Posts Tagged ‘tax tips’

Tuesday Tax Tips

Did you know the IRS issued more than 111.8 million refunds, averaging over $2800 each, for the 2018 tax year? There are still ways you can boost your 2019 tax year refund. Boost Retirement contributions. You can contribute to an IRS until the April 15 tax deadline and it will still count toward the 2019…

Read MoreWhat Your Tax Preparer Needs to Calculate Your Business Taxes

If you love to hate taxes, maybe it will help to think about it this way: Taxes impact all of us and fund our community structure. Without taxes, we could not fund our roadways, our government, nor services like firefighters and police. No roads means no product delivery and no customers. No police means security…

Read MoreBusiness Tax Tip Tuesday

Apparently, the IRS is seeing a problem with small business owner form filing. It has issued a reminder that we are passing along today. A small business files either Form 944, annual tax return OR Form 941, quarterly tax return but NOT both. Want more information? Visit www.businesstaxprep.org to be connected to a tax professional…

Read MoreAfter Tuesday Tax Tip

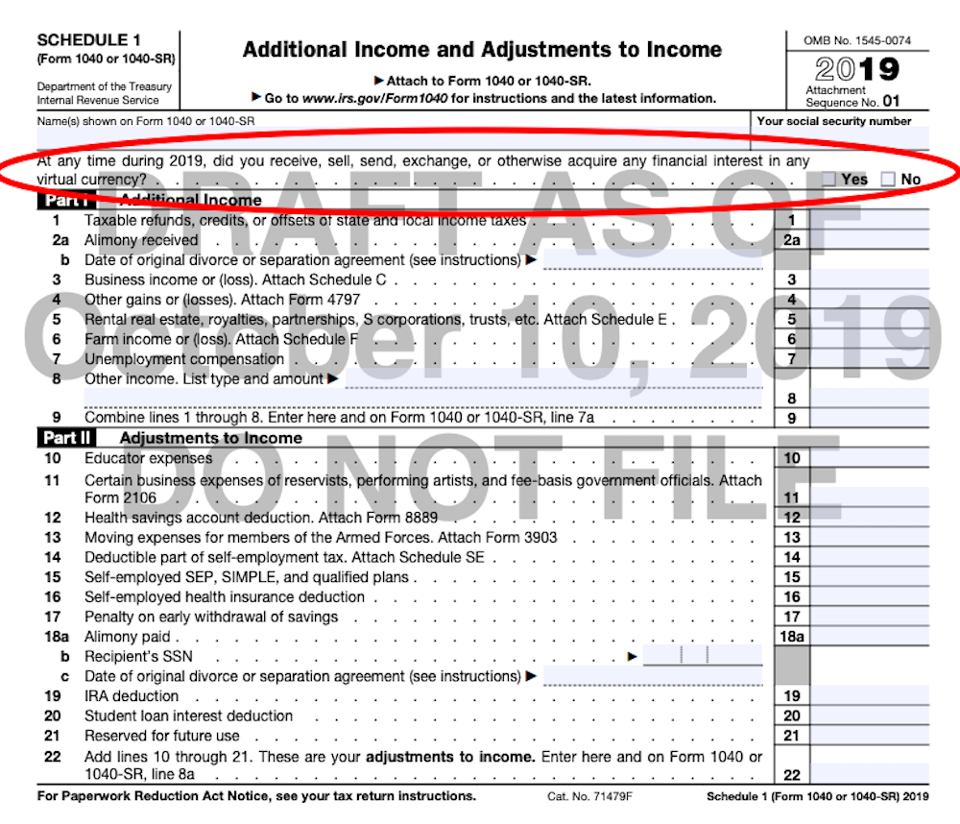

If there is any better indicator that virtual currencies such as bit coin are here to stay, it is the IRS figuring out how to tax virtual currency. The first step is to define virtual currency, and the next step is to track it. The IRS, in fact, has defined virtual currency. IRS Definition of…

Read MoreTuesday Tax Tip – Distribution Checks

Tuesday Tax Tip – Distribution Checks The IRS released a ruling that retirement plan distribution checks must be taxed even if the check hasn’t been cashed. An individual’s failure to cash the distribution check received in 2019 does not permit one to exclude the amount of the designated distribution from gross income for that year…

Read More