Posts Tagged ‘tax tip’

We Should Have a Conversation

Americore: We should have a conversation.

Read MoreTuesday Tax Tips

Did you know the IRS issued more than 111.8 million refunds, averaging over $2800 each, for the 2018 tax year? There are still ways you can boost your 2019 tax year refund. Boost Retirement contributions. You can contribute to an IRS until the April 15 tax deadline and it will still count toward the 2019…

Read MoreStill Need Tax Answers?

If you got stuck on hold on the IRS tax help line…there’s still help. President’s Day weekend is the busiest rush on IRS phones, and not everyone can get through to get the answers they need. There is good news. IRS.gov is now offering tax tools online, so you get the answers you need when…

Read MoreWhat Your Tax Preparer Needs to Calculate Your Business Taxes

If you love to hate taxes, maybe it will help to think about it this way: Taxes impact all of us and fund our community structure. Without taxes, we could not fund our roadways, our government, nor services like firefighters and police. No roads means no product delivery and no customers. No police means security…

Read MoreDo You Know the Difference Between an Itemized Deduction and a Standard Deduction?

Do you know the difference between an itemized deduction and a standard deduction? Deductions reduce the amount of taxes you owe when filing a federal tax return. That said, there are two types of deductions: The standard deduction, based on an IRS schedule, or the itemized deduction. Knowing which type of deduction is best for…

Read MoreKnow Your Taxpayer Rights

Best PersonalTaxPrep.com tax tip this year: Know your rights. Fifteen years ago, the IRS has created the Taxpayer Bill of Rights (TBOR). Since then, congress codified it as part of the tax code. That means the Taxpayer Bill of Rights is law and it applies to all U.S. taxpayers anytime they must deal with the…

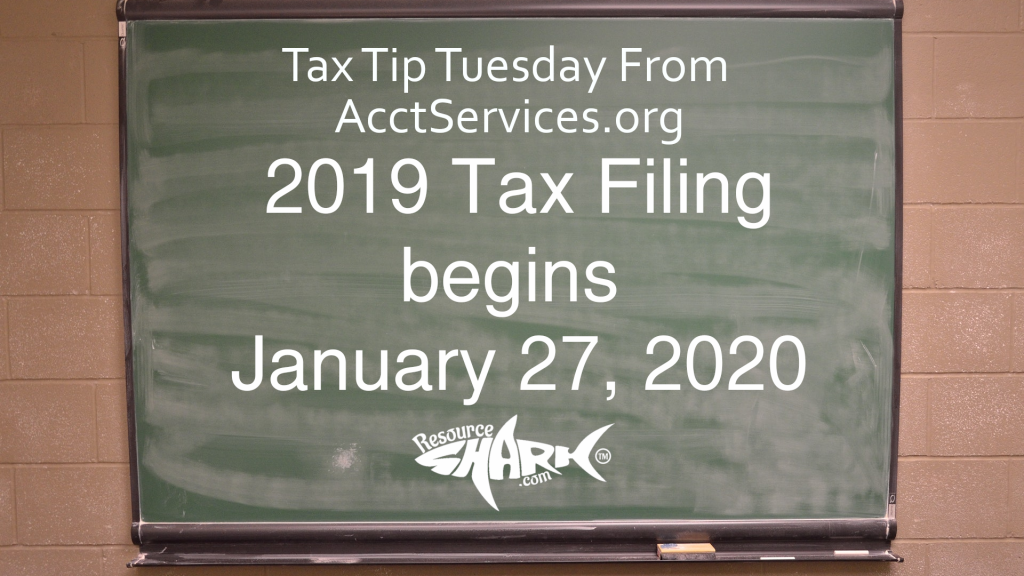

Read MoreTuesday Tax Tip

Tax Tip Tuesday

Tax Tip for Gig Businesses

It is a new Gig Economy. More and more, people are free lancing with Lyft, Uber, blogging, IG or TW influencer role, and self employed tech contractors. We know the USA has evolved into a Gig Economy because the IRS, who loves to follow the money, has now launched a new gig economy tax center…

Read More