Bert’s March Dividend Income Summary

Lanny said it best in his dividend income summary. The coronavirus has dominated everything lately, as it has taken our world and shaken it upside down. Everyone is learning to adjust to the new, short-term reality, including individuals and businesses. For me personally, I have cherished the opportunity to spend every day with my daughter, as I have worked at home exclusively. I’ve truly grown to appreciate seeing all the little things and seeing how much she grows and learns each day. This is a feeling that has just made me hungrier, and hungrier, for financial freedom. And while all of this madness has been going on, the dividends have continued to quietly roll in. Let’s take a look at my March dividend income summary!

Dividend Investing is amazing for so many reasons. As we continue to build a growing, passive income stream by investing in undervalued dividend growth stocks identified by our dividend stock screener, it is always important to track your progress and make sure you are achieving your goals. Seeing the progress makes the income feel real. And it motivates us that much more to reach financial freedom.

See – Our Dividend Stock Screener

We find the stocks to invest in using the Dividend Diplomats Dividend Stock Screener and other carefully created lists. Recently, the lists have focused primarily on finding quality, dividend growth stocks (aka Dividend Aristocrats) that are made to weather this current pandemic, unlike some other industries.

See- Our Top 5 Foundation Dividend Stocks

See – Industries Built for the Coronavirus Pandemic and Dividend Investors

See – Dividend Aristocrats with Low Debt

Over the last 6+ years, our portfolio and dividend income have slowly grown. We’ve maximized our 401(k) contributions the last several years, invested every extra dollar we could, reinvested our dividends, and realized the benefits of reinvesting our dividends. Slowly, but surely, we are seeing the process work. The dividend engine is starting to hum and the power of compounding will start taking over soon. That my friends, is what it is all about!

See – The Power of Dividend Reinvesting

See – The Power of $50,000 in Dividend Income, Explained

(adsbygoogle = window.adsbygoogle || []).push({}); Bert’s March Dividend Income Summary

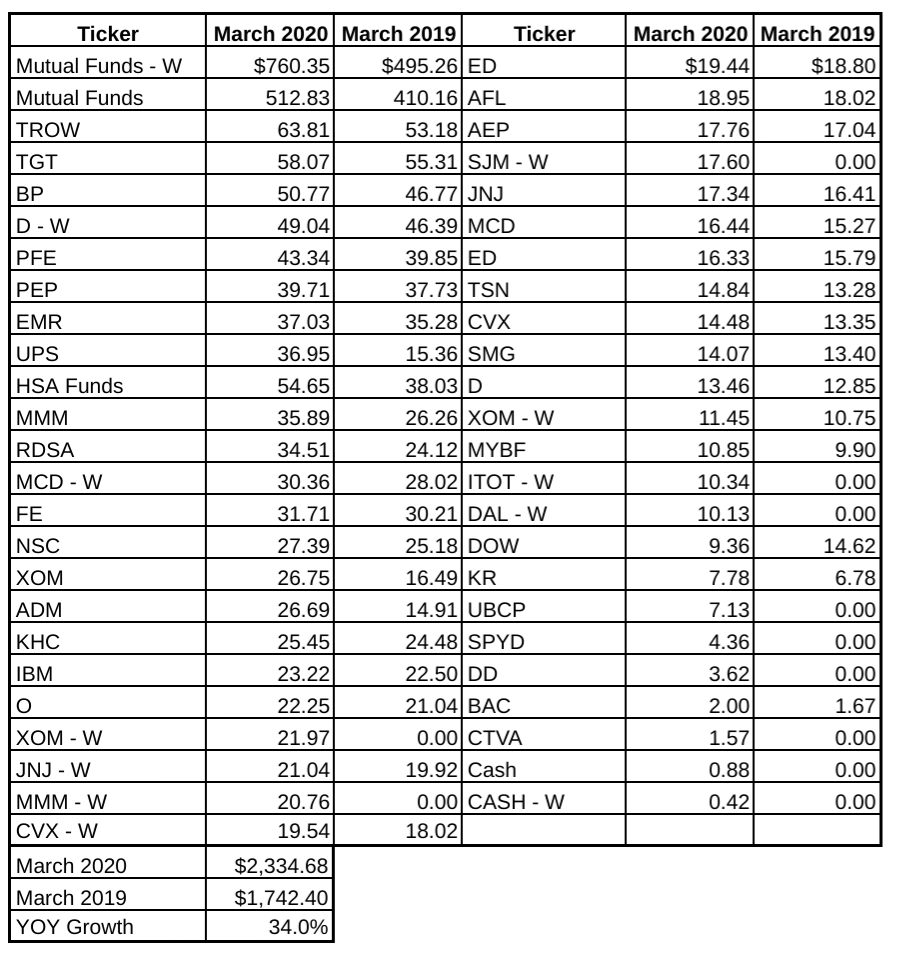

In March, my wife and I received $2,334.68 in dividend income. That is a 34% growth rate compared to last March. The following table provides a detailed listing of each dividend received.

