MSCI World Index: How the not-so-global index works

Investors interested in diversifying their equity portfolio look into index funds or exchange traded funds (ETFs) tracking global indices. Those who can stomach extreme volatility invest in ETFs tracking the MSCI Emerging Markets Index. For others, the MSCI World Index could be more suitable. Let’s find out what it is and how it works.

Q1 2020 hedge fund letters, conferences and more

Not a ‘World’ index

The Morgan Stanley Capital International (MSCI) World Index is not a global index. It’s a broad equity index that reflects the large-cap and mid-cap equity performance across 23 developed markets. Despite its name, the index does not give you exposure to emerging markets and frontier economies.

What if you want to invest in a truly global index? Let me explain. There is the MSCI All Country World Index (ACWI). It covers more than 2,800 large- and mid-cap stocks in 23 developed markets and 26 emerging markets. But emerging markets constitute only 11% of the ACWI even though they have a little over one-third of the world’s GDP.

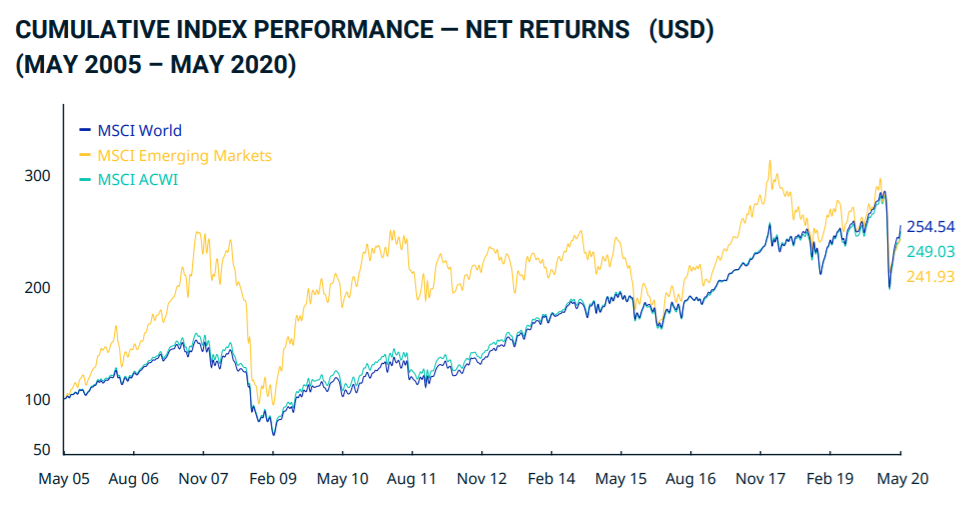

Since developed markets have about 89% share in the ACWI, performance of the MSCI World Index and MSCI ACWI is similar. Since December 2000, the MSCI World Index has delivered 4.94% annualized returns while the MSCI ACWI has returned 4.97%.

Large- and mid-cap stocks from the following 23 countries are part of the index: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the UK and the US.

