After Tuesday Tax Tip

If there is any better indicator that virtual currencies such as bit coin are here to stay, it is the IRS figuring out how to tax virtual currency. The first step is to define virtual currency, and the next step is to track it. The IRS, in fact, has defined virtual currency.

IRS Definition of Virtual Currency:

“Virtual currency is a digital representation of value that functions as a medium of exchange, a unit of account and a store of value other than a representation of the United States dollar or a foreign currency.”

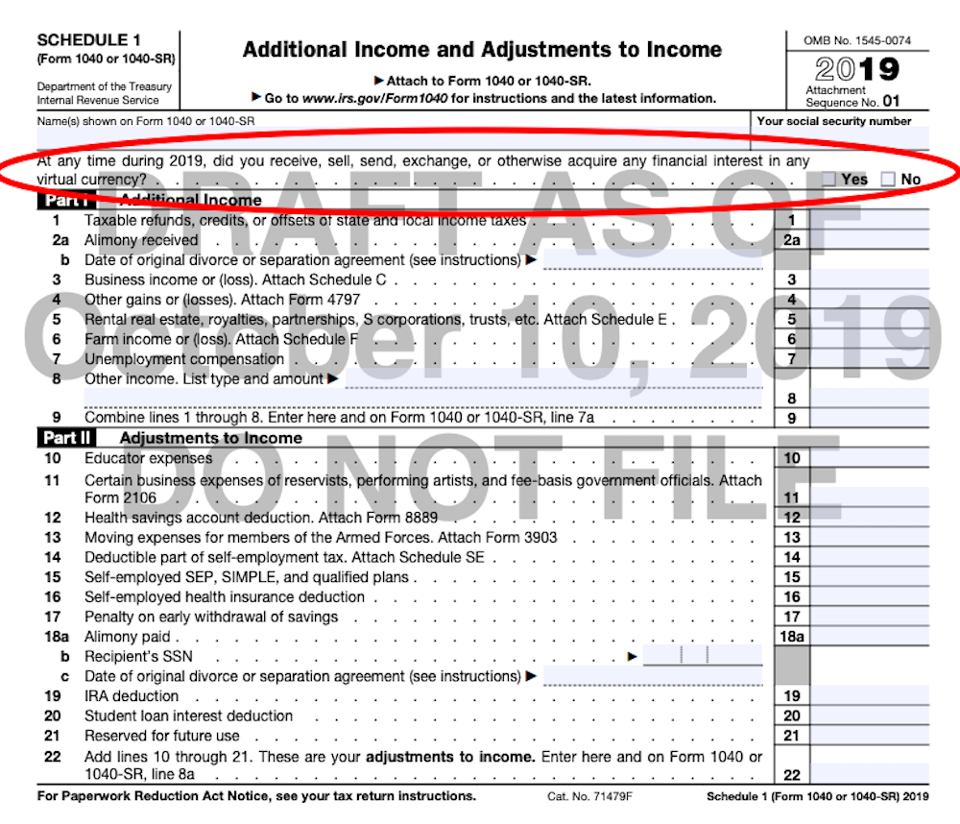

IRS uses Schedule 1 to Track Virtual Currency:

Based on the second early draft version of the new 1040 schedule 1, the very first question asks whether you used or acquired interest in virtual currency. In an email sent by the IRS to tax professionals, if the answer to question one is no, taxpayers don’t need to file Schedule 1 unless they need to file for another purpose.