Here are some of the highlights:

- Mutual funds continued to lead the way for us. Since this is the third quarter of the month, our dividend income receives a huge boost from these funds. For some funds, the capital gains distributions far outpaced the first quarter last year. Given the selling that occurred, especially as things turned sour in February and March, it wasn’t surprising to see some funds take their gains off of the table. This should be an interesting trend to follow in June, September, and December. Will the payouts in those quarters be less, as a result of the March distributions?

- Many of the purchases I made in January and February (click here for last purchase summary) were made before their ex-dividend date. So I was able to receive the dividend payment this quarter. That include MMM in my wife’s portfolio and the additional shares of UPS and ADM in my portfolio, just to name a few.

- My wife received her first dividend from Smuckers (SJM) this quarter. Smuckers is one of the few companies that is holding up well during the pandemic. Their products are essential to everyday life and lend themselves to perform well during tough economic times. I know we have stocked up on a few extra jars of peanut butter in our house.

- Lastly, I always have to make this comment when reviewing the table, but there were many companies for which I did not purchase any additional shares over the last year. However, you can see their dividend increase due to the good old fashioned power of dividend reinvesting and dividend increases.

(adsbygoogle = window.adsbygoogle || []).push({}); Bert’s March Portfolio Transactions

In this section, I like to discuss the impact of stock purchased 401(k) contributions, and dividend increases had on my portfolio and forward dividend income. Typically, I include a chart detailing the impact of each. However, March was crazy. While I didn’t purchase as much stock as I would have wanted, especially towards the end of the month when the market plummeted, I purchased enough to warrant a separate article to discuss this activity. So there will be more to come!

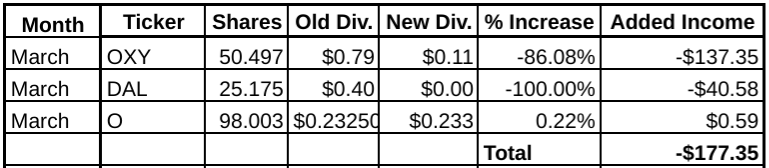

However, I will state this about my purchases. Stock purchases and 401(k) contributions added $190.02 in dividend income to my forward dividend income in March. Which is great, considering the next chart I am about to show all of you. This next chart typically shows the dividend increases I received this month. Let’s just say, in MArch, the dividend cuts outweighed the dividend increases by a significant margin.

Yikes. Thanks to Occidental Petroleum (OXY) and Delta Airlines (DAL), I lost nearly $178 in forward dividend income. Neither of the cuts were surprising given the collapse in the price of oil and all of the stay at home orders. It will be a while before either of these companies increases their dividend once again, in my opinion.

I must say though, I am lucky that the impact from dividend cuts was not worse last month. Many retail companies quickly, and aggressively, slashed their dividends and suspended their forward guidance. It is only the middle of April and there will be more cuts to come in the future if we cannot start returning to normal soon. Obviously though, the most important thing is slowing the curve and doing everything we can to stay healthy and safe. I’ll say it time and time again.

Thank goodness that the new income added covered the income lost from the dividend cuts. Overall, I added $12.67 to my forward dividend income in March.

Read – PG and JNJ Lead the List of Powerhouse Companies Expected to Increase their Dividend in April

Summary

This truly has been the most unique month and a half of investing that I have experienced…ever. The market fell fast and furiously, and then quickly whipsawed back upwards. There are days when I am kicking myself for not being more aggressive, but I am still waiting to learn more about the economic conditions and start seeing companies report earnings. It is coming soon, now that we are several weeks past the quarter end. Hopefully, more information will be available to make the best investment decisions that we can!

For now, I will continue my strategy of making small purchases of Dividend Aristocrats or other companies with strong balance sheets. I’ve enjoyed the strategy and it has allowed me to remain flexible while averaging my cost basis downward on some great dividend growth stocks. And on top of it, I’ll enjoy reinvesting my dividends at these lower stock prices. It’ll be interesting to see how things shake out and what I’ll be writing at this same time next month!

How did you perform in March? Did you see strong year over year growth? What were your major stock purchases for the month? Have you been investing a lot of capital, or remaining on the sidelines?

Bert

P.S. We are now officially LIVE on Instagram! Stop by our page and see some behind the scenes footage of the Diplomats in action!

(adsbygoogle = window.adsbygoogle || []).push({});

The post Bert’s March Dividend Income Summary appeared first on Dividend Diplomats.