Posts Tagged ‘tax’

Withholding Estimator Now Saves Headache in New Year

Planning to figure your taxes after the new year? Why wait? In the first of a series of tax filing reminders, the IRS urges individual taxpayers to use the Tax Withholding Estimator to find out whether more should be withheld or worse, how much will be due when the tax return is filed. If you…

Read More2 Million ITINs expire in 2019

By the end of 2019, 2 million ITINs will to expire. If you, or someone you know were unable to get a social security number, and needed to get an ITIN instead, you may need to renew it to avoid a delayed refund. Any ITIN with the middle digits 83,84,85,86,87 will expire as of December…

Read MoreE-file Oct 31 Payroll Tax Forms

The payroll tax return due date of October 31 is almost here. But you don’t have to scramble to mail these returns. The IRS is encouraging you to e-file forms 940,941,943,944 or 945. The IRS in a new release stated e-filing payroll returns are more accurate, due to instant alerts on missing information. Processing time…

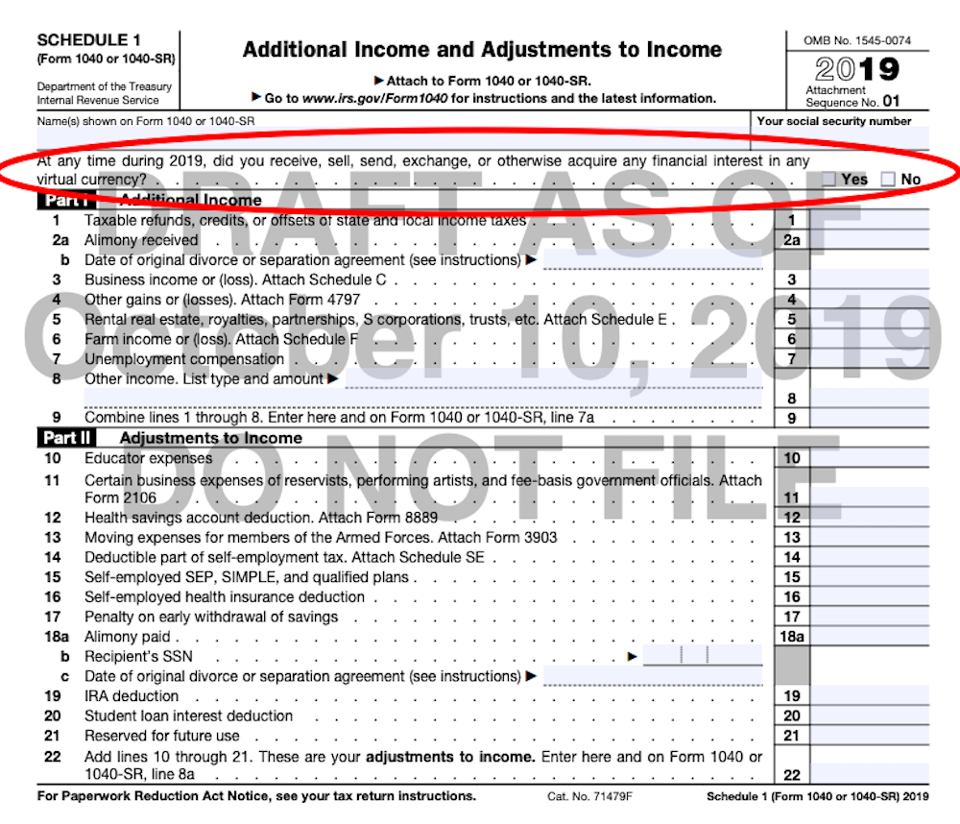

Read MoreAfter Tuesday Tax Tip

If there is any better indicator that virtual currencies such as bit coin are here to stay, it is the IRS figuring out how to tax virtual currency. The first step is to define virtual currency, and the next step is to track it. The IRS, in fact, has defined virtual currency. IRS Definition of…

Read MoreTuesday Tax Tip

Remember: as you faithfully label and save every business entertainment receipt: Business Entertainment is reduced or eliminated from current business taxes. The TCJA allows meal expenses incurred in connection with business entertainment (meals at games) and meal expenses to wine and dine prospects and customers are still 50 percent deductible, but many entertainment expenses acceptable…

Read MoreIRS videos in Sign Language

In a celebration of the international day of sign languages, IRS ASL Channel on YouTube featured several tax topics: Tax Tips – videos on general tax topics – meant to help people understand their tax responsibilities ID Theft – as taxpayers and their returns becomes a major target for identity thieves, the IRS provides videos…

Read MoreIRS Using Private Debt Collection for Overdue Taxes

Four collection firms have been contracted by the IRS’ new private collection program of overdue federal tax debts. The groups are CBE Group of Cedar Falls, IA, Conserve of Fairport, NY, Performant of Livermore CA, and Pioneer of Horseheads, NY. Each taxpayer or business tax account which owes these certain types of overdue federal tax…

Read MoreTuesday Tax Tip: 3rd Quarter Estimated Tax Due Soon

Third Quarter Estimated tax payment due Monday Sept 16. Can you believe major tax reform is in its second year? As taxpayers are seeing its full effect on 2018 returns, the IRS reminds people who pay estimated tax that their third quarter payment for 2019 is due Monday September 16. Thanks, IRS. On a brighter…

Read MoreHome Schooling Tax Reminder

Home Schooling? In 2018 the IRS EO(Exempt Organization) implemented revisions to the form 1023EZ. Now the IRS EO will Ask for a short description of your activities when applying for 501(c)(3) status Ask more questions about: Your gross receipts (your sources of income) Your assets (what you own) What kind of foundation are you? If…

Read More