Capital markets use to increase, as US P&C carriers look for capacity: KBRA

Use of the capital markets and insurance-linked securities (ILS) solutions to source reinsurance capacity may increase in the wake of 2020, as property and casualty insurers in the United States come to terms with another expensive year on the severe weather and catastrophe front, Kroll Bond Rating Agency (KBRA) believes.

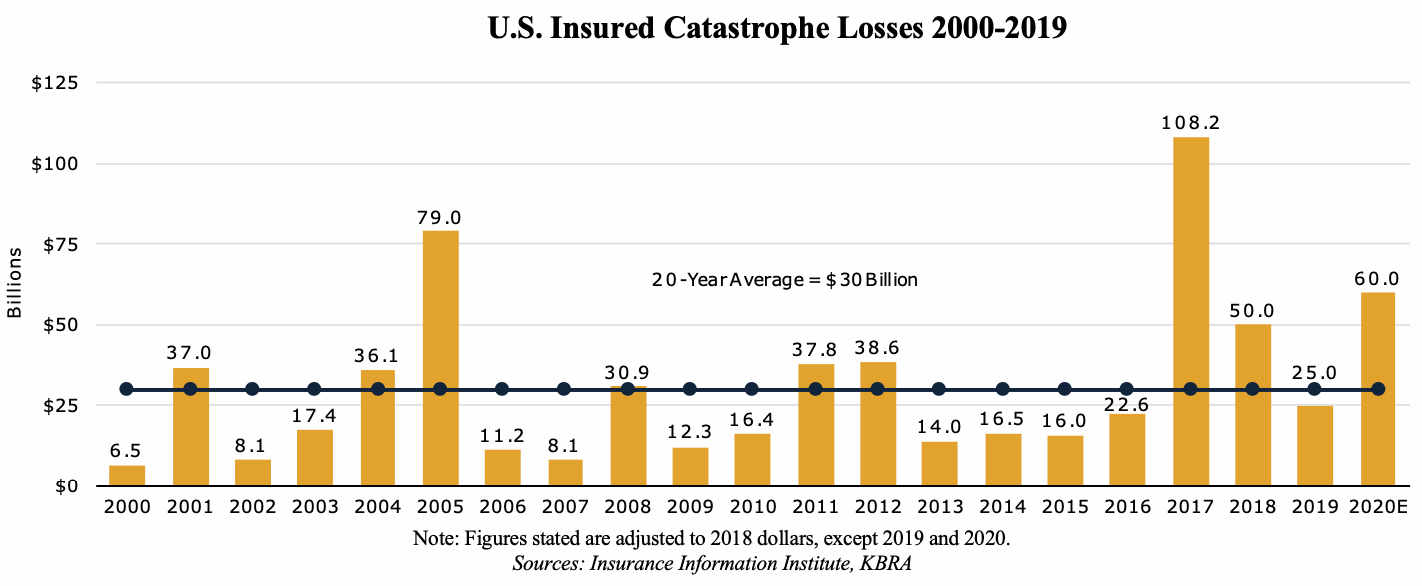

Not only has the U.S. Property & Casualty (P&C) insurance market dealt with the impacts of the COVID-19 pandemic in 2020, in terms of losses and volatility on the investment side, the this year looks set to be the third most expensive in terms of insured catastrophe losses on record, behind 2017 and 2005.

Reflecting on the 2020 hurricane season and its impacts on the United States, KBRA notes that part of the story has been frequency (as we explained recently here), which has led to repeat losses for U.S. P&C carriers and in many cases these haven’t been sufficiently severe to drive major reinsurance claims.

Alongside another particularly costly year from severe convective storms, hail and other forms of severe weather, plus wildfires, the U.S. P&C market has retained a significant percentage of its losses in 2020, which may in some cases have dented capital and capacity.

Insured catastrophe losses for 2020 could mean “industry earnings will decline and some insurers will likely experience surplus erosion,” KBRA explained.

While the rating agency says that the sector has the capital to deal with its losses from 2020, there are further headwinds coming as the U.S. P&C insurance market now faces much higher reinsurance costs in 2021 and the prospect of lower-for-longer interest rates.

“P/C insurers (especially smaller regional players) will need to refocus on underwriting profitability, particularly in light of the dual headwinds of availability/affordability of reinsurance as well as persistent low interest rates that constrain investment income,” KBRA said.

Reinsurance capacity is expected to be relatively flat this year, the rating agency said it, “expects the reinsurance industry will provide a similar level of capacity as in prior years, but with material adjustments to pricing, terms and conditions, and overall structure.”

All of which could further pressure P&C carriers and potentially cause them to look outside of the traditional market, for alternative solutions, KBRA believes.

“The market may also experience increases in capital market solutions to provide additional capacity to P/C carriers,” KBRA forecasts.

Which suggests that ILS and other forms of capital markets backed reinsurance such as catastrophe bonds could increasingly find themselves favoured as additional and efficient sources of reinsurance capacity, that can be utilised by P&C carriers to effectively allow them to continue growing and writing more business.

This is how reinsurers utilise alternative capital today, as an extension of their capital, adding depth and a greater ability to write more risk.

Primary carriers are increasingly looking at the capital markets in the same way and we do expect to see more innovative solutions, that bring capital markets funding into the business model of a primary carrier, emerge in 2021 and beyond.

Capital markets use to increase, as US P&C carriers look for capacity: KBRA was published by: www.Artemis.bm

Our catastrophe bond deal directory

Sign up for our free weekly email newsletter here.

Original Article Posted at : https://www.artemis.bm/news/capital-markets-use-to-increase-as-us-pc-carriers-look-for-capacity-kbra/