ILS funds rise 0.3% in Feb 2020, some cat bond funds hit by pandemic

While the average return of insurance-linked securities (ILS), catastrophe bond and reinsurance linked investment funds was 0.3% in February 2020, some cat bond funds became early victims of the coronavirus pandemic and suffered a decline due to the devaluation of the World Bank’s pandemic bonds.

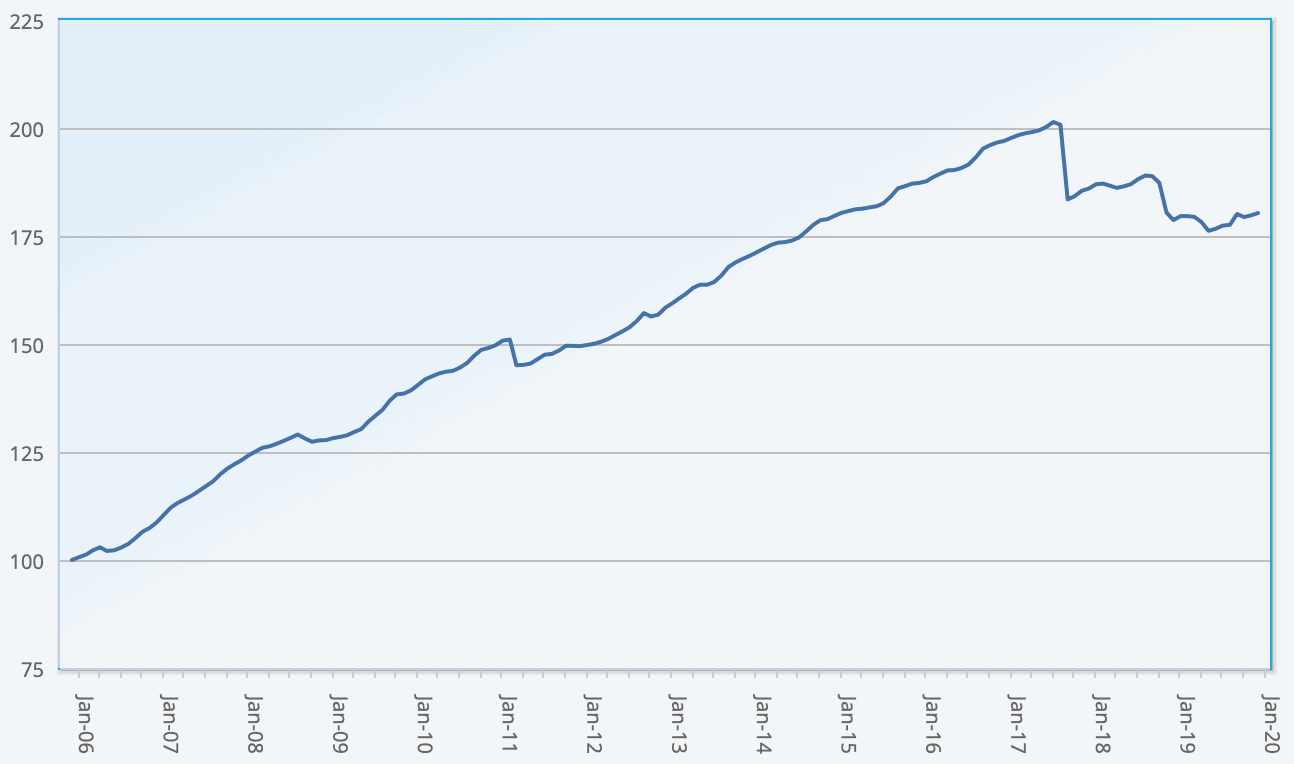

February’s 0.3% average ILS fund return is the best performance for the month since 2017, according to the Eurekahedge ILS Advisers Index, but the month wasn’t without its challenges.

February’s 0.3% average ILS fund return is the best performance for the month since 2017, according to the Eurekahedge ILS Advisers Index, but the month wasn’t without its challenges.

We’re aware of some collateralised reinsurance positions facing losses in February from catastrophe and weather events that affected Australia, in particular the hail storm that impacted east coast areas. But we don’t believe that was a particularly big hit to the private ILS side of the market in February.

On an aggregated basis though, the Australian weather losses are eroding deductibles which could mean some impact to certain collateralised reinsurance contracts further down the line and may be reflected in ILS fund portfolios at a later date than February.

European winter windstorms had little impact on the ILS market, ILS Advisers noted.

In addition, the global Covid-19 coronavirus pandemic impacted catastrophe bond funds as the two World Bank supported pandemic cat bond tranches of notes both suffered declines in value, which caused funds to mark their books to reflect that and resulted in some negative performance.

Overall, the ILS fund and cat bond fund sector, as tracked by the Eurekahedge ILS Advisers Index, recorded an average return of 0.3% in February 2020.

Pure catastrophe bond funds as a group were up by 0.25%, but underperformed the group of ILS funds investing in private collateralised reinsurance deals which returned 0.33% for the month.

Commenting on cat bond funds, ILS Advisers Founder Stefan Kräuchi told Artemis, “The COVID 19 pandemic had a small impact on the two Worldbank pandemic cat bonds which started to be mark down in February. Some cat bond managers had small exposures to these bonds, but overall the exposure remained limited.”

For February, 25 of the constituent funds in the ILS Advisers Index reported positive returns, while 6 fell to a negative return for the month.

Most of the negative were pure catastrophe bond funds, we’re told, with the worst performing being a fund that experienced a -1.87% decline in February.

The best performer returned a positive 1.43% return, which was a fund invested in private ILS and collateralised reinsurance, we understand.

Giving the ILS fund group tracked by ILS Advisers Index a performance gap, between best and worst returns, of 3.3% in February.

March returns will feature some more impacts to cat bond fund performance, we imagine.

The selling off of cat bonds and pressure that exerted on pricing will mean some mark-to-market declines, although these should all be recovered in time for cat bonds that have zero exposure to the pandemic.

The Vitality Re series of deals were also marked down at the end of March, which may read through to many portfolios performance for the month.

Most interesting though will be the private ILS and collateralised reinsurance focused funds, in seeing whether there is any early sign of pandemic related impacts to any of these. It seems unlikely that anything particularly noticeable would be seen in March, with any risk to ILS funds that invest more broadly across specialty and other lines of business perhaps more likely to become visible further down the line.

You can track the Eurekahedge ILS Advisers Index here on Artemis, including the USD hedged version of the index. It comprises an equally weighted index of 33 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.

ILS funds rise 0.3% in Feb 2020, some cat bond funds hit by pandemic was published by: www.Artemis.bm

Our catastrophe bond deal directory

Sign up for our free weekly email newsletter here.

Original Article Posted at : https://www.artemis.bm/news/ils-funds-rise-0-3-in-feb-2020-some-cat-bond-funds-hit-by-pandemic/