Record catastrophe bond issuance drives market high in Q1: Report

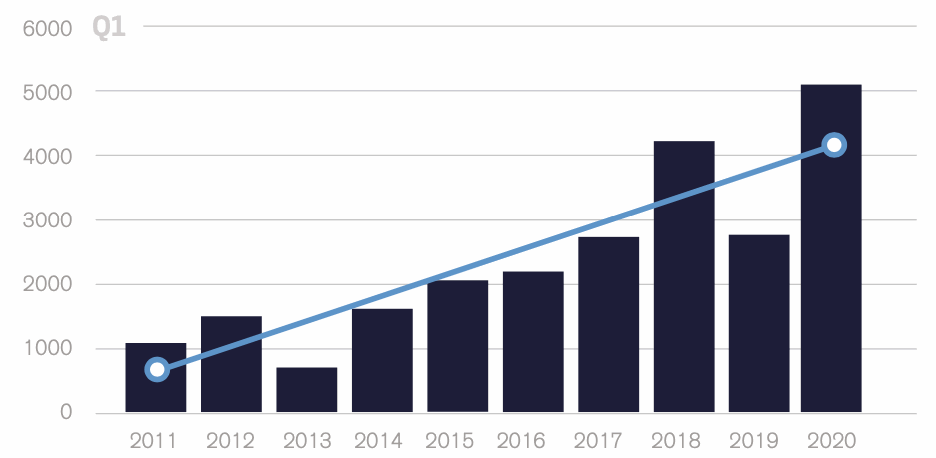

Record first-quarter issuance of new catastrophe bonds and related insurance-linked securities (ILS) resulted in over $5 billion of risk capital coming to market as 2020 got off to a rapid start, driving the outstanding market to a new high according to the latest report and data from Artemis.

Our latest quarterly report on the catastrophe bond and related insurance-linked securities (ILS) market is available for you to download now.

Our latest quarterly report on the catastrophe bond and related insurance-linked securities (ILS) market is available for you to download now.

The report, ‘Q1 2020 – Record levels of catastrophe issuance drives new market high in Q1’, analyses a record first-quarter that saw over $5 billion of new cat bond and related ILS issuance and analyses the composition of transactions issued during the three-month period.

For the first time in any first-quarter and a rarity in any quarter, catastrophe bond and ILS issuance exceeded $5 billion in Q1 2020, according to Artemis’ data from our extensive cat bond Deal Directory.

As shown by our new cat bond market report, the record level of issuance came from 27 deals consisting of 51 tranches of notes and at $5.05 billion it exceeded the prior year quarter issuance by some 82% and was 19% higher than the previous Q1 record set in 2018.

Also impressive, is the fact Q1 2020 issuance was $2.6 billion above the ten-year average for the period, not to mention the fact almost $3.9 billion of the new risk capital brought to market focused on catastrophe risk.

In recent times, quarterly issuance has often strongly featured mortgage ILS deals, and while Essent Guaranty and Radian Guaranty both issued transactions in Q1, issuance was heavily dominated by pure catastrophe risk deals this time around.

New sponsors entering the marketplace in Q1 included Markel Bermuda (on behalf of funds under management of Nephila Capital) and Bayview Asset Management with its innovative parametric cat bond deal, while the quarter also featured a number of private deals from unknown sponsors.

In terms of the number of transactions issued and the volume of risk capital issued, repeat sponsors dominated Q1 2020 as they showed continued access to the capital markets for reinsurance and retrocession was desirable in current market conditions.

After huge levels of reinsurance market losses, subsequent trapped collateral and loss development challenges, investors and sponsors clearly remain attracted to the ILS space, for both catastrophe and non-catastrophe coverage and diversification.

With issuance high for the quarter a good deal of diversification came to market in the way of perils and triggers as well, which our report details fully for you.

The record-breaking level of issuance sees the outstanding catastrophe bond and ILS market size stand at $42.4 billion as at the end of the first-quarter.

This represents outright market growth of more than $1.75 billion from the end of 2019, and takes the outstanding market to a new end-of-quarter high.

In Q2, some $5.5 billion worth of deals are scheduled for maturity, according to Artemis’ data. The average level of catastrophe bond and ILS issuance in the second-quarter over the last ten years is roughly $3.5 billion, meaning an above-average quarter is required if the market is to grow from the end of Q1.

Given the uncertainty that the current pandemic crisis now presents, this may prove a stretch. So we could see the market struggle to remain on a course for growth in the short-term, but we expect outright market growth to resume once things settle down and the coronavirus outbreak come under better control globally.

Stay tuned to Artemis as we move through 2020 and we’ll keep you updated on all catastrophe bond and related ILS transaction issuance, as well as evolving trends in the cat bond and insurance-linked securities (ILS) market.

For full details of first-quarter 2020 cat bond and related ILS issuance, including a breakdown of deal flow by factors such as perils, triggers, expected loss, and pricing, as well as analysis of the issuance trends by month and year.

For full details of first-quarter 2020 cat bond and related ILS issuance, including a breakdown of deal flow by factors such as perils, triggers, expected loss, and pricing, as well as analysis of the issuance trends by month and year.

Download your free copy of Artemis’ Q1 2020 Cat Bond & ILS Market Report here.

For copies of all our catastrophe bond market reports, visit our archive page and download them all.

Record catastrophe bond issuance drives market high in Q1: Report was published by: www.Artemis.bm

Our catastrophe bond deal directory

Sign up for our free weekly email newsletter here.

Original Article Posted at : https://www.artemis.bm/news/record-catastrophe-bond-issuance-drives-market-high-in-q1-report/