Posts Tagged ‘tuesdaytaxtip’

Tuesday Tax Tips

Did you know the IRS issued more than 111.8 million refunds, averaging over $2800 each, for the 2018 tax year? There are still ways you can boost your 2019 tax year refund. Boost Retirement contributions. You can contribute to an IRS until the April 15 tax deadline and it will still count toward the 2019…

Read MoreStill Need Tax Answers?

If you got stuck on hold on the IRS tax help line…there’s still help. President’s Day weekend is the busiest rush on IRS phones, and not everyone can get through to get the answers they need. There is good news. IRS.gov is now offering tax tools online, so you get the answers you need when…

Read MoreWithholding Estimator Now Saves Headache in New Year

Planning to figure your taxes after the new year? Why wait? In the first of a series of tax filing reminders, the IRS urges individual taxpayers to use the Tax Withholding Estimator to find out whether more should be withheld or worse, how much will be due when the tax return is filed. If you…

Read MoreTuesday Tax Tip

Remember: as you faithfully label and save every business entertainment receipt: Business Entertainment is reduced or eliminated from current business taxes. The TCJA allows meal expenses incurred in connection with business entertainment (meals at games) and meal expenses to wine and dine prospects and customers are still 50 percent deductible, but many entertainment expenses acceptable…

Read MoreIRS Extension Filing Deadline Almost Here

If you requested an extension for filing your 2018 tax return, the IRS reminds us your deadline is close, Tuesday, October 15, 2019. AcctServices.org wants to remind you there is still time for taxpayers to file a complete – and hopefully accurate – return. The deadline doesn’t mean you should wait until October 15 to…

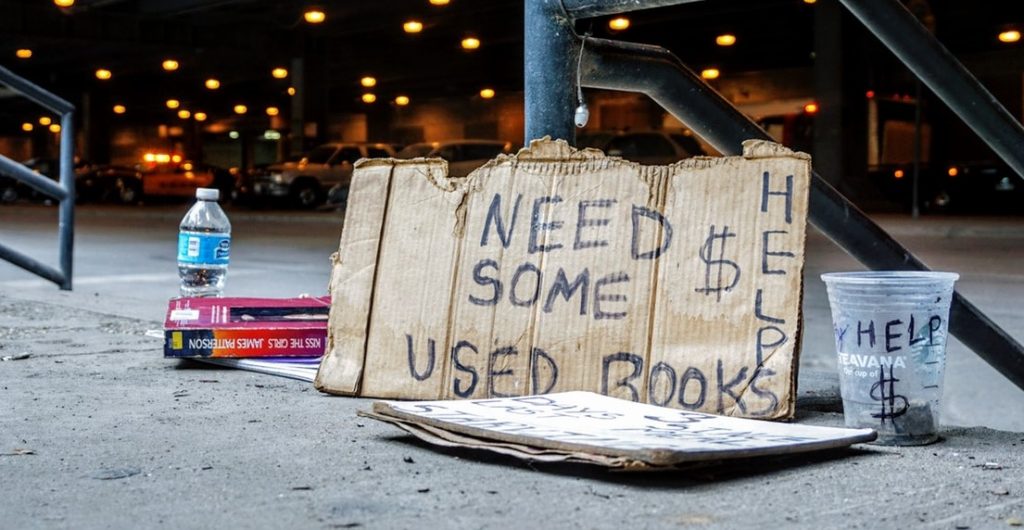

Read MoreIRS Using Private Debt Collection for Overdue Taxes

Four collection firms have been contracted by the IRS’ new private collection program of overdue federal tax debts. The groups are CBE Group of Cedar Falls, IA, Conserve of Fairport, NY, Performant of Livermore CA, and Pioneer of Horseheads, NY. Each taxpayer or business tax account which owes these certain types of overdue federal tax…

Read MoreHome Schooling Tax Reminder

Home Schooling? In 2018 the IRS EO(Exempt Organization) implemented revisions to the form 1023EZ. Now the IRS EO will Ask for a short description of your activities when applying for 501(c)(3) status Ask more questions about: Your gross receipts (your sources of income) Your assets (what you own) What kind of foundation are you? If…

Read MoreTuesday Tax Tip

As Dorian approaches, IRS reminds preparation for natural disaster Secure key documents and make copies think tax returns, birth certificates, deeds, titles and insurance policies. Put in waterproof containers in a secure space. Duplicates should be kept with a trusted person outside the disaster area. A backup scan on flash drive is another way to…

Read More