Lanny’s Dividend Stock Purchase Activity – February 2020

On your journey to financial freedom or financial independence, you have to stay hungry out there. The stock market volatility from the extreme news & outbreak of the Coronavirus (COVID-19) displayed opportunity and one has to be ready to strike on a dividend stock when the price is right. Time to check out my February activity!

Investing consistently in Dividend Income Stocks allows you to create & build another income source, with Dividends. This is my primary vehicle on my road to Financial Freedom, which you can see through my Dividend Income and my Dividend Portfolio, to which continues to build and build.

How do I make dividend stock purchases and screen for dividend stocks? I usually put the stocks through our Dividend Diplomat Stock Screener and trade on Ally’s investment platform (one of our Financial Freedom Products).

See – Dividend Diplomat Stock Screener

See – Financial Freedom Products

How do I build the capital to make these stock purchases? I save anywhere from 60-85% of my take-home pay and strongly believe Financial Freedom does not happen by hitting a home run on an investment. Nothing matters more than your savings rate on your journey to Financial Freedom, plain and simple. Therefore, I work my butt off to make sure expenses remain in-check and that my savings rate is meeting our investment and financial independence goals! Then, you rinse and repeat.

The stock purchases

Even though the market was shaky and rocky, I was able to make consistent dividend stock investments in the market. The new $0 in trading fees really has allowed the individual stock investor to make smaller purchases, often. See January’s dividend stock purchases below!

(adsbygoogle = window.adsbygoogle || []).push({}); Stock Purchase – Viacomcbs (viac)

![]()

VIacomCBS (VIAC) has been a VERY hot topic lately. You can see the evidence by my ViacomCBS, full-blown, dividend stock analysis at Seeking Alpha.

See – ViacomCBS: A Sleeping Giant And Undervalued Dividend Growth Stock

ViacomCBS has been a beaten stock. They are down 49% from the beginning of the year. See their chart below:

Though they have been beaten down, their metrics are looking insanely incredible for a dividend investor. See the stats through our Dividend Diplomat Stock Screener:

- Price to Earnings: Analysts are now expecting $5.32 for 2020. At purchase prices of $28.37 and $23.27, this equates to a price to earnings ratio of 5.33 and 4.37. Crazy…LOW.

- Dividend Growth: ViacomCBS is not necessary a dividend growth stock, from a consistency standpoint. ViacomCBS, however, does increase their dividend every 3 years, it seems. December 2019 happened to be that year and their dividend was increased by a whopping 33%! I therefore, give that an average dividend growth rate of 11%.

- Dividend Yield: Given my spread of stock purchase prices, the yield went from a low of 3.38% to 4.13% on my last purchase.

- Payout Ratio: Based on expected earnings of $5.32 and a dividend of $0.96 per year, this equates to a payout ratio of 18%. Again, amazing room to continue strong dividend growth for years to come.

I purchased 29 shares during January for a total cost of $766.39. The 29 shares added $27.84 to my forward dividend income projection. I now have approximately have 122 shares and would say I am full in my stock position here.

Stock Purchase – Pfizer (pfe)

First, this, “Big Pharma” of Pfizer (PFE) was on my Dividend Stock Watch List in March and even the month before that. It’s no surprise with the coronavirus downturn, that I scooped up shares of this Viagra making company. Maybe this will provide a “spark” to my dividend income going forward! (side note – I had to make some form of joke here!)

- Price to Earnings: 9 analysts are projecting $2.90 in earnings for 2020. The stock price, at the time of purchase, was $37.42. This equates to a price to earnings ratio of 12.90, well below the market, on average.

- Dividend Growth: They are going for 10 years of dividend increases. The most recent was $0.02 per share, per quarter increase or 5.50%. I anticipate similar dividend increases going forward at a 2 cent per share, per quarter.

- Dividend Yield: At an annual dividend of $1.52, the yield at time of purchase was 4.06%. This is a higher yield than my overall portfolio and fits nicely with Pfizer’s dividend growth rate.

- Payout Ratio: Since Pfizer pays $1.52 per year over $2.90 in earnings, this equates to a payout ratio of 52%. Right in the sweet spot, I say!

I purchased 21 more shares during February for a total cost of $785.76. The 21 shares added $31.92 to my forward dividend income projection. I now have approximately have 125 shares and am fairly satisfied with my dividend stock position.

