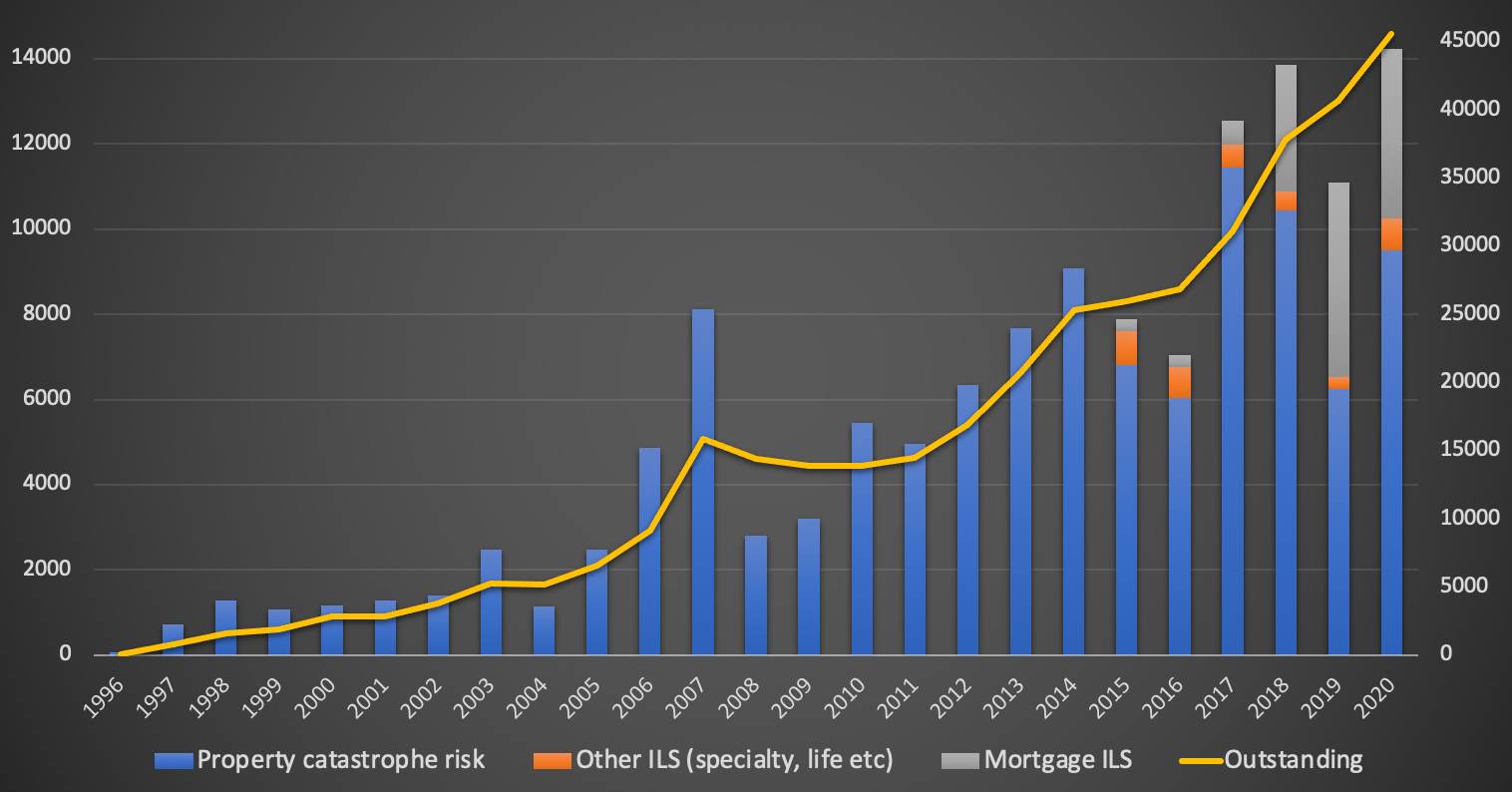

Catastrophe bonds & related ILS hit new issuance record at $14.24bn in 2020

Catastrophe bond and related insurance-linked securities (ILS) issuance has reached a new annual record already in 2020, surpassing $14 billion for the very first time, according to Artemis’ data on the cat bond market.

