ILS should play a role in pandemic backstop solutions: Survey respondents

Insurance-linked securities (ILS) and capital markets backed sources of insurance or reinsurance capacity should play a role in any government or industry supported pandemic risk pooling facility or backstop, respondents to our latest survey said.

Overwhelmingly, the hundreds of respondents to our latest market survey are in favour of and recognise the need for some kind of mandated government and industry supported backstop reinsurance scheme for future pandemics.

We reached out to our readership community again in the last few weeks alongside sister publication Reinsurance News to get an updated view of how the sector is feeling about the implications of the Covid-19 coronavirus pandemic for the insurance and reinsurance industry.

Hundreds responded again, giving us another strong sample of data on opinions among senior industry executives and it turns out the majority are forward-thinking when it comes to pandemic risk facilities or backstops and how they should be funded.

In fact, more than 22% of respondents to our survey said that a backstop of some kind is “essential” to help the insurance and reinsurance industry do a better job in future on providing pandemic coverage to its customers.

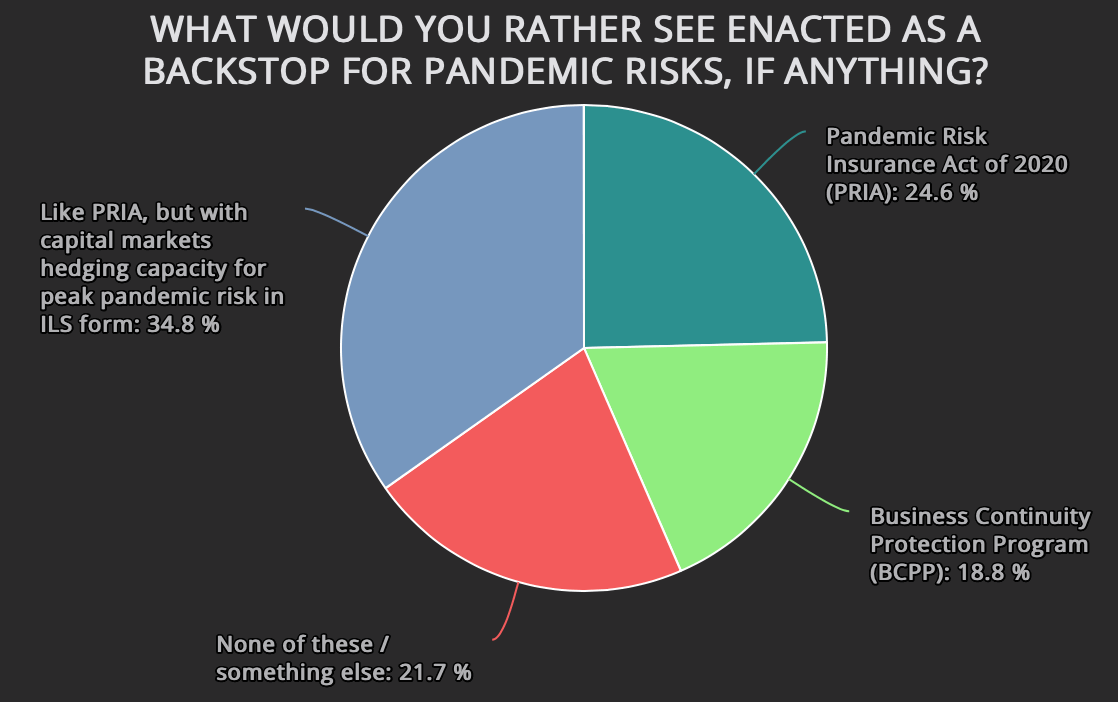

But respondents opted for a third-way, rather than either of the two highly publicised options, of the Pandemic Risk Insurance Act of 2020 (PRIA) and the Business Continuity Protection Program (BCPP).

The majority said they would rather see a PRIA-like backstop facility, but one that also taps into the capital markets using insurance-linked securities (ILS) to extend its capacity and ultimately its usefulness.

We thought this would be an interesting question to ask, give neither of the proposals currently on the table explicitly call for the use of ILS such as catastrophe bonds as a way to augment and extend the capacity of any pandemic risk backstop facility.

Overall though, the response is very mixed, with more people opting for nothing or a complete rethink than showing support for the industry-backed BCPP idea in its current form.

Only slightly more respondents, at 24.6%, are in favour of the politically supported PRIA bill and the Pandemic Risk Reinsurance Program it proposes.

The largest group of respondents, at almost 35%, see the need for expanded access to capacity and use of the capital markets through issuance of ILS in order to make a pandemic backstop truly useful.

There’s clearly a need for any supportive solution on pandemic risk to be able to offer deep risk transfer capacity. So the capital markets seem an appropriate and complimentary source of capital to achieve the goal of any backstop.

Our Covid-19 reinsurance market survey update features responses from hundreds of identifiable senior insurance and reinsurance industry executives, including 16 CEO’s, 15 CUO’s, 12 COO’s, 27 senior Board members, reinsurance buyers, senior underwriting executives, ILS managers, brokers and a range of other service providers.

We’ve made the full results of this COVID-19 re/insurance market survey freely available to our readers and we’re happy to discuss the results with industry participants and to discuss sponsorship enquiries from those looking to raise their profile in the reinsurance sector.

Analyse the results of our June 2020 COVID-19 Market Survey Update here.

Our global readership reached over 200,000 individuals across Reinsurance News & Artemis in May 2020. Please get in touch to work with us on a sponsored survey to gauge the market’s opinion, or to discuss advertising options.

ILS should play a role in pandemic backstop solutions: Survey respondents was published by: www.Artemis.bm

Our catastrophe bond deal directory

Sign up for our free weekly email newsletter here.

Original Article Posted at : https://www.artemis.bm/news/ils-should-play-a-role-in-pandemic-backstop-solutions-survey-respondents/