Dividend Income Summary: Bert’s June 2020 Summary

The stock market continues to put on quite the show in 2020. Luckily, our dividend income is putting on a show as well. The power of dividend investing is real and hopefully our results will motivate you to continue investing in dividend growth stocks. This article contains our June dividend income summary, including the total dividend income and the dividend increases we received this month.

Why I Invest in Dividend stocks

Dividend income is the name of the game. You have probably figured this out by now; however, if you haven’t, the two of us are extremely passionate dividend growth investors. Our goal is to invest in dividend paying stocks that consistently increase their dividend. We find these stocks using the Dividend Diplomats’ Dividend Stock Screener. The stock screener uses 3 SIMPLE metrics to identify undervalued investment opportunities.

Dividend investing is simple and it makes sense to me. That is why I pursue this route. You invest in high quality dividend growth stocks that have demonstrated their ability to increase their dividend through good times and bad. In return for your investment, the company pays you a dividend. Overall, it is simple, easy, and most importantly, passive.

Dividend investing in 2020 is more important than ever. Why? The cash in your savings account is earning NOTHING. Interest rates continue to fall. Further, according to Chairmen Powell, we will be in a low interest rate environment for the foreseeable future. We are always looking for new ways to earn interest income. That is why dividend stocks are one of our suggested alternatives to holding cash in a savings account. The dividend stock can help increase the yield earned on your cash.

Related: Cash is Dead – Why Holding Money in a Savings Account is a Fool’s Game

Building a significant stream of dividend income takes hard work, consistency, saving, investing, and most importantly, time. If you save as much of your income as possible and invest the proceeds into income producing assets over a long period of time, you will realize the fruits of your labor with a strong growing income stream. I started my dividend investing journey in 2012. Slowly, but steadily, my income has increased annually. Eight years later, I am enjoying some of my strongest dividend months yet. The best part is…I’m just getting started. We continue to save, invest, rinse, and repeat here in our household. The best is yet to come.

Related: The Power of Dividend Reinvesting

Each month, we share our dividend income summaries to highlight our annual dividend growth rate. This is a fun and helpful excercise. It holds us accountable to ensure we are hitting our goals. Further, it helps you, our followers, understand where we are allocating our capital and the stocks we are purchasing. The comments I receive are great, helpful, and motivating. That’s what it is all about.

(adsbygoogle = window.adsbygoogle || []).push({}); Bert’s June 2020 Dividend Income Summary

June was not a record setting month for me. However, we are closing in on a milestone and should hit this milestone in September (barring additional dividend cuts). The milestone is receiving $2,000 of dividend income in a non-December month. In December, mutual funds and ETFs pay out their capital gain distributions. The payments received in the last month of the year will always be higher than the other 12 months. That is why crossing $2,000 in a non-December month will be so exciting for us!

Related: Milestones and Dividend Investing – A Match Made in Heaven

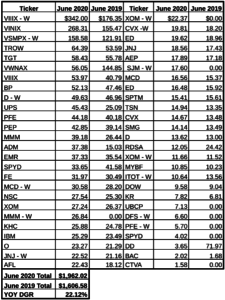

In June 2020, my wife and I received $1,962.02 in dividend income. $37.98 short of the $2,000 mark! This was a 22% increase compared to the dividends received in June 2019. We received over 50 individual payments from companies and fund families. Think about that for a second. 50+ entities paid us a check and we didn’t have to lift a finger to earn the cash. Beautiful. The chart below provides a detailed breakdown of the 50+ dividend payments we received:

In each dividend income summary, I provide a few highlights and observations about the dividend income I received. My notes for my June 2020 dividend income summary are as follows:

- Let’s start with a positive note. We invested a lot of capital into my wife’s accounts at the end of 2019 and start of 2020. It is very exciting to see her dividend income totals increase each month. In June, she received new dividends from Smuckers, 3M, Pfizer, Discover, and Exxon Mobil compared to last year. Not only is it exciting to see my income grow, it is also exciting to see hers grow as well.

- Similarly, I received increased dividends compared to last year due to continued purchases throughout the year. One example of this is United Parcel Services (UPS). The dividend I received from UPS doubled compared to last year due to purchases made in 2020. UPS trucks are everywhere during the pandemic with increased online purchases. Further, their return partnership with Amazon is great. When we return a package, I simply drop it off at the nearby UPS store within walking distance of my house and they take care of the packaging, shipping, and handling. I couldn’t be happier that I own this stock and will add more if the price falls again.

- There were several negative items from the month. First, my dividend income from Dow-Dupont decreased compared to last year. The company split into three separate companies around this time in 2019. Shareholders received a special cash dividend as a part of the transaction. This was reflected in my June 2019 dividend income summary. We did not receive a similar special dividend this year. Therefore, my dividend income decreased over $70.

