Posts Tagged ‘debt’

Spending Moratorium Part 6: Discovering Thredup

Along with the spending moratorium I thought I would use the process to declutter. While I had done an initial closet cleaning, it was pretty minimal. I recently read something about a company called Thredup. It is an online thrift store, that sends a kit to you after you choose whether you want the unlisted…

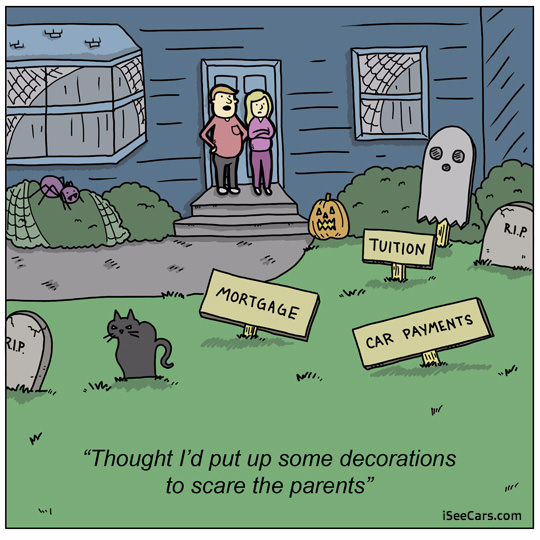

Read MoreReally Scary Decorations…

Google Image Result for https://i.imgur.com/uRhe3p8.jpg https://images.app.goo.gl/tdaRhuFJjU4Rbupy7 #humor #humorous #mortgage #RealEstate #jokes

Read MoreStop the Abusive Creditor Calls

Most of us have debt. When we fall behind on payment of those debts, a debt collector has the right to contact us in a reasonable attempt to collect the debt. When those attempts become unreasonable, resulting in harassment, it crosses the line established by the Fair Debt Collection Practices Act (FDCPA) in 1977. Abusive…

Read MoreWord of the Day: Frugality!

DebtReliefZone.com Word of the day is Frugality! Frugality is a Great Word! I recently came across an article on frugality and thought we don’t value its sexy quality enough. That’s right, frugality can be sexy! It makes life more vibrant because being frugal can make one think more about what one is doing -and it…

Read MoreSpike in Oil Prices Means Good Time to Revamp Budget

Don’t panic over oil prices following the Saudi attack. Make this the right time to revisit your household budget to see where you can cut if fuel prices stay up. Whether you rent or own, you can complete a simple worksheet to see the amount of your debt and what it would take to pay…

Read MoreTurn the Tables on Your Creditors

You may owe the debt, but there are rules for collection. Know your rights and you may be able to turn the tables on your creditors. The Fair Debt Collection Practices Act (FDCPA) makes abusive, unfair or deceptive collection practices illegal. There are punitive fines that can be levied on abusive debt collectors. The FTC…

Read More7 Steps to Fast Recovery from Bankruptcy

ConsumerLawAssist.com Can help you find the right lawyer to advise you when and if you should file for bankruptcy protection. How quickly you recover from bankruptcy will totally depend on you. Within two years, you could have a credit score over 640 if you are disciplined. Within 2 years you could qualify to buy a…

Read MoreDon’t Click That Link!

As consumers, we have been taught to NEVER click on the link in an email or text from an unfamiliar party. That is good. It saves many devices from hacks and viruses. But why is the Consumer Financial Protection Bureau proposing debt collectors to be allowed to disclose people’s rights via text or email links…

Read MoreDebt Relief Tip

Debtreliefzones.comBuying Convenience can land you in debt. A little planning can get you back out of debt. See us at DebtReliefZones.com #debtfree #relief

Read More