The Gold Price Today, COVID 2nd Wave, and Fed Reserve

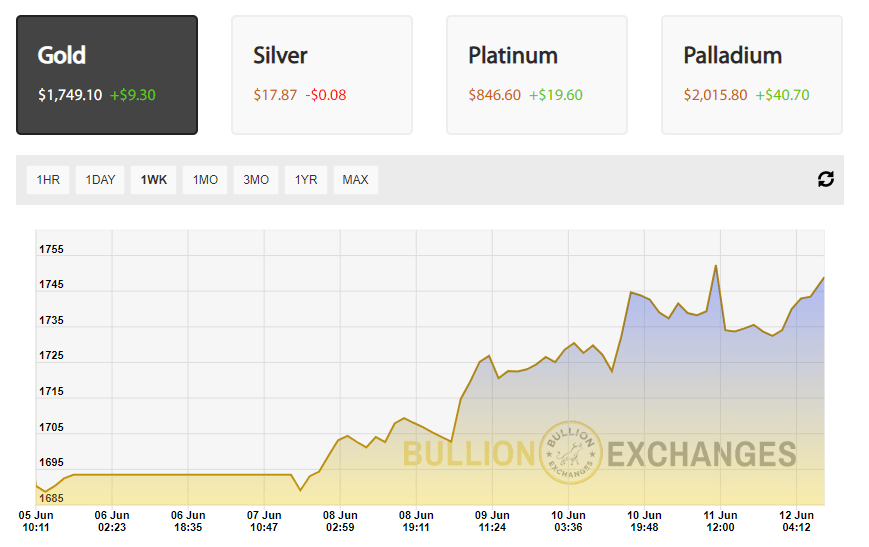

On June 9, the Federal Reserve announced a rate of 0 through 2022. As a result, the gold price today is steadily rising once again with reignited demand and interest. The effects of the Federal Reserve’s official statement on June 9th led to massive stock sell-offs in the following session. These sell-offs are also increasing because of rising fears that the second wave of COVID-19 is sweeping the nation. Therefore, rather than taking losses from business impeded by the shutdown, investors are selling their stocks once again.

if (typeof jQuery == ‘undefined’) { document.write(”); }

Q1 2020 hedge fund letters, conferences and more

Buy Gold to Hedge Your Stock Portfolio Today?

If investors are worried about inflation, zero percent interest rates, the stock market, global COVID-19 resurgence, and losing wealth in general, why are they turning to gold? Why not try to stockpile as much cash as possible? The answer is because gold is a precious commodity, and its value usually moves opposite to the dollar. Because we are not on the gold standard, the dollar’s inflation will only serve to increase the gold price today.

Gold fell two sessions in a row. This is because stocks jumped last week in the hopes that the US can reopen more of the country and economy. The gold price today, however, is rising once again perhaps towards $1750, last seen on June 1st and very nearly again ten days later.

The dollar index also recently rose to a 2 week+ high against its rivals like safe-havens and bond yields. This made gold more expensive for investors in other countries, which is now only becoming more expensive because of increased demand.

Why Should I have Gold if there is a Second Wave of COVID?

While it is true that you cannot buy things like food with gold or silver right now, these precious metals are an important tool that helps you defend the value of your portfolio. Here’s a few quick reasons why:

- Gold is a depression protection asset. As inflation increases, you will still have valuable gold in your safe haven collection. The gold price will also climb since the price responds to the dollar. So, when the dollar loses value, the gold price increases since it holds its own value as a rare commodity.

- Smart investors will not scramble for cash when inflation spikes. Inflation is a big concern because if the Fed keeps printing, then the value of the dollar weakens. Inflation is predicted to occur especially because the federal interest rate is expected to stay around 0 for the next year and a half. Therefore, as the dollar erodes, gold shines. As gold shines, demand can increase because many want to escape inflation.

- Worst case scenario, there is a complete economic collapse. While this isn’t a likely future, the chances of this happening are not exactly zero. Many people who invest in precious metals are preparing for the Doomsday scenario. There is merit in this approach because gold, silver, and other metals were once traded as currency. If for whatever reason this occurs, the economy after a collapse with a useless dollar would probably return to this early system.

- On a different note, oil is also a commodity that many turn to. However, the supply and demand for oil led the market to turn bearish in less than a week. As there is a surplus once again with barely resurgent demand, the oil price continues to slump. The rise in COVID cases contributes to the demand weakness as investors not only back out of stocks, but consumers also stay home to hide from the outbreak. The oil price is highly volatile right now, and gold is a valuable commodity in and of itself, making it a potentially better option for a safe haven asset.

The Near Future and the Gold Price Today

Right now, economists believe that with the way the gold price is today, it can surpass $1,800 by the end of the third or fourth quarter in 2020. Gary Wagner of TheGoldForecast.com predicts that gold and equities will move together on the upside in response to the effects of quantitative easing.

As for the economic recovery, there could still be a long way to go. Unemployment and debt levels are still high, and we have not yet seen the consequences of quantitative easing. Even though the stock market experienced a rally recently, this level of success does not yet account for these issues in the long term. For these reasons, the gold price today may very well see $1,800 by the end of the year as it steadily increases for the next six months.

What Kind of Gold Should I Buy Today?

When you decide to buy gold, you need to consider what your goals are. Do you want to accumulate a large amount of gold with lower premiums? Or do you want to invest in gold coins that might be more liquid and grow in value due to increasing rarity over time? When you want to start investing in , these are all factors to consider. Also, always be sure to check what the ‘gold price today’ is to time your investments.

One gold bar that is highly popular among investors is the PAMP Suisse Lady Fortuna gold bar. Because these bars also have a variety of different sizes, you don’t have to worry about being able to afford an entire ounce of gold. Having even a little gold is better than no gold at all. As for gold coins, there is a wide range to choose from. The American Gold Eagle coins and Canadian Maple Leaf coins are always two favorites for gold collectors.

Don’t Forget to Look at Silver

The silver price also rose over 3% on June 10, and it opened just above $18/oz on June 11. Although silver is more common than gold, its value is still comparable to gold through the gold/silver ratio.

(From Alpha Bullion)

On June 11, the gold-to-silver ratio was just shy of 1:100 once again. This means that 100 ounces of silver could buy gold. To quote our last , “The world silver market is approximately 1/12 the size of the gold market. This is important because any amount of capital that goes into silver can potentially hold 12x the upward price impact of the same amount of money going into gold. This is why silver prices tend to augment gold by about 2-3x.” Therefore, even though the silver price does not seem to be gaining as much as gold, the two trade so closely together that you should not discount its worth for your portfolio.

As COVID cases continue to rise, be safe and smart with your investing. Plan wisely and carefully, and don’t forget to keep wearing your mask.

.fb_iframe_widget_fluid_desktop iframe { width: 100% !important; }

The post The Gold Price Today, COVID 2nd Wave, and Fed Reserve appeared first on ValueWalk.

Original Article Posted at : https://www.valuewalk.com/2020/06/gold-price-today-covid-2nd-wave/