Within our Artemis Deal Directory, which is the most extensive source of information available on catastrophe bonds and other similar insurance-linked securities (ILS), with over 700 transactions now listed, so far in 2020 we have recorded a stunning $14.24 billion of new issuance so far this year.

That beats the previous record of $13.86 billion set in 2018 and there is more to come before year-end, with still four catastrophe bond transactions yet to complete that we are tracking and we’re also aware of more still to come.

As well as annual catastrophe bond and related ILS issuance, as recorded by Artemis, reaching a new annual record high, so too has the amount of risk capital outstanding.

This has surpassed $45 billion for the first time ever in recent weeks and is currently fast approaching $45.6 billion, the highest figure seen since we began tracking this marketplace in the late 90’s.

This data includes property catastrophe bonds (including private deals, or cat bond lites), specialty catastrophe bonds, life and health catastrophe bond equivalents and also issuance of mortgage insurance-linked securities.

All of those transaction types were included in the previous record set in 2018, so on a comparable basis 2020 is now the most active year on-record for catastrophe bonds and related insurance-linked securities (ILS), which was also recently evidenced by the record for number of deals issued being surpassed as well.

Issuance has been helped along by the fact catastrophe bonds are increasingly becoming a cost-effective alternative to traditional reinsurance and retrocession in 2020, as well as the cat bond market having ample capital to satisfy ceding company needs for reinsurance coverage.

Excluding mortgage ILS issuance, which has become an increasing component of the overall marketplace as mortgage insurers look to ILS structures and the capital markets for reinsurance capacity, issuance is still trailing the 2017 record of almost $12 billion though.

Issuance of property catastrophe, specialty, life and health related catastrophe bond type deals (including cat bond lites) has reached $10.05 billion for 2020 so far, according to Artemis’ data. But this still sits some way below 2017’s $11.98 billion of similar deals, so it’s not clear if that record can be broken, at this late stage of 2020.

However, it would only take a couple of additional larger retrocessional reinsurance cat bonds to come to market and we could see annual issuance for 2020, excluding mortgage ILS deals, getting closer to the 2017 record.

The fact the market is setting these records in 2020, a year where everyone in financial services and capital markets has faced challenges due to the pandemic and volatility it caused, is testament to both the utility of the catastrophe bonds coverage and the appetite of investors for relatively uncorrelated sources of investment return.

There are almost $540 million of additional cat bond issues to add to the 2020 total, just based on the four transactions we have listed in our Deal Directory that are yet to complete.

We’re also aware of a number of new catastrophe bonds that should hit the market in the next few weeks, although some of these could roll over into 2021 for settlement.

Whether we hit records for pure catastrophe bond issuance, which is the figure most of the brokers track in their market reports, or not, 2020 will still have been record-setting in many ways.

Coming in a year when global capital markets and the reinsurance sector have been so affected by the pandemic, this is testament to the professionalism of the ILS market, the utility of the risk transfer alternative it provides and the continued, still rising attraction to ILS returns that major global investors display.

Stay tuned to Artemis for news every catastrophe bond and related ILS transaction that comes to market, as well as other structures including reinsurance sidecars.

You can view information on every catastrophe bond issued so far in 2020 and all prior years, totalling over 700 issues, in the Artemis Deal Directory.

Keep up-to-date with the make-up of the catastrophe bond and ILS market using the Artemis Catastrophe Bond & ILS Market Dashboard, designed to be a simple and effective tool providing key data and statistics on every transaction (there are 700+) contained in our catastrophe bond & ILS Deal Directory.

Keep up-to-date with the make-up of the catastrophe bond and ILS market using the Artemis Catastrophe Bond & ILS Market Dashboard, designed to be a simple and effective tool providing key data and statistics on every transaction (there are 700+) contained in our catastrophe bond & ILS Deal Directory.

Catastrophe bonds & related ILS hit new issuance record at $14.24bn in 2020 was published by: www.Artemis.bm

Our catastrophe bond deal directory

Sign up for our free weekly email newsletter here.

Original Article Posted at : https://www.artemis.bm/news/catastrophe-bonds-related-ils-hit-new-issuance-record-at-14-24bn-in-2020/