My Stock Purchase Summary (Plus the ~$500 and Less)

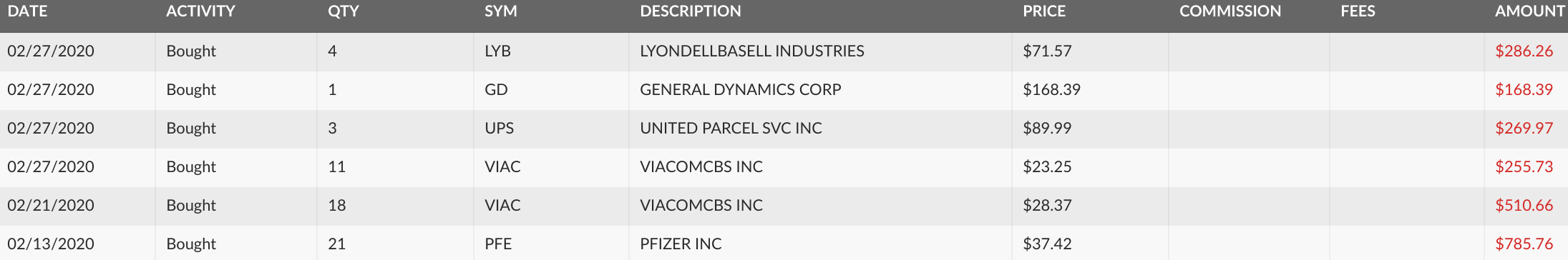

Since the trading wars have heated up and fees now are $0 to trade, I am going to list out those dividend investments made, since they are purchased sporadically when prices are deemed right. That way – I’ll still go over significant results for the month above, but include all purchases below in one image.

Therefore, see my February Dividend Stock Purchases summary:

Outside of those discussed above I did manage to average down, continually, on my ViacomCBS (VIAC) position, and they are currently trading at a steep/deep undervaluation. In addition, I swooped up another share of the Dividend Aristocrat – General Dynamics (GD) and a few more shares of Lyondell Basell (LYB). Lastly, I did purchase 3 more shares of United Parcel Services (UPS), to add to that position. All purchases were additions to current positions in my dividend portfolio.

In total, I deployed a total amount of $2,276.77 and added $93.08 to our forward dividend income, equating to an average dividend yield of 4.09%.

My Wife’s Dividend Stock Purchases

My wife has an account that we also make dividend stock purchases into. Though we are married, we are still running two separate, individual, taxable accounts. All is good, especially because we use the same platform, but just haven’t wanted to deal with the administrative tasks of combining. In February, as expected, we made quite a few dividend stock purchases for my wife’s account:

We continued to add to positions, with Exxon (XOM), Oracle (ORCL), Eastman Chemical (EMN), Delta (DAL) and even Wendy’s (WEN). We also initiated a solid start with Discover Financial (DFS). Her portfolio is full of safe and sound dividend investments and since we’ve been together, her portfolio has been blossoming into an extremely significant part of our family’s finances.

In total, $5,567.21 was put into investments, producing $137.78 in Dividend Income going forward. This is an average dividend yield of 2.47%.

(adsbygoogle = window.adsbygoogle || []).push({}); Summary & Conclusion

Another solid, consistent month. Combined, my wife and I deployed a total capital amount of $7,843.98 for January and added $230.86 to our forward dividend income total (2.94% yield overall)!

I will maintain my main message. Stick to the strategy that works for you, but review if there is anything that may impact your strategy going forward. You are in control and the emotion button is hard to turn off. Persevere and stay consistent, if you can and are able to. I am locked in and ready for further opportunities. This was one step closer to financial freedom and I hope to continue making strides. Lastly, my dividend portfolio has been updated.

Therefore, we managed to be very active during the month, especially as the coronavirus cases continued to spread and hit multiple countries, including our own. The market has been significant volatile as of late and as long as you do your due diligence and stick to your consistent strategy, all should play out. Did you stay on the sidelines during the extreme volatility? Any dividend stock purchases you were surprised about, based on what you see above? Please share your thoughts and comments! Thanks again everyone, and, as always, good luck and happy investing!

-Lanny

The post Lanny’s Dividend Stock Purchase Activity – February 2020 appeared first on Dividend Diplomats.