Lanny’s Dividend Stock Purchase Activity – April 2020

April was overall another positive month for the market, after a wild ride down in the mid-to-end of March. There were dividend suspensions across the retail industry and even dividend cuts, including one from a major oil player that did not cut their dividend since the World War days. Time to dive into April’s dividend stock purchase activity!

Investing consistently in Dividend Income Stocks allows you to create & build another income source, with Dividends. This is my primary vehicle on my road to Financial Freedom, which you can see through my Dividend Income and my Dividend Portfolio, to which continues to build and build.

How do I make dividend stock purchases and screen for dividend stocks? I usually put the stocks through our Dividend Diplomat Stock Screener and trade on Ally’s investment platform (one of our Financial Freedom Products).

See – Dividend Diplomat Stock Screener

See – Financial Freedom Products

How do I build the capital to make these stock purchases? I save anywhere from 60-85% of my take-home pay and strongly believe Financial Freedom does not happen by hitting a home run on an investment. Nothing matters more than your savings rate on your journey to Financial Freedom, plain and simple. Therefore, I work my butt off to make sure expenses remain in-check and that my savings rate is meeting our investment and financial independence goals! Then, you rinse and repeat.

The stock purchases

Given I was stung by Shell’s (RDS) dividend cut, I was ready to make moves, in order to make up for the lost dividend income. I was ready to get back to basics and began purchasing shares of stock in industries that are built for the pandemic and also have longevity of consistent dividend increases.

Therefore, my purchase activity really hit a stride on that Thursday, the last day of April. See the purchases below and I go into more detail on those investments that were more significant than others, typically at least $500 or more.

Stock Purchase – People’s United Financial, INC (PBCT)

People’s United Financial (PBCT) is definitely a new name that you’ll see around here. PBCT was recently on my Dividend Stock Watch List for May. Further details about PBCT are at that link.

PBCT’s metrics were definitely hard to pass up. See the statistics below from the Dividend Diplomat Stock Screener:

- Price to Earnings: 7 analysts are projecting $1.05 in earnings for 2020. Therefore, at price points of $12.63 and $12.04, that equates to p/e ratios of 12.03 and 11.47

- Dividend Growth: PBCT is a dividend aristocrat with 25+ years of consecutive dividend increases. Their 3 year dividend growth rate is only 1.44%, which is essentially a quarter of a cent increase per year, to their quarterly payout.

- Dividend Yield: At an annual dividend of $0.72 per year, the dividend yield at the purchase prices were 5.70% and 5.98%. The 5-year average yield is 4.41%. Therefore, more signs of undervaluation.

- Payout Ratio:Given that PBCT pays $0.72 in dividends per year and their earnings is projected at $1.05, this equates to a payout ratio of 69%, which is slightly on the higher side.

I purchased 50 shares during April for a total cost of $606.70. The 50 shares added $36.00 to my forward dividend income projection. Another dividend aristocrat to the portfolio, and they are in the banking arena.

Stock Purchase – Cisco Systems (CSCO)

Cisco Systems (CSCO) is a stock previously in my portfolio, so this is an add to a current position. In addition, they are mentioned in my Industries Built for the Coronavirus, due to their technology, cloud solutions, security and video-conferencing.

I purchased them twice during April, as you’ll see in the activity summary screen shot. See the statistics below from the Dividend Diplomat Stock Screener:

- Price to Earnings: On a projected $3.06 in earnings per share, this equates to a price to earnings ratio of 13.81 at a price of $42.25. Who knows where earnings really stands, but that’s a decent ratio for the stock market at this time.

- Dividend Growth: The dividend growth rate is 9.68%, the average for the last 3 years, and the most recent was 2.9%. The dividend increase is fairly sounds, now that we are in the pandemic, and Cisco did not have to overexert themselves. They have had over 8 years of dividend growth.

- Dividend Yield: The dividend yield, with a dividend of $1.44, Cisco yields a solid 3.40%, which is significantly above the market and higher than most tech companies.

- Payout Ratio: At an earnings projection of $3.06 and a dividend of $1.44, the payout ratio equates to 47%.

I purchased 12 more shares during April for a total cost of $504.60. The 8 shares added $17.28 to my forward dividend income projection. I now have approximately have 112 shares, producing over $160+ in dividends.

Stock Purchase – Archer Daniels Midland (ADM)

Archer Daniels Midland (ADM), another dividend aristocrat baby! This purchases correlates to my belief that we still need to make and produce food, as well as – we all are still eating. Therefore, I believe ADM is a stock that is built in an Industry for LIFE.

See ADM’s statistics below from the Dividend Diplomat Stock Screener:

- Price to Earnings: At their price of $37.50 and an earnings projection of $2.95, this equates to a price to earnings ratio of 12.71, definitely signs of undervaluation.

- Dividend Growth: ADM has a 45+ year dividend growth streak going, at an average rate of 5% over the last 3 years, which is a solid growth rate at the yield you’ll see below.

- Dividend Yield: At a dividend of $1.44 and a stock price of $37.50, this equates to a dividend yield of 3.84%, higher than my portfolio and the market on average.

- Payout Ratio: ADM produces a dividend of $1.44. Since the estimate is $2.95 in earnings, the payout ratio is 49%, definitely in that sweet spot of 40-60%.

I purchased 13 more shares during April for a total cost of $487.50. The 13 shares added $18.72 to my forward dividend income projection. I now have approximately have 203 shares, producing $292 in dividends.

