How Much Foreclosure Relief Can you Expect?

They said they would help. They said they would work with homeowners to avoid foreclosure. In the expectation of the largest unemployment numbers since the great depression, what are lenders really doing to help homeowners who can’t pay the mortgage?

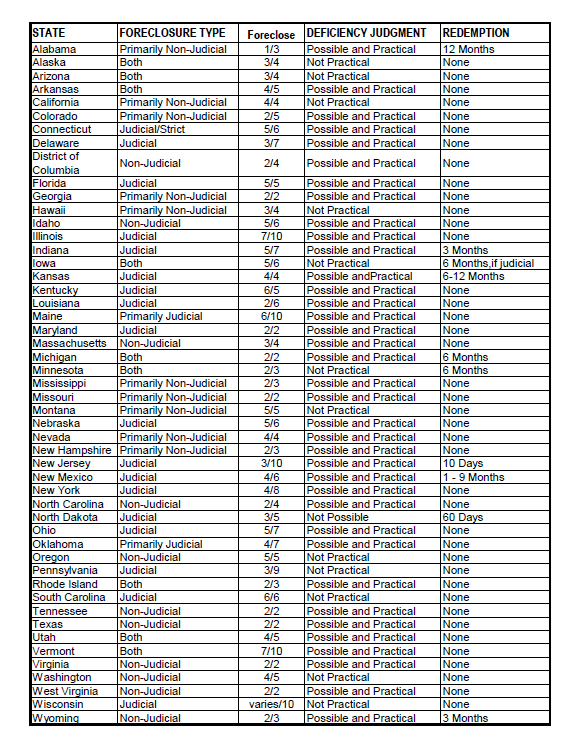

The answer depends on where your home is located. States have adopted specific measures to offer relief to their residents. Some emergency state proclamations are narrow in scope. While evictions have been stopped in many states, the foreclosure process was not halted. The deadlines might not have changed, and you could still lose your home once the redemption period passes. When the emergency order expires, a foreclosure sale can still be scheduled, unless specifically restricted in that states COVID19 relief edicts.

Before you panic, understand that under the federal regulated RESPA (Real Estate Settlement Procedures Act) most mortgage servicers cannot proceed to the foreclosure process until the mortgage goes into default, which is over 90 days past due. Homeowners must be notified, and procedure adhered to in each jurisdiction. Because it varies by state, type of mortgage and foreclosure rules, it makes sense to do three things.

- Read up on your state foreclosure process, so you understand normal process in your jurisdiction.

- Re read your mortgage contract (was in your closing package when you took out the loan). Know what you agreed to and the terms of the contract.

- Refer to an attorney who is licensed to practice law in your jurisdiction, and who is experienced in foreclosure defense law. Though you may be struggling financially, you stand to lose your biggest asset if you don’t know how to defend your home.

If you don’t know who to go to in your area, contact Wrongfullyforeclosed.com or call (888) 800-6030 and find out how you can get the protection you need for your home.