ILS market risks an ESG “credibility gap” – Synpulse

The insurance-linked securities (ILS) marketplace could put itself at risk of a potentially damaging “credibility gap” if it over promises on environmental, social and governance (ESG) alignment, Synpulse Management Consulting has warned.

During the third-quarter of 2020 we teamed up with boutique consulting firm Synpulse Management Consulting to conduct a survey of the maturity of environmental, social, and governance (ESG) practices in the risk transfer, reinsurance and insurance-linked securities (ILS) markets.

One finding from the survey and subsequent study of the results was that, while the insurance-linked securities (ILS) and reinsurance marketplace are incorporating ESG into their underwriting and investment processes, the results are not consistent at all.

Some categories of companies all believe they have ESG fully integrated into their underwriting, while others are less convinced.

For example, 100% of insurers said they integrate ESG standards and guidelines into their underwriting, compared to 75% of dedicated insurance-linked securities (ILS) managers, 73% of non-dedicated ILS managers, and just 56% of reinsurance firms that responded to the survey.

Excluding non-desired clients, projects, industries or geographies is the main way respondents achieve standards and guideline implementation.

On the product side, some 96% of respondents said that ESG is a factor in their insurance, reinsurance or risk transfer products, which Synpulse notes is surprisingly high given the survey shows mixed levels of maturity in ESG adoption.

Synpulse cautions that, “It may be a sign of greenwashing: companies are promoting products as ESG-friendly when in fact they are not.”

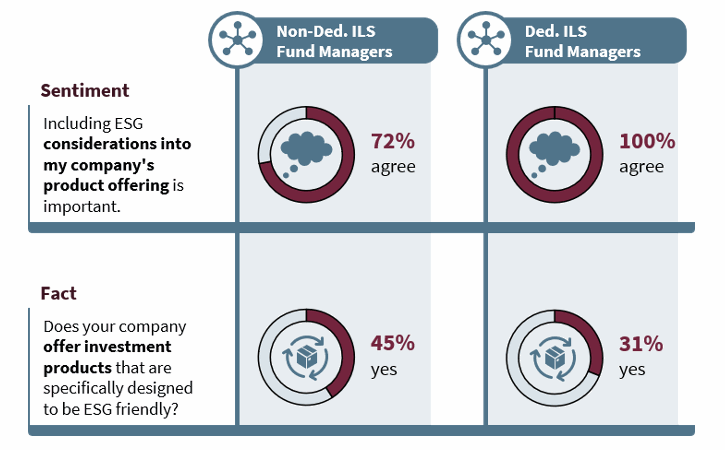

On the investment products side, 92% of ILS fund managers surveyed noted the importance of including ESG considerations in their product offering, but the percentage offering an investment product they believe to be ESG friendly falls way below this.

That’s no surprise though, as creating a truly ESG compliant (in the eyes of the major ESG allocator investors) is an extremely difficult task and in our view has to be an origination led strategy, where ILS managers go out of their way to source only ESG compatible risk investments,

Synpulse adds some useful conclusions to this section, saying, “Can an investment product offering be ESG-friendly if there is no effective ESG strategy incorporated into the operating model? We think not. Again, the message is clear: companies that are serious about putting their ambitious ESG aspirations into practice and have not yet formalized and operationalized their ESG strategy need to consider tackling ESG using a bottom-up approach starting with their strategy and set about filling the gaps.

“Whatever the case, fund managers have some catching up to do if they are truly going to deliver on their promise to investors. For fund managers subject to the SFDR, considerations in respect of ESG friendly products have to be made anyways – no matter whether they want to offer an ESG-friendly product or not. Hence, there is no better time to think about an ESG friendly product than now.

“Address the gap between ESG aspiration and practice – otherwise you might soon be facing a major credibility gap or even regulatory ramifications.”

The gap between ambitions and delivery is currently quite wide, when it comes to ESG in the ILS and risk transfer market it seems, which is where the potential credibility gap lies.

If ILS managers want to call their investment fund strategies ESG friendly, or compliant, they really need to be able to back this up, with practices that must be demonstrable and also with specific data on their portfolios.

Patrick Roder, Associate Partner and Global Head of ILS at Synpulse Management Consulting, sums it up well by saying, “In an environment where investors are increasingly demanding ESG to be embedded into underwriting decisions and investment offerings and regulators are pushing for more ESG disclosure, risk transfer market players should consider this as an opportunity to step up and show their true level of ESG commitment.”

Our previous articles on this ESG survey explained that, ESG is seen as having huge strategic relevance for risk transfer & ILS markets, but that while ESG is perceived as very important, there is an evident gap between perception and actual practice.

Download a copy of the full ESG in the Risk Transfer Market report here.

ILS market risks an ESG “credibility gap” – Synpulse was published by: www.Artemis.bm

Our catastrophe bond deal directory

Sign up for our free weekly email newsletter here.

Original Article Posted at : https://www.artemis.bm/news/ils-market-risks-an-esg-credibility-gap-synpulse/