- Second, I felt the impact of a few dividend cuts from earlier in the year. The most devastating was Royal Dutch Shell. I’ll never forget the shock and frustration that we had when it was announced Shell was cutting their dividend. So far, they have been the only major integrated oil company to do so. Exxon Mobil, Chevron, Total, and BP have each maintained their dividend. Time will tell if Shell was ahead of the curve or acted too quickly and unnecessarily cut their dividend.

- Lastly, my dividend income from mutual funds decreased significantly compared to last year. I have a lot to say about this. Therefore, I will discuss this further in the next section of my article.

(adsbygoogle = window.adsbygoogle || []).push({}); Dividend Portfolio News & Updates – June 2020

In this section of my dividend income summary, I typically discuss the dividend impact of stock purchases, 401(k) contributions, and dividend increases. However, this month, I am going to exclusively discuss news related to dividend increases and cuts. Similar to Lanny, I will publish a separate article disclosing my purchases for the month.

Related: Dividend Increases Expected in July 2020

Related: Lanny’s June Dividend Stock Purchase Summary

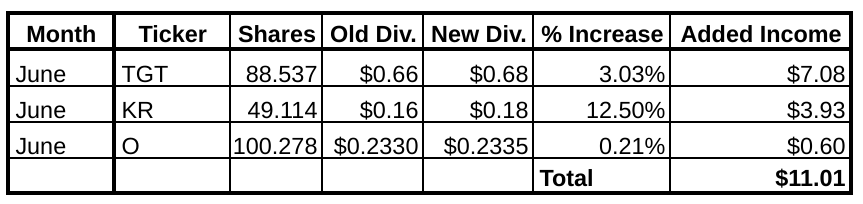

The following table displays the dividend increases received during the month and the additional forward dividend income I will receive from each company. Overall, dividend increases added $11 to our forward dividend income. The dollar amounts may not seem large. However, just remember, you are on a website that preaches the importance of making every dollar count.

We received some very nice dividend increases this month. In total, 3 portfolio holdings increased their dividends: two Dividend Aristocrats (Target and Realty Income) and one supermarket giant (Kroger). Target and Realty Income’s dividend increases met my expecations. The largest, and most surprising, dividend increase belonged to Kroger. I knew Kroger was performing well during the pandemic based on news articles and their industry. However, I was not expecting a double digit dividend increase in this environment. That was a pleasant surprise and helped my portfolio offset some of the dividend cuts I received earlier in the quarter.

Now, I would like to discuss a topic mentioned earlier in the article. This month, my dividend income was negatively impacted by decreased dividend payments from mutual funds and ETFs. We have received dividend cuts from plenty of companies over the last few months. Retail giants, airlines, oil, and many other companies slashed their dividend as the economic impact of COVID intensified.

Related: The Impact Dividend Cuts Have Had on Lanny’s Dividend Income This Year

Until this month, my relationship with dividend cuts was isolated to individual stocks. A company I held cut their dividend and my dividend income decreased accordingly. Pretty simple, clean, and easy to understand after reviewing their press release. However, it didn’t dawn on me until a conversation I had with Lanny early in June that we were heading for some troubled waters with our mutual fund dividend payments.

My mutual fund holdings are low cost index funds with dividend yields between 1.8% – 2%, historically. The dividend payment the funds receive also mimic the dividend payments of companies in the S&P 500. Since the funds mimic the market, the funds have exposure to previously listed industries that were severely impacted by the coronavirus pandemic. Within these sectors, there were a TON of dividend cuts.

Related: Mutual Funds vs. ETFs: Understanding the Key Differences

Finally, it hit me. Funds with exposure to these sectors will receive less dividends due to their holdings cutting their dividends. Therefore, I, as an investor in the fund, will receive less dividends from the fund. Luckily, I realized this at the beginning of the month and was able to lower my expectations. However, take a look at my dividend income chart above once again. The decreased dividends from VWNAX had a huge impact on my dividend income. While I hold other mutual funds, the decreased payout from other holdings were at least offset by increased contributions to the funds. Imagine the growth I would have experienced if we didn’t receive the dividend cuts. I would be boasting about how we blew past $2,000 dividend income in June.

Dividend Income Summary

Another month in the books. Time continues to fly by. July has already been an eventful month filled with daily investing surprises. I have a lot of thoughts about the Dominion dividend cut announced in July. None of those thoughts are great. So stay tuned for next month to see. Growing as an investor has been one of the most pleasant aspects of this journey. There is so much information to learn. Let’s continue pushing ourselves and making sure that our income continues to move forward. It is as simple as that. Time to buckle down and buy some more income producing assets.

How did you perform in June? Did you set a personal record? Did you have decreased mutual fund distributions as well? What is your plan of attack for July?

Bert

The post Dividend Income Summary: Bert’s June 2020 Summary appeared first on Dividend Diplomats.