Posts Tagged ‘debtfreedom’

Gratitude – Not Greed

“Gratitude turns what we have into enough.” – Melody Beattie, bestselling author. In the movie Wallstreet, iconic speech by Gordon Gekko declares “…Greed, for lack of a better word, is good. Greed is right. Greed works…” Gordon was wrong. Drive is good. Inspiration is good. Desire to improve the world is good. Pure, unadulterated greed…

Read MoreBudget Comparisons Can Re-Inspire

According to the International institute of Finance, Global debt is the first 6 months of 2019 surged by $7.5 trillion. I can’t even imagine that many zeroes, but if governments around the world can’t balance budgets, how will you and I budget our households? What if you have been doing better than you thought? I…

Read MoreHow to Start your 2020 Debt Freedom Journey

We rang in the new year, and for so many of us, the bills are starting to come in. Yes, you will need to get the extra charges paid off, but there are other things you can do to think ahead for next year. Get inspired by the journey to Debt Freedom in 2020 by…

Read MoreA Plan for Surviving Holiday Spending

Ouch! This season of joy is seriously crimping my wallet! It’s okay. I expected it and because becoming free of debt is so important to me, I am working to stay focused on gratitude for what I have, not on what I want. As one blogger recently posted, consumerism has a negative effect not just…

Read MoreRising Debt Danger

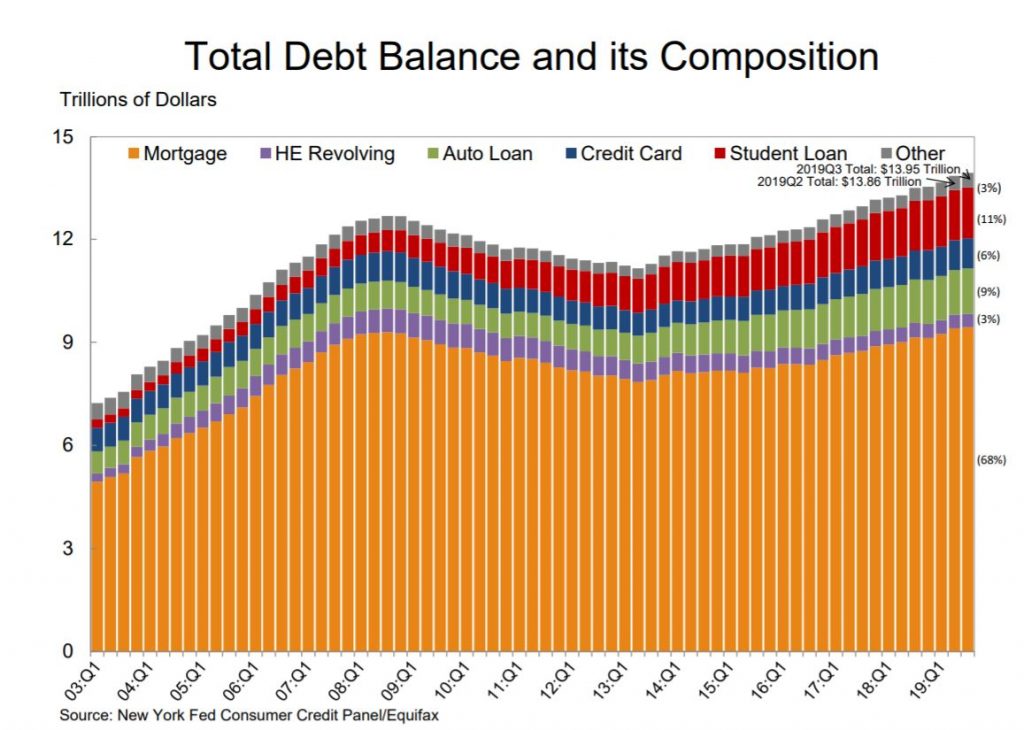

Rising Personal Debt: Last week, The Federal Reserve Bank of New York released debt statistics for the 3rd quarter. While noting that delinquent mortgages have decreased, the Household Debt and Credit Report states the total debt balance of mortgages has actually increased to $13.95 trillion, $1.3 trillion higher than the previous mortgage peak of $12.68…

Read More5 Hints for Debt Free Holidays

We are in the final quarter of 2019, and facing the most dangerous spending months of the year. It is time to make your holiday budget plan and your new year’s resolutions for debt free living in 2020! Here are five hints I’m following this year as part of my resolution to be debt free…

Read More30 Days of Saving

I am constantly looking at fresh approaches to debt freedom, so when I recently came across the 30 day savings rule, I liked that it has a lot of common sense behind it. Impulse purchases can quickly derail any debt reduction or debt elimination plan, but impulse purchases can be so tempting. When you see…

Read MoreWord of the Day: Frugality!

DebtReliefZone.com Word of the day is Frugality! Frugality is a Great Word! I recently came across an article on frugality and thought we don’t value its sexy quality enough. That’s right, frugality can be sexy! It makes life more vibrant because being frugal can make one think more about what one is doing -and it…

Read MoreSpike in Oil Prices Means Good Time to Revamp Budget

Don’t panic over oil prices following the Saudi attack. Make this the right time to revisit your household budget to see where you can cut if fuel prices stay up. Whether you rent or own, you can complete a simple worksheet to see the amount of your debt and what it would take to pay…

Read More