My Stock Purchase Summary (Plus the ~$500 and Less)

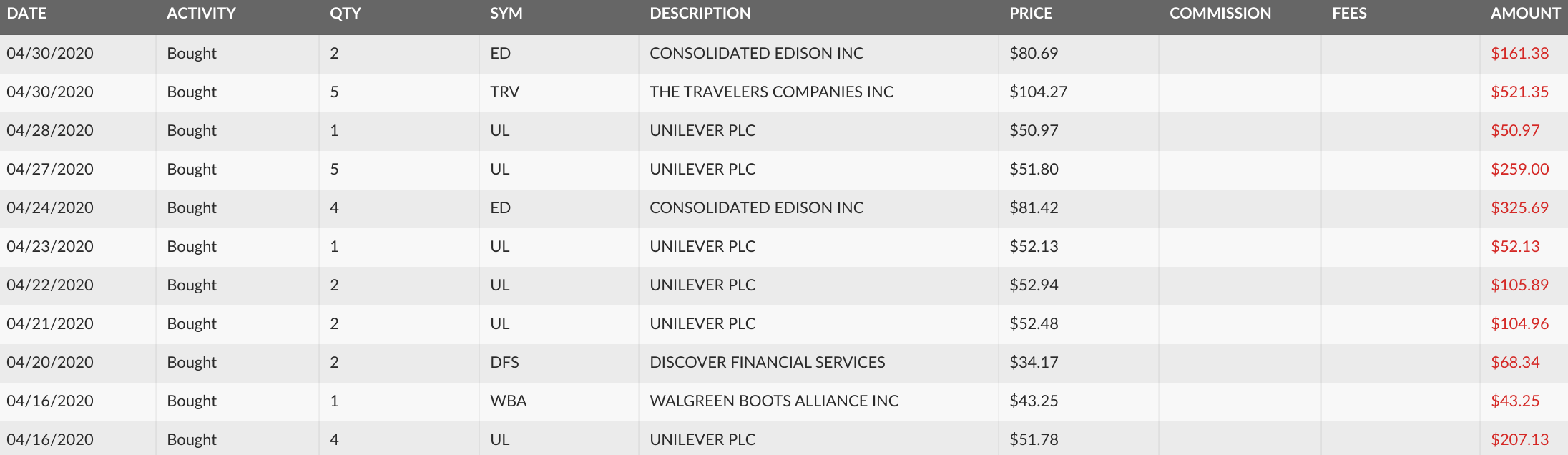

Since the trading wars have heated up and fees now are $0 to trade, I am going to list out those dividend investments made, since they are purchased sporadically when prices are deemed right. That way – I’ll still go over significant results for the month above, but include all purchases below in one image.

Therefore, see my March Dividend Stock Purchases summary:

Taxable Account:

Only one new position, to which it was very small – Wendy’s (WEN), was added to my dividend portfolio. However, all other dividend stock purchases were additional adds to current positions. I love beefing up current positions in my portfolio at discounted prices!

In total, I deployed a total amount of $2,764.85 and added $106.68 to our forward dividend income, equating to an average dividend yield of 3.86%.

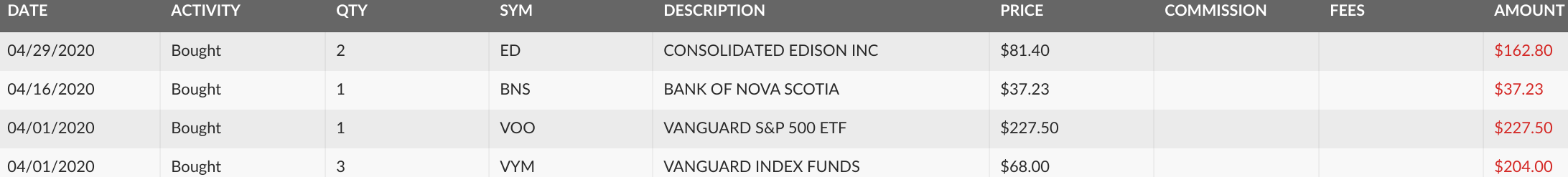

My Wife’s Dividend Stock Purchases

My wife has accounts that we also make dividend stock purchases into. Though we are married, we are still running two separate, individual, taxable accounts. All is good, especially because we use the same platform, but just haven’t wanted to deal with the administrative tasks of combining.

In April, we made quite a few dividend stock purchases for my wife’s account:

Taxable Account:

Roth IRA:

We continued to add to positions, specifically Unilever (UL) and ConEd (ED). They are two companies that will crush through the pandemic, delivering consumer goods and electricity. Further, we really were trying to round out her position in Unilever and build that up similar to how those build up Procter Gamble (PG) and Johnson & Johnson (JNJ). My wife’s portfolio is typically full of safe and sound dividend investments and since we’ve been together, her portfolio has been blossoming into an extremely significant part of our family’s finances.

In total, $2,531.62 was put into investments, producing $90.64 in Dividend Income going forward. This is an average dividend yield of 3.58%.

Summary & Conclusion

Another solid, consistent month. Combined, my wife and I deployed a total capital amount of $5,296.47 for January and added $197.32 to our forward dividend income total (3.73% yield overall)!

I will maintain my main message. Stick to the strategy that works for you, but review if there is anything that may impact your strategy going forward. You are in control and the emotion button is hard to turn off. Persevere and stay consistent, if you can and are able to. I am locked in and ready for further opportunities. This was one step closer to financial freedom and I hope to continue making strides. Lastly, my dividend portfolio has been updated.

I know it was a crazy month again. Unemployment is skyrocketing, millions are lining up, each and every week. Further, the government aid is mounting, with trillions flooding the market, from individuals, families and small businesses, specifically. Given all of the macroeconomic noise, were you able to make moves? Are you waiting for the Q2 earnings to start purchasing stock? Any one else that you picked up? Please share your thoughts and comments! Thanks again everyone, and, as always, good luck and happy investing!

-Lanny

The post Lanny’s Dividend Stock Purchase Activity – April 2020 appeared first on Dividend Diplomats.