Cat claims 34% above 10-year average in 2021 on US winter storm: Jefferies

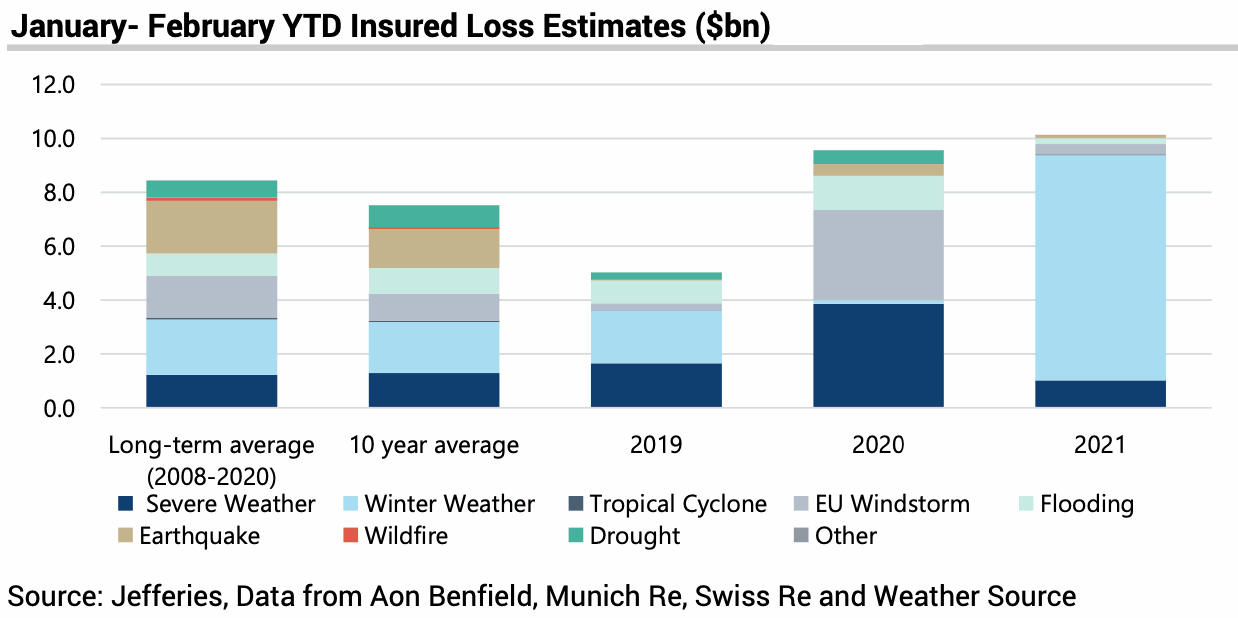

Insurance and reinsurance industry catastrophe claims are likely running around 34% above the 10-year average for the year-to-date thanks to the significant contribution from US winter storms and freezing weather, according to analysts at Jefferies.

In its latest update on catastrophe and weather losses facing the insurance and reinsurance industry, the analyst team from the investment bank notes that at this run-rate some companies will see their first-quarter results negatively impacted.

However, Jefferies only initially estimated a $7.6 billion industry loss from the polar vortex event and related severe winter weather, which is far lower than the $10 billion to $20 billion estimates ranging around the market.

Now, the company has updated this to provide a range, but it’s still only just getting into the ranges more widely discussed, as Jefferies now says, “As this an unusual event, and our model uses insured loss percentages as a key input, we would not be surprised to find that the ultimate claims figure was above our $7.6bn estimate and therefore we would suggest a range of $7.6bn to $12.5bn as a guesstimate.”

The impacts of the winter weather event, coming after a costly 2020 for some insurers where multiple losses aggregated for them, Jefferies believes this most recent major loss will provide further impetus for rising pricing.

“From a pricing perspective, we believe that if unexpected events like the US winter weather and severe weather losses continue to increase in severity, this could build momentum for both insurance and reinsurance prices,” the analysts explained.

Part of the reason for Jefferies lower estimate is that it understands the severity of losses coming out of the winter storm are not particularly high, so policyholders may retain more and insurers the majority, while reinsurance covers less.

With burst pipes in Texas a significant driver of the claims, we are also hearing that average claims amounts are relatively low for such a large industry event, with the number of claims though a major factor, alongside inflationary factors, in the overall industry impacts.

For February 2021, Jefferies analysts estimate that global insured catastrophe losses were 59% above the long-term average, with winter weather accounting for 97% of losses.

The analysts say, “While we note that winter losses were less material relative to severe weather in previous years, the current deteriorating winter weather trends could perhaps be an indication of climate change and further suggests that consensus may be underestimating the severity of losses emerging from this peril as they tend to be less frequent than other perils.”

The analysts estimate that catastrophe and weather losses are running 20% higher than the long- term average (2008-2020) and more than 34% higher than the 10-year average, for the first two months of 2021.

“Relative to previous years, we note that winter weather losses so far in 2021 have been very high, potentially so high that 2021 is already the highest year in our model for winter weather,” they explain.

Also read:

– Winter storms mean higher renewal rates into 2022: ILS Capital.

– Aon says winter storm losses to hit record level, warns of climate effect.

– Winter storm losses in Texas drive ERCOT subrogation speculation.

– Winter storm losses to factor into alternative capital investor discussions: S&P.

– Winter storm exposed cat bonds stage partial price recovery.

– US winter storm loss creep likely to be prolonged: Aon.

– Winter storm losses seen a driver for mid-year reinsurance firming: KBW.

– Winter storm at $12bn – $18bn only attritional to aggregate cat bonds: Plenum.

– USAA aggregate cat bonds in focus on winter storm impacts.

– Hurricane-level winter storm claims to drive billions of losses: Aon.

– Winter storm Uri loss could be “well in excess” of $10bn: AIR.

– Palomar expects reinsurance recoveries for winter storm Uri.

– Winter storm Uri insured loss seen up to $20bn: Fitch.

– Winter storm Uri an aggregate threat, but commercial loss may protect ILS: Twelve Capital.

– Winter storm to drive record losses, reevaluation of cat budgets: AM Best.

– KCC raises US winter storm insurance industry loss estimate to $18bn.

Cat claims 34% above 10-year average in 2021 on US winter storm: Jefferies was published by: www.Artemis.bm

Our catastrophe bond deal directory

Sign up for our free weekly email newsletter here.

Original Article Posted at : https://www.artemis.bm/news/cat-claims-34-above-10-year-average-in-2021-on-us-winter-storm-jefferies/