Posts Tagged ‘tax preparers’

Common Tax Mistakes to Avoid

AcctServices.org reminds you of several common taxpayer errors that can impact your refund, and possibly your taxes, this year and beyond. A quick check before filing can save you much pain later. Here’s the list from the IRS of frequently received tax filing mistakes: Missing or Wrong Social Security Numbers, or EIN numbers. Unless this…

Read MoreHow Do You Find a Great, Affordable Tax Preparer?

Are you looking for a good tax preparer or do you want to prepare your own tax return? Maybe you have concerns about your income or your expenses. A professional tax preparer can help answer your questions and file on your behalf but how do you find a good preparer? The IRS offers guidance on…

Read MoreStill Need Tax Answers?

If you got stuck on hold on the IRS tax help line…there’s still help. President’s Day weekend is the busiest rush on IRS phones, and not everyone can get through to get the answers they need. There is good news. IRS.gov is now offering tax tools online, so you get the answers you need when…

Read MoreWhat Your Tax Preparer Needs to Calculate Your Business Taxes

If you love to hate taxes, maybe it will help to think about it this way: Taxes impact all of us and fund our community structure. Without taxes, we could not fund our roadways, our government, nor services like firefighters and police. No roads means no product delivery and no customers. No police means security…

Read MoreTuesday Tax Tip

Business Tax Tip Tuesday

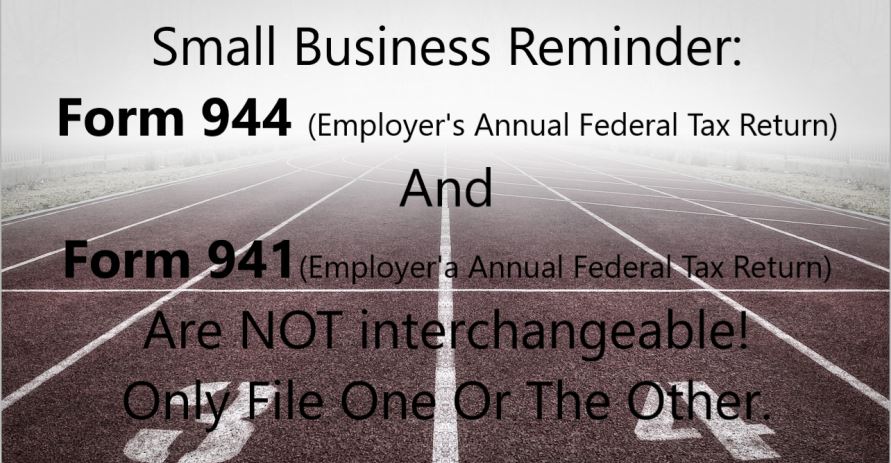

Apparently, the IRS is seeing a problem with small business owner form filing. It has issued a reminder that we are passing along today. A small business files either Form 944, annual tax return OR Form 941, quarterly tax return but NOT both. Want more information? Visit www.businesstaxprep.org to be connected to a tax professional…

Read MoreLast Tax Tip Tuesday of 2019

Donating? It is your last day to donate to a charity for 2019 tax deduction. You can donate online or in person…The IRS offers a list of tax exempt organizations that double as tax deductible donations here or visit PersonalTaxPrep.com to locate an experienced CPA near you to guide you on your tax plan.

Read MoreDeadline for Distributions

Reminder: Retirees born prior to July 1, 1949 must take your retirement plan required minimum distributions (RMD) by December 31, 2019. The RMD rules apply to: Retirees with traditional IRAs Retirees with traditional (Simplified Employee Pension) or SEP IRAs Retirees with Savings Incentive Match Plans for Employees (SIMPLE) IRAs Participants in workplace retirement plans such…

Read MoreHow to Avoid 2019 Tax Surprises.

Amidst all the holiday parties and get-togethers, take a few minutes to save yourself hassle in 2020. Think you know you’re getting a tax refund when you file? Things that happen now might change what you think you will get. You could even owe the government more money! Know what you owe. Certain financial transactions…

Read More