Positive cat bond market momentum continues: Q3 2020 Report

The catastrophe bond market saw continued positive momentum throughout the third-quarter of 2020 and despite continued financial market uncertainty and volatility as a result of the Covid-19 pandemic, the result was an above-average quarter of issuance, according to the latest report and data from Artemis.

Our latest quarterly report on the catastrophe bond and related insurance-linked securities (ILS) market is available for you to download now.

Our latest quarterly report on the catastrophe bond and related insurance-linked securities (ILS) market is available for you to download now.

The report, ‘Q3 2020 – Positive momentum continues in above-average third-quarte’, analyses a positive third-quarter that saw $1.63 billion of new cat bond and related ILS issuance and analyses the composition of transactions issued during the three-month period.

In total, 21 tranches of notes from 11 individual catastrophe bond and related insurance-linked security (ILS) transactions came to market in the third-quarter of 2020.

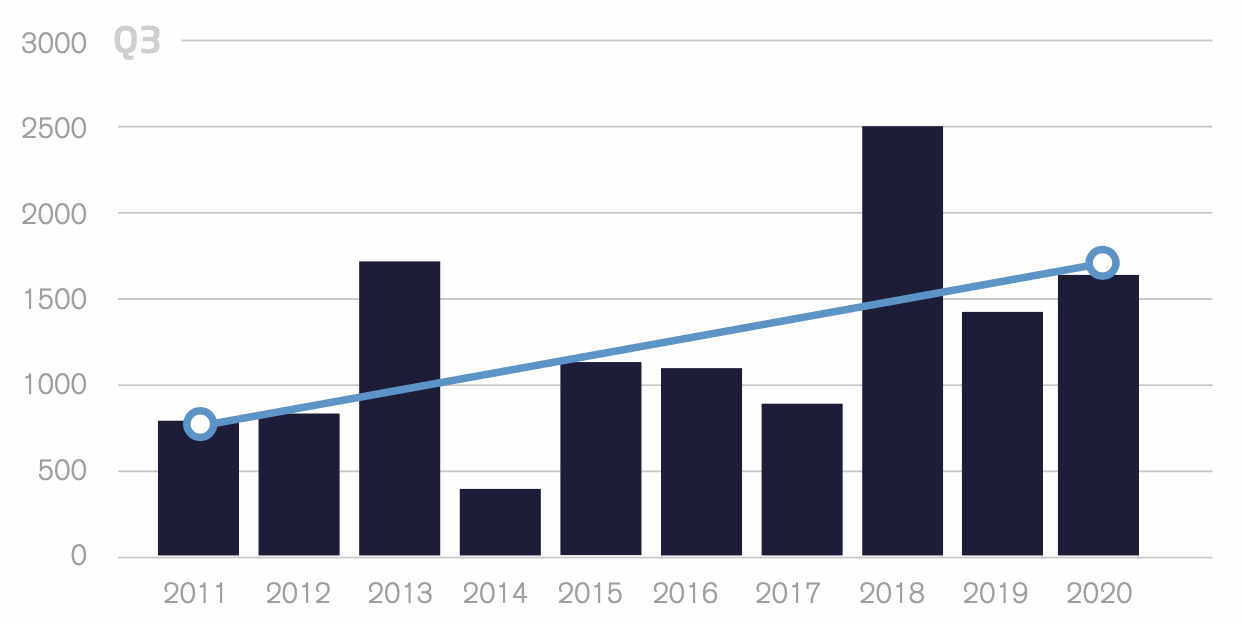

Year-on-year, issuance grew by roughly $214 million and demonstrating the appetite for liquid ILS investments even under the shadow of a pandemic, Q3 2020 issuance has been the third highest of the past decade.

As was the case in Q3 2019, mortgage ILS deals accounted for a sizeable portion of issuance this year, with approximately 46% of new risk capital brought to market in the period covered mortgage insurance risk.

Private ILS deals, or cat bond lites, were also a feature of the third-quarter of 2020, with five privately placed transactions accounting for $142 million of quarterly issuance.

Catastrophe bond and ILS issuance in the third-quarter of 2020 was above the ten-year average for the period and, at $1.63 billion this ensures issuance for the first nine-months of the year has exceeded $10 billion for the third time in the past four years.

Convex Re, part of Stephen Catlin and Paul Brand’s Convex Group, was the only new catastrophe bond sponsor to feature in Q3 2020, with the $300 million Hypatia (Series 2020-1) deal.

Repeat sponsors delivered the majority of the known issuance for the period, with private cat bonds with unnamed sponsors the rest.

These included reinsurance giant Swiss Re, sponsoring its fourth Matterhorn Re cat bond of the year. Utility Sempra Energy also returned to the cat bond market for another wildfire linked deal and UnipolSai Assicurazioni S.p.A. also returned to the market for capital markets backed reinsurance.

Mortgage ILS transactions accounted for $745 million of the risk capital issued during the third-quarter of 2020, with the rest being property catastrophe linked.

Overall, third-quarter catastrophe bond and related ILS issuance for Q3 2020 was 33% higher than the ten-year average of $1.2 billion for the quarter.

For just the third time in the past decade issuance levels surpassed the $1.5 billion mark in Q3, making it the third most active Q3 ever.

As at the end of September 2020, cat bond and related ILS issuance for the year has reached an impressive $10.44 billion, which is roughly $2.64 billion higher than the level of issuance witnessed in 9M 2019.

Of this, 73% or roughly $7.6 billion of deals issued so far this year featured property catastrophe risks. While $2.2 billion were mortgage ILS deals and $661 million offered reinsurance protection against operational risks and medical benefit claims.

Stay tuned to Artemis as we move through the final quarter of 2020, which looks set to be a busy one for new catastrophe bond issuance as year-end renewals approach.

We’ll keep you updated on all catastrophe bond and related ILS transaction issuance, as well as evolving trends in the cat bond and insurance-linked securities (ILS) market.

For full details of third-quarter 2020 cat bond and related ILS issuance, including a breakdown of deal flow by factors such as perils, triggers, expected loss, and pricing, as well as analysis of the issuance trends by month and year.

For full details of third-quarter 2020 cat bond and related ILS issuance, including a breakdown of deal flow by factors such as perils, triggers, expected loss, and pricing, as well as analysis of the issuance trends by month and year.

Download your free copy of Artemis’ Q2 3020 Cat Bond & ILS Market Report here.

For copies of all our catastrophe bond market reports, visit our archive page and download them all.

Positive cat bond market momentum continues: Q3 2020 Report was published by: www.Artemis.bm

Our catastrophe bond deal directory

Sign up for our free weekly email newsletter here.

Original Article Posted at : https://www.artemis.bm/news/positive-cat-bond-market-momentum-continues-q3-2020-report/