Hang Seng Index declines amid growing coronavirus concerns

September 29, 2020 Update: The growing number of coronavirus cases is weighing on global indices, including the Hang Seng Index. The index initially climbed 0.5% in early trading today but then ended the trading session down 0.9%. The Hang Seng Index climbed 1% on Monday, recording its best day since Aug. 24 after last week marked its worst weekly loss since March.

Globally, more than 1 million people have now died from the coronavirus, which marks a major milestone for the disease and has been weighing on global stock indices. Emperor Securities director Stanley Chan told the South China Morning Post that the markets are concerned that if there is another COVID-19 outbreak, some parts of the world will have to tighten restrictions again, which will negatively impact the economic recovery.

Banking stocks have especially been under pressure as the industry is closely tied to the economic recovery, which isn’t going very well. Sentiment for mainland China and international banks is weak, and banking stocks led Tuesday’s decline on the Hang Seng.

New ETFs tracking Hang Seng Index’s tech gauge coming soon

August 27, 2020 Update: The Hang Seng Index’s tech gauge came online last month with 30 members, and several firms are also planning products that track the tech index. Fund houses in Hong Kong and in Mainland China are racing to launch exchange-traded funds that track China’s biggest tech behemoths, according to Bloomberg.

China Asset Management, Harvest Global Investments and several other asset-management companies are preparing to launch ETFs that track the Hang Seng Tech Index, according to the China Securities Regulatory Commission. Hong Kong’s CSOP Asset Management is also preparing to launch its own ETF tracking the index this week.

Such ETFs will enable investors in Mainland China to invest in Alibaba, which can’t be traded via links with Hong Kong. Filings show ETF firms will apply to use Qualified Domestic Institutional Investor quotas, which enable mainland institutions to invest in assets that are offshore.

Hang Seng Index: Know the world’s best performing index

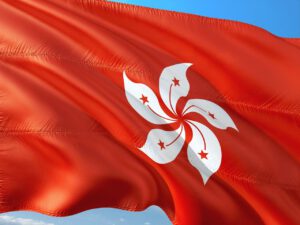

International investors tracking the Asian markets keep a close watch on the Hang Seng Index, which tracks the 50 largest companies listed on the Hong Kong Stock Exchange. Hong Kong is one of the world’s leading financial centers. Hang Seng has gained even more prominence in recent decades due to a growing number of large Chinese companies getting listed on the Hong Kong Stock Exchange.

Q1 2020 hedge fund letters, conferences and more

What is Hang Seng?

The Hang Seng Index (INDEXHANGSENG: HSI) represents about 60% of the Hong Kong Stock Exchange’s total market capitalization. It’s a free-float market capitalization-weighted index. The index value is calculated in real-time at 2-second intervals during trading hours.

The index was launched in 1969 when the Hang Seng Bank chairman Ho Sin Hang proposed the creation of the “Dow Jones Index of Hong Kong.” Though launched in 1969, the index was backdated to July 1964 with the base value of 100 points.

The Hang Seng Index is maintained by Hang Seng Indexes Company Limited, a subsidiary of Hang Seng Bank, which itself is majorly owned by the banking giant HSBC.

The index groups constituent stocks in four sub-indices – Finance, Utilities, Properties, and Commerce & Industry. The index provider applies a 10% capping to ensure that no single stock dominates the index. The components are added or removed every quarter depending on their free-float market capitalization.

World’s best performing index

The Hang Seng Index is seen as a barometer of the Hong Kong as well as Chinese economy. Hong Kong is a special administrative region of China. A large number of Chinese companies are listed on the Hong Kong Stock Exchange. The two economies are closely linked.

Hang Seng is the world’s best performing stock market index. According to data from Bloomberg, it has delivered around 16,700% return since its inception in 1969. Over the last five decades, Chinese stocks have become a bigger part of the index, accounting for more than 50% of its market capitalization. The first ever Chinese company to be added to the index was CITIC Ltd. in 1992.

However, the index has suffered over the last few years due to economic difficulties, pro-democracy protests, and now the coronavirus pandemic.

How to invest

The American Depository Receipts (ADRs) of several Hang Seng Index constituents are listed on the US stock exchanges. You can invest in them to get some exposure to individual stocks. Unfortunately, there is no exchange-traded fund (ETF) trading in the US that tracks the Hang Seng Index.

If you do want to invest, the best way is to put your money into the iShares MSCI Hong Kong Index Fund ETF (EWH). It tracks the broader MSCI Hong Kong Index, which captures more than 80% of the Hong Kong Stock Exchange’s market capitalization.

The post Hang Seng Index declines amid growing coronavirus concerns appeared first on ValueWalk.

Original Article Posted at : https://www.valuewalk.com/2020/05/hang-seng-index-indexhangseng-his/<\p>