Accounting

Most accountants are lowballing their fees. Here’s how to fix that

As an accountant, your clients don’t care how much you need to earn to keep your business afloat; they care how much value they’re receiving at a particular price. ]] Original Article Posted at : https://www.accountingtoday.com/opinion/most-accountants-are-lowballing-their-fees-heres-how-to-fix-that

Read MoreSEC moves to force access to audits of foreign companies

The commission is starting to implement a tough law passed at the end of the Trump administration, aimed largely at Chinese stocks. ]] Original Article Posted at : https://www.accountingtoday.com/articles/sec-starts-implementing-audit-law-that-risks-chinese-stock-delistings

Read MoreSEC starts implementing audit law that risks Chinese stock delistings

The threat of Chinese stocks being kicked off U.S. exchanges is gaining traction, with the Securities and Exchange Commission starting to implement a tough law passed at the end of the Trump administration. ]] Original Article Posted at : https://www.accountingtoday.com/articles/sec-starts-implementing-audit-law-that-risks-chinese-stock-delistings

Read MoreTreasury has sent $325B in stimulus payments

The government has so far sent about 127 million stimulus payments to individuals and households. ]] Original Article Posted at : https://www.accountingtoday.com/articles/treasury-has-sent-325b-in-household-stimulus-payments

Read MoreTreasury has sent $325B in household stimulus payments

The Treasury Department and Internal Revenue Service have so far sent about 127 million stimulus payments worth around $325 billion, according to the federal government. ]] Original Article Posted at : https://www.accountingtoday.com/articles/treasury-has-sent-325b-in-household-stimulus-payments

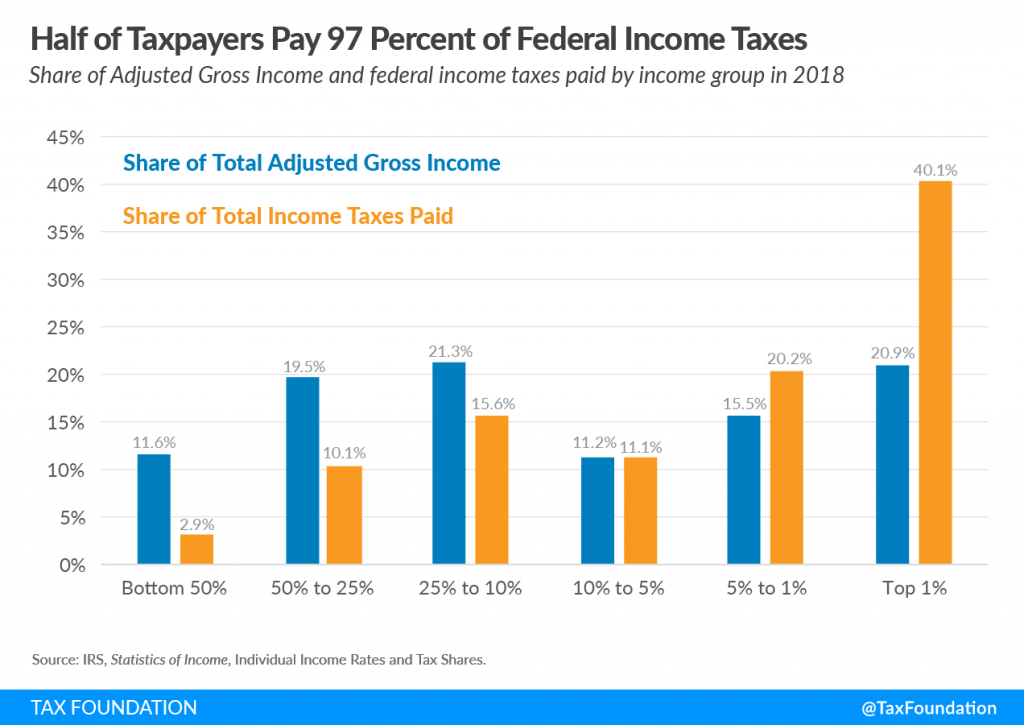

Read MoreTestimony: Senate Budget Committee Hearing on the Progressivity of the U.S. Tax Code

Note: The following is the testimony of Scott A. Hodge, President of the Tax Foundation, prepared for a Senate Budget Committee Hearing on March 26, 2021, titled, “Ending a Rigged Tax Code: The Need to Make the Wealthiest People and Largest Corporations Pay Their Fair Share of Taxes.” Table of Contents The Rich Bear America’s…

Read MoreSanders proposes bigger tax hikes than White House

The Senate Budget Committee chairman wants to raise the corporate tax rate to 35 percent. ]] Original Article Posted at : https://www.accountingtoday.com/articles/sanders-proposes-bigger-tax-hikes-than-white-house-is-planning

Read MoreSanders proposes bigger tax hikes than White House is planning

Senate Budget Committee Chairman Bernie Sanders is proposing tax increases that are even bigger than the ones President Joe Biden is considering. ]] Original Article Posted at : https://www.accountingtoday.com/articles/sanders-proposes-bigger-tax-hikes-than-white-house-is-planning

Read MoreWall Street trading tax gets surprise nod from conservative group

A conservative think tank is throwing its support behind proposals long associated with progressives like Elizabeth Warren and Bernie Sanders: taxing stock trades and breaking up Wall Street investment banks. ]] Original Article Posted at : https://www.accountingtoday.com/articles/wall-street-trading-tax-gets-conservative-groups-unlikely-tout

Read More