Rising Debt Danger

Rising Personal Debt:

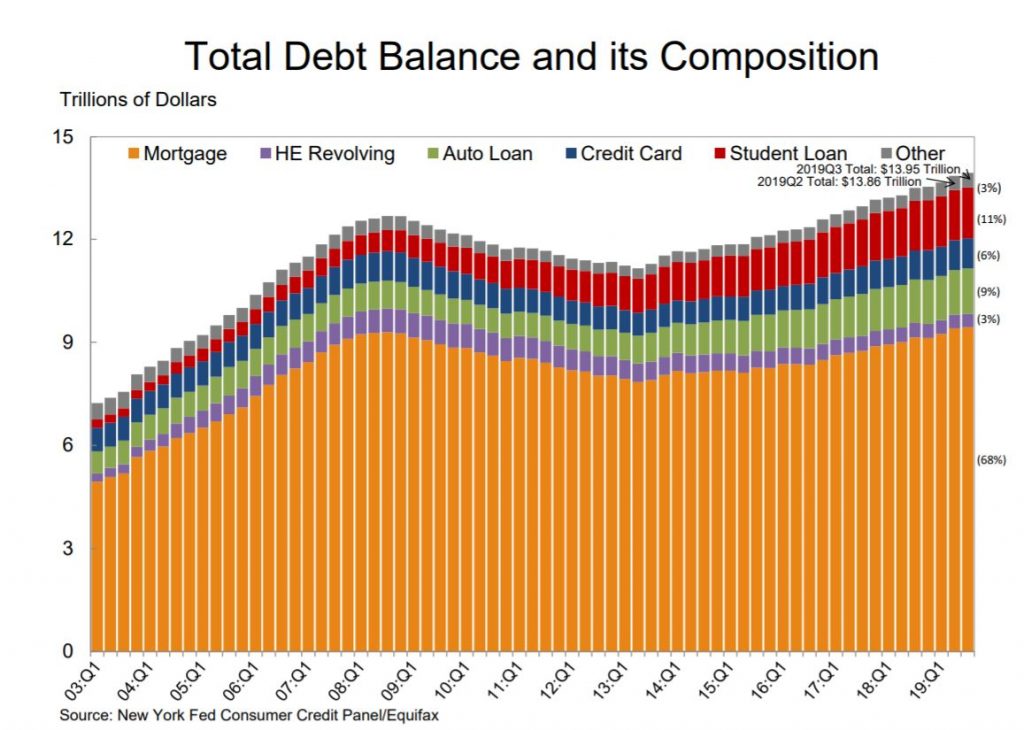

Last week, The Federal Reserve Bank of New York released debt statistics for the 3rd quarter. While noting that delinquent mortgages have decreased, the Household Debt and Credit Report states the total debt balance of mortgages has actually increased to $13.95 trillion, $1.3 trillion higher than the previous mortgage peak of $12.68 trillion in the third quarter of 2008. Hmm. Is that a red flag?

Still, when reviewing the number of bankruptcies and new foreclosures, it is plain that the bankruptcy levels are far below 2011. And the foreclosure levels are much lower than 2008 to 2011 foreclosure levels. What still gives pause, is the increasing level of total debt on all age groups over the age of 18, so that we collectively owe twice what was owed in 2003. While this does not automatically mean bankruptcies will rise, it does indicate Americans are spending more than they earn, and it is being spent on mortgage and auto loans.

Now let’s look at the current trend of serious delinquencies (loans with payments over 90 days past due, or in default.) According to credit bureau, Equifax, auto loans delinquencies have risen since 2014 levels, for those between ages of eighteen and forty-nine. Compared to 2010, bankruptcies and foreclosures are still low, but Americans continue to go further and further into debt especially with larger balances on mortgages, auto loans and student loans.

Consequences:

Most economists agree that a recession is looming. Politics aside, look at historical economic cycles, and you can guess it is about time for another economic slump. The upswing in real estate sales with home selling quickly and over market value in most markets is an indicator of reaching the tipping point. If Americans become unemployed due to a recession, the debt will become harder to repay. Many homeowners are turning to the equity in their homes, but the conditions for a Home Equity Line of Credit are not possible for borrowers to meet, once they become desperate. This is when real estate finance experts get creative in helping people release the equity in their homes, such as the residential sale leaseback and quick home sales platforms. The thing is, once the equity is released by this method, there is no more equity-based options. It is nice to think that people use the money wisely to get out of a difficult financial situation, but generally, people charge credit cards back up and land back in trouble with no equity bailout options available.

Assistance:

Need to find another way? DebtReliefZones.com can match you to a debt counselor who can walk you through how to make life changes that lead to freedom from the overwhelming debt. When you are ready to chip away at the debt and reach the debt freedom you once knew, visit DebtReliefZones.com and find the help you need.