dividend income can be a revenue engine. A revenue engine that allows you to take back control of your life. A revenue engine to help you reach financial freedom. Dividend investing, once you learn the right way, becomes easier and starts to immensely make sense!

Excited for the future, no doubt. Further, all of the investing from last year and moves this year, shows that my aim to save 60% of my income, and making every dollar count, has provided the dividend growth.

If you are just starting out on your investment journey and you aren’t sure to start – please see the articles mentioned throughout this post. We are trying to bring you financial education and help you reach your financial goals.

Further, if you are starting out and/or want to know the Top 5 Stocks we always recommend, please see our YouTube video, subscribe to our channel and check us out! We’ll help break down further investing topics not only on this blog, but by showing you through video!

As always, thank you for stopping by, leave your comments and questions below. Good luck and happy investing everyone!

The post Dividend Income Summary: Lanny’s June 2020 Summary appeared first on Dividend Diplomats.