High Yield Savings Account: Adding Capital One and ~$100

On your road to financial freedom, you look to maximize every aspect of your budget. Your goal is to maximize your income and minimize your expenses. While many transactions or activities may result in large dollar gains, the reality is that you must win a lot of the small transactions as well to reach financial freedom. Growing up, and still today, I am a huge baseball fan. To incorporate a baseball reference here, the singles are just as important as the home runs. Using a high yield savings account is a single; but it is critical to maximizing the interest earned on your cash.

Lanny and I are constantly making moves to maximize our dollars every day, large and small. One of my goals for the rest of the year on this blog is to start sharing all victories with you. Whether I hit a financial home run or a financial single, each victory is as important as the rest. So today, I am going to share a small move I made that will increase the interest my interest income over $100 for the next year. This took less than 30 minutes. I earned this income my simply increase the yield on my savings account. Let me explain.

Related: Our 12 Financial Freedom Products to help you Earn, or Save, More

Maximizing my high yield savings accounts

Historically, I have held my cash at the following two financial institutions:

Capital One – Several years ago I ditched my brick and mortar bank and embraced Capital One as my primary checking account and savings account for property taxes. Using an online bank has been amazing and I haven’t looked back. Prior to this account, the savings rate on my checking account and savings accounts at Capital One were .1% and .5%, respectively.

Ally Savings Bank – I used to use Ally as my investing brokerage and savings account. However, I moved my brokerage to Fidelity last year. Ally’s always offered a strong rate on their high yield savings account compared to others. Up until last month, it was one of the highest industry. Then, Ally reduced my rate to 1.25% as interest rates fell. That is currently what I’m earning on this account.

One day, I was signing into my Capital One account to review the transactions and I noticed a new savings account. The bank was now offering the Capital One 360 Performance Savings Account. The marketing was great, showing the account had a savings rate 5X the national average. This savings account rate was 1.50%. Instantly, I was excited since it was higher than the interest rate on all of my current cash accounts.

Immediately, I reviewed my Capital One and Ally accounts to determine if it was worthwhile opening the new savings account. Upon review, I identified over $11,380 that I could potentially shift from an account with a lower rate to a higher account. Naturally, I was pretty excited.

Don’t Miss: Dividend Diplomats’ Dividend Stock Screener

I’ll be the first person to admit that the accounts were not maximized to earn the highest interest rate. For some reason, despite the fact that Ally offered a higher rate than Capital One in the past, I never transferred my property tax savings account or excess cash from my checking accounts there. Instead, I left the balances in the lower yielding accounts at Capital One. This was a move done out of laziness most likely and I wish I had an answer. This cost me at least $150-$250 over the years, which sucks. But this new promotional savings account with Capital One offered me a chance to correct this error and start earning more interest going forward. This time, and going forward, I was not going to miss my opportunity to strike. I rebalanced $8,380 of my Capital One accounts to maximize my savings rate there.

Outside of Capital One, I took my last lesson to heart. Capital One offered a higher savings rate than Ally Bank by 25 basis points. So rather than sit by and do nothing. I decided to spend one minute, log into Ally, and transfer $3,000 from my Ally account to my new Capital One account. Again, I am no longer sitting on the sidelines. The time to act is now.

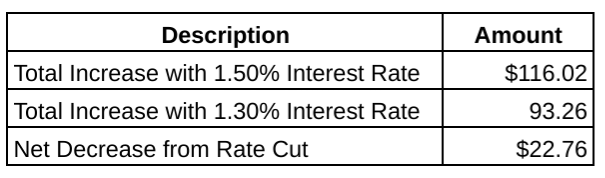

In the following table, I am going to break down the impact these transfer had on my interest income. When the dust settles, I should earn $116.02 in interest income as a result of the transfers.

(adsbygoogle = window.adsbygoogle || []).push({}); The Downside with High Yield Savings Accounts

There is one major downside with high yield savings account. The banks can change the interest rates quickly as interest rates change in the market. Sometimes the changes can benefit you. Other times, the changes can hurt you. Unfortunately, this change was latter category.

At the time I made the switch (heck, even at the time I started writing this article), Capital One was offering a 1.50% rate on their savings account. However, today, less than one week after I made the transition, Capital One decreased their rate from 1.50% to 1.30%. This is hardly a Capital One thing as well. Over the last several months, Ally Bank has decreased their high yield savings account twice and Fidelity has decreased the yield on their money market funds.

Taking a step back, it makes perfect sense. If you watch the interest rate environment closely, you can predict when your interest rate may increase or decrease. Rates have continued to decrease over the last few months. If banks make less on loans, they will pay less on their depositors too.

This 20 basis point reduction was not fun to receive. Let’s re-run the impact of my rebalancing with a 1.30% savings rate instead.

As you can see, my interest income only increased $93.26 annually once the interest rate was reduced. The net impact of this transaction was reduced by $22.76. Just like that, with a snap of a finger, $22.76 is gone. I’m still excited about the positives, gaining $93.26 in annual interest income, but this is a great demonstration of one of the cons that comes with using high yield savings accounts. The bank can giveth and the bank can taketh quickly.

Summary

Despite the reduction in interest rate, I still am very happy the transaction. Rebalancing my high yield savings accounts, opening new accounts with Capital One, and transferring the cash from Ally to Capital One took less than 30 minutes combined.

Further, let’s make this fun. Because heck, we are dividend investors here. In order to earn $93.26 in dividend income annually, I would have to invest $2,664 at 3.5%. Not a ton of cash, but it sure is nice to not have to invest that, right?!

Not a bad return on time investment if you ask me! Hopefully, you can see through my experiences that paying close attention and maximizing the yield on your savings account is a worthwhile time investment. Whether you pick Capital One, Ally, CIT Bank, or any of the other banks or credit unions, it is worth investigating and acting on. You will love the increased interest income you will earn. I promise that!

Do you use high yield savings accounts? If so, what is the highest rate you are currently using? What are your experiences using online accounts? If you haven’t, do how do you maximize your cash and emergency funds?

Bert

The post High Yield Savings Account: Adding Capital One and ~$100 appeared first on Dividend Diplomats.