Posts Tagged ‘debt reduction’

Debt Collection is Not Credit Repair

There are firms that specialize in helping you negotiate your credit balances and settle your debt accounts for a fee. Then there are collection companies. Each type of firm answers to a different set of regulations. If you feel a creditor is mishandling your debt, you should certainly check into it. Just be aware that…

Read More4 Ways to Still Save on Christmas Shopping

Once again, I am dealing with the problem of shopping for others, without buying things for us adding to our debt. Put another way, I seem to buy more for me when I am looking for gifts for others. I know it is a horrible habit, but as an undiagnosed ADD victim, I constantly get…

Read More7 Ways to Bring Back Holiday Joy

It can be tough to get excited about Holidays when you are struggling to keep up with the debt you already have. Maybe you need some activities to bring nostalgia and FUN back into the season. Here are some reminders and ideas to give you back your holiday joy this year. Just say no. You…

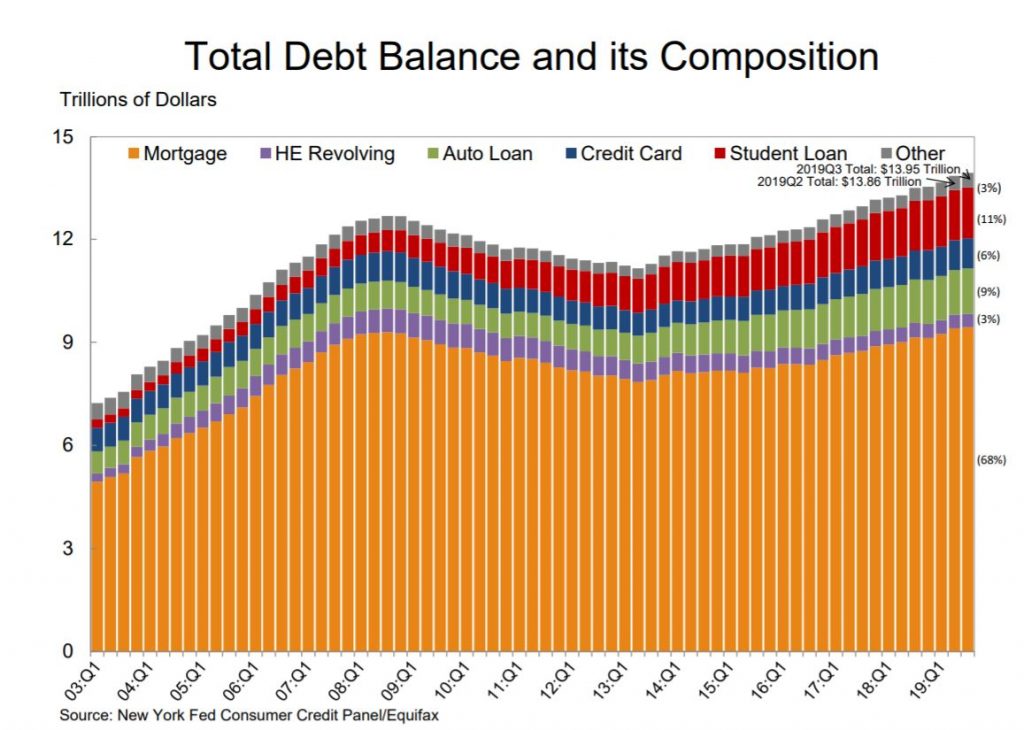

Read MoreRising Debt Danger

Rising Personal Debt: Last week, The Federal Reserve Bank of New York released debt statistics for the 3rd quarter. While noting that delinquent mortgages have decreased, the Household Debt and Credit Report states the total debt balance of mortgages has actually increased to $13.95 trillion, $1.3 trillion higher than the previous mortgage peak of $12.68…

Read MoreSpending Moratorium – Final Insights

Well, it has been just over the 6 months I committed to on my spending moratorium. I have been able to save some money, so I can pay off some of my debt. I do not think I will continue on the spending moratorium to reduce debt, but I do think it has taught me…

Read More30 Days of Saving

I am constantly looking at fresh approaches to debt freedom, so when I recently came across the 30 day savings rule, I liked that it has a lot of common sense behind it. Impulse purchases can quickly derail any debt reduction or debt elimination plan, but impulse purchases can be so tempting. When you see…

Read MoreYou Can Stop Unsustainable Debt by following these 6 Steps.

Unsustainable debt. Whole nations struggle with how to control it, but you can be debt free by following these six steps. Make a budget. Check what your take home pay is. List your monthly obligations. For this exercise, don’t worry about whether your monthly obligations are over your take home pay, just get the expenses…

Read MoreSpending Moratorium Part 6: Discovering Thredup

Along with the spending moratorium I thought I would use the process to declutter. While I had done an initial closet cleaning, it was pretty minimal. I recently read something about a company called Thredup. It is an online thrift store, that sends a kit to you after you choose whether you want the unlisted…

Read MoreDebt Relief Tip

Debtreliefzones.comBuying Convenience can land you in debt. A little planning can get you back out of debt. See us at DebtReliefZones.com #debtfree #relief

Read More