MSCI World Index constituents

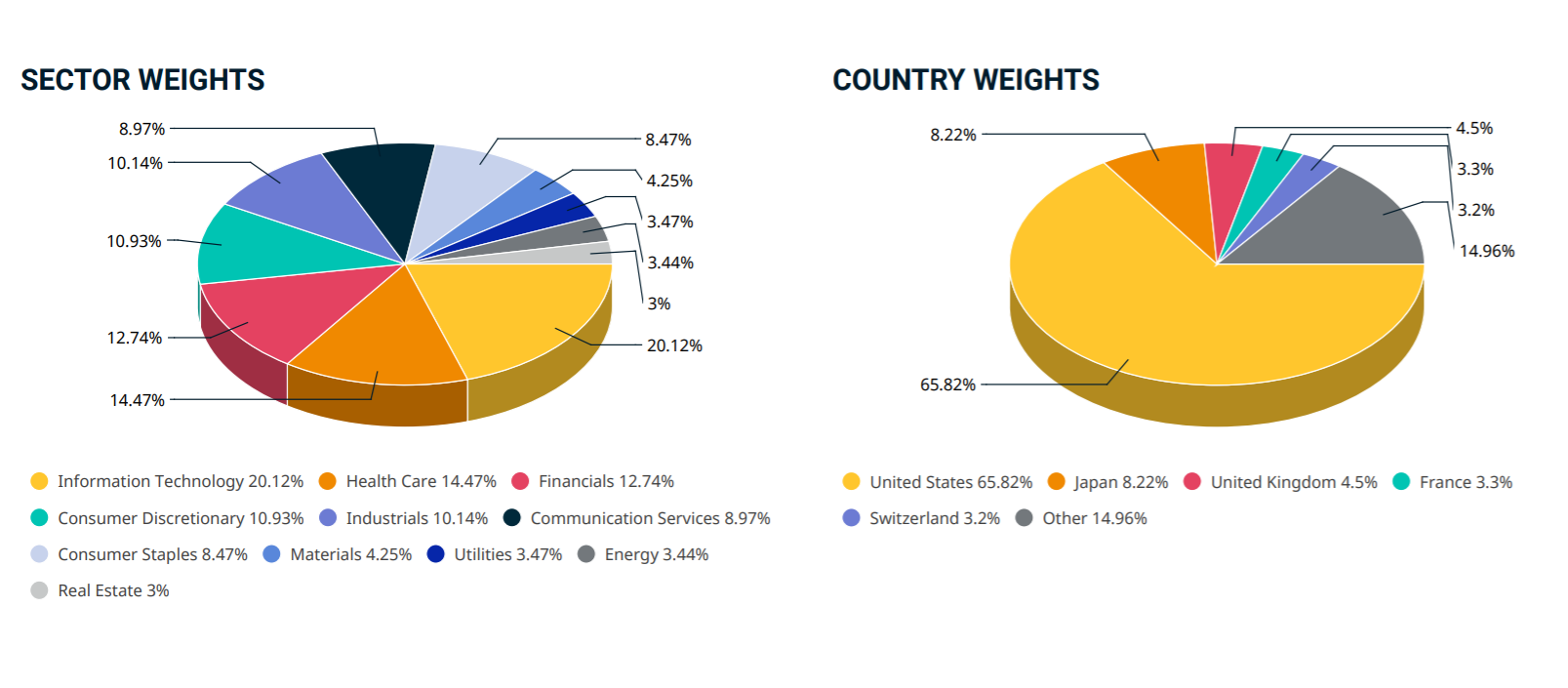

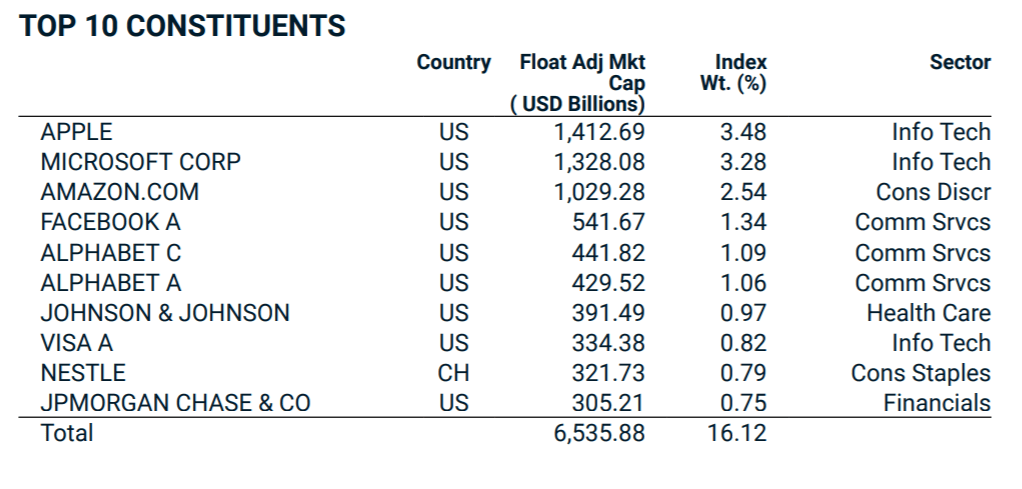

The index includes 1,637 stocks from 23 developed markets. It captures approximately 85% of the free float-adjusted market cap in each country. The US alone accounts for nearly 66% of the index, followed by Japan (8.22%), the United Kingdom (4.5%) and France (3.3%).

Even if you look at the individual stocks constituting the index, nine of the top ten biggest constituents are American companies. The only non-US company in the top ten is the Swiss giant Nestle.

How to invest

Individual investors can gain exposure to the MSCI World Index by purchasing ETFs tracking the index. The most popular ETF tracking the index is the iShares MSCI World ETF (URTH). Since the MSCI ACWI and World Index have historically delivered similar returns, you can also choose to invest in the iShares MSCI ACWI ETF (ACWI). Remember that developed markets account for 89% of the ACWI.

The post MSCI World Index: How the not-so-global index works appeared first on ValueWalk.

Original Article Posted at : https://www.valuewalk.com/2020/06/msci-world-